Table of Contents

ToggleWhat is MakerDAO?

The MakerDAO project was launched in December 2017 as a Ethereum-based initiative aimed at developing a stablecoin, DAI, backed by cryptocurrency and pegged to the USD. The DAO ecosystem is not controlled by a single entity or group of developers, but instead relies on proposals driven by the MKR governance token. This model is commonly referred to as a decentralized autonomous organization or decentralized self-governing entity.

- Users generate Collateralized Debt Position Smart Contracts (CDPs) by interacting with MakerDAO. These contracts operate as intelligent agreements for collateralized debt obligations.

- Subsequently, the user will be required to deposit an amount of DAI equivalent to the value of the assets they intend to store. This is a crucial step in the process of asset security and the maintenance of the decentralized platform’s integrity.

- Finally, in order to retrieve the pledged assets, the user must repay the borrowed amount of DAI and the stability fee.

What is CDP?

The CDP is a contract created to oversee the minting of DAI. Ensuring the smooth operation of the stablecoin without the need for any external intervention. Users who wish to borrow DAI must lock their funds into this contract at a certain liquidation ratio. Based on this ratio, one can calculate the collateral assets that can be added or removed. If the value of these assets fluctuates and drops below the liquidation ratio. Users will incur a penalty fee or have their assets liquidated if they fail to repay the borrowed DAI and interest.

Specifically:

- In the event that the value of DAI decreases, the system will incentivize users to repay their debts in order to burn existing DAI and enable users to reclaim their collateral. To achieve this, it will be necessary to increase the stability fee, resulting in higher borrowing costs. Additionally, increasing the DAI liquidation ratio may also help drive demand for investment in DAI.

- In the event that the value of DAI increases beyond a certain threshold, the system will incentivize users to mint more DAI by decreasing the stability fee. This process will lead to the creation of more DAI, thereby increasing the overall supply. Additionally, DAI may also decrease the liquidation ratio in order to reduce demand for DAI, which may prompt investors to seek alternative avenues for better returns.

What is DAI?

DAI is one of the top stablecoins with the highest market capitalization in the cryptocurrency world. Its supply is unlimited and is dependent on users providing collateral assets, enabling uninterrupted creation of DAI.

Several benefits of using DAI can be listed as follows:

- To ensure stable expenditure, it is recommended that users avoid using cryptocurrencies with high volatility. Instead, it is advisable to opt for assets with stable values to make payments or expenses.

- Stablecoin possesses all the benefits of Blockchain technology, providing users with a safe and secure means of conducting transactions and storing currency without relying on traditional banking institutions. This allows individuals to leverage the strengths of Blockchain while enjoying the stability and convenience of a digital currency.

- By utilizing DAI, the users can significantly minimize certain investment risks. And avail a safer alternative for entering or exiting positions. This allows for a more secure and effective profit-taking strategy, enabling the possibility to close out trades and avoid potential losses.

What is the special feature of MakerDAO?

The emergence of MakerDAO has played a crucial role in addressing the issue of capital utilization more efficiently. It offers a solution wherein users are not required to sell their assets but instead leverage them to borrow Stablecoins, thereby enabling effective management of tasks and investments. This mechanism has proven to be highly effective in enhancing financial flexibility and optimization. Especially in 2021, as DeFi gradually explodes, Stablecoins are also being used as similar assets due to their ability to generate profits through Yield Farming or other capital efficiency solutions. At that time, MakerDAO was the only project that provided a borrowing solution for Stablecoins. This is also the reason why MakerDAO has experienced significant growth with the largest TVL in 2021 amounting to 18 billion USD (as reported by DeFi Llama). It can be observed that the demand for DAI is exceptionally high during the golden age of DeFi, as evidenced by the fact that by the year 2022. Or three years hence, DAI’s market capitalization has surged from 1 million USD to 10 billion USD (the highest limit according to CoinGecko). Representing an increase of approximately 10,000 times.Project team, partners and investors

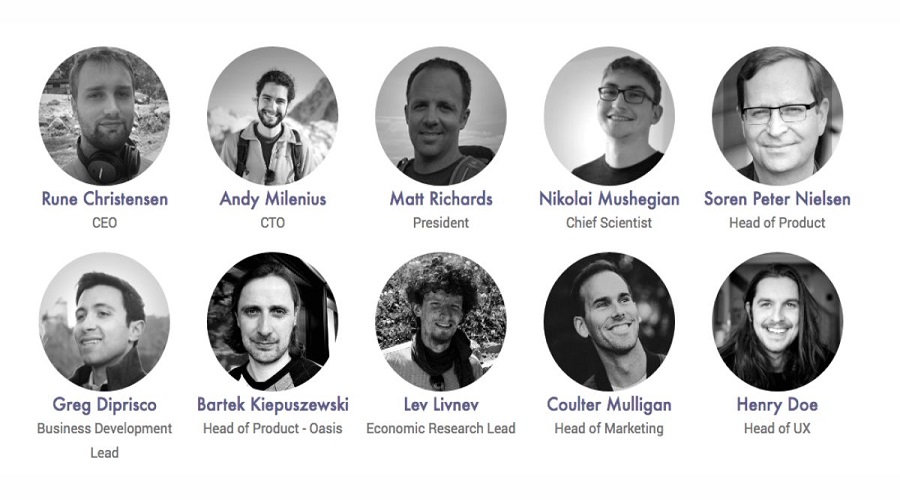

Project team

One of the prominent individuals in the project worth mentioning is Rune, co-founder of the project in the past. Nevertheless, at present, Rune has separated and only serves as a contributing member to MakerDAO.

Investors

Paradigm, Dragonfly Capital, and a16z are among the prominent investors of the project.Partner

DAI has established collaborations with multiple entities, including Inverse Finance, who utilizes DAI to mint DOLA, their stablecoin, and Aave, which allows MakerDAO to provide or withdraw DAI to maintain interest rates, effectively optimizing its operations.Roadmap & Update MakerDao

March 2020

During the occurrence of “Black Thursday”, there was a significant decline in ETH which resulted in the forced liquidation of many outstanding loans on MakerDAO. As a result, there was a high demand for DAI to repay the loans, causing the price of DAI to rise up to 1.1USD. In order to alleviate the demand for DAI, the community accepted USDC as a means of repayment. The aforementioned is also the basis for the birth of PSM (Peg Stability Module), whereby users are able to exchange 1USDC for 1DAI regardless of the current market price. As of September 2022, the amount of PSM has accounted for approximately 40% of the collateral assets in Mint DAI within PSM. This figure indicates strong community support for PSM. When performing a swap of a large amount of USDC in projects like 1Inch. Users will be directed to MakerDAO’s PSM. Therefore, PSM is a reliable shield that ensures the safety of DAI’s peg.April 2021

The proposed Direct Deposit DAI Module (D3M) by MakerDAO and Aave allows for MakerDAO to deposit or withdraw DAI from Aave in order to maintain the interest rate of DAI at Aave. This proposal was reviewed and approved. Real World Assets (RWA) have been proposed and approved for use as collateral. The decision to use RWA is not a random concept, but rather a goal set at the beginning of 2020, aimed at developing the acceptance of tangible assets as collateral.MKR token information

Key metric

- Token Name: Maker

- Ticker: MKR

- Blockchain: Ethereum.

- Token Standard: ERC-20

- Contract: 0x9f8f72aa9304c8b593d555f12ef6589cc3a579a2

- Token type: Governance

- Total Supply: 1,005,577 MKR

- Circulating Supply: 977,631 MKR

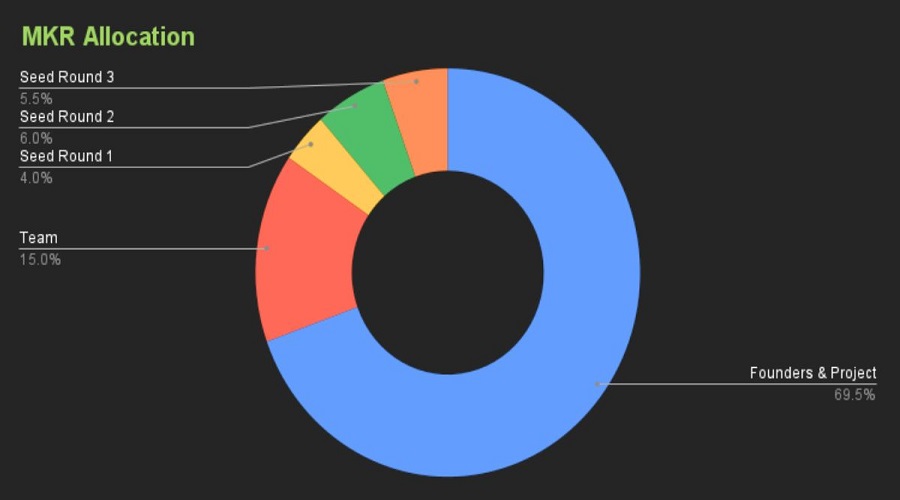

Token Allocation

Token Sale

- In the year 2017, several notable investors including Polychain Capital and a16z participated in the acquisition of MRK at a price of 300 USD/MKR.

- In 2018, MakerDAO was granted 15 million USD, at a rate of 250 USD per MKR, from a16z, in exchange for 6% of the total MKR supply.

- In order to expand its market to Asia, a amount of tokens were also sold to Paradigm and Dragonfly in 2019. This strategic move was taken to increase the company’s reach and presence in the Asian market, and was executed through the sale of tokens to these established partners.

Token Release Schedule

Nearly all MKR tokens have been unlocked, indicating high levels of market activity and liquidity.What is the potential of MakerDAO?

- The utilization of ETH as a trading pair is imperative in the MakerDAO ecosystem, where two primary ERC20 tokens, MKR and DAI, are frequently exchanged. It is noteworthy that both of these tokens rely on ETH as their trading counterpart.

- As analyzed in the CDP section, MakerDAO has meticulously calculated the stability of DAI currency in maintaining its value at $1 USD. Moreover, in case of a potential depreciation of USD or collapse of the US economy. DAI also has the option to be transferred to other currencies, ensuring its stability in the long-term.

The decentralized platform of MakerDAO has been extensively supported by several top global decentralized exchanges. Indicating a high level of potential for DEX support.

- The right to vote in decision-making processes for the DAI Stablecoin lies with the MKR holders, who possess the ability to make final decisions. This factor serves as a crucial element in building trust within the community and promoting stability in the platform’s operations.

What is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Initial DEX Offering (IDO crypto)? Does playing IDO really give you a 100% chance of winning?

One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO...

Read moreWhat is ERC – 20? Advantages, disadvantages & how to create ERC- 20 network tokens

In this article, we will explore ERC-20 and ERC-20 tokens along with their applications and advantages and disadvantages. For those...

Read moreWhat is Airdrop Crypto? Instructions for making airdrop coins in the Crypto market

What is Airdrop and how many forms of Airdrop Crypto exist? Discover the limitations and effective instructions on how to...

Read moreWhat is DAO? Limitations and Investment Potential of DAO in Crypto

Understanding the terminologies used in the field of cryptocurrency is crucial for individuals involved in Crypto market participation or intending...

Read moreWhat is zkEVM? Classification of groups zkEVM

ZkEVM is an abbreviation for the term "Zero-Knowledge Ethereum Virtual Machine". It is a protocol that enables the execution of...

Read moreWhat is web3 technology? How to invest in Web3 in 2023

The emergence of Web 3.0 following Web 2.0 has brought about increased flexibility and superior interaction capabilities compared to its...

Read moreWhat is move to earn? best move to earn crypto in 2023

In the current GameFi market, it is possible to combine the seemingly unrelated tasks of earning money and improving one's...

Read moreWhat does NFT crypto stand for: Clarifying the Significance of Non-Fungible Tokens (NFTs) through technical examination

Non-fungible token (NFT) art are digital assets stored on a blockchain that depict physical or non-physical items, such as digital...

Read moreWhat are play to earn (P2E) Games? How to earn money with play game crypto?

Play to Earn has emerged as a popular trend in mid-2021, leading to a notable increase in the activity of...

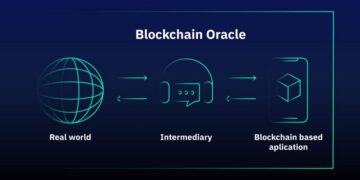

Read moreWhat is an oracle in blockchain? Top blockchain oracle projects 2023

The intended function of blockchain technology was never to operate in isolation from the larger economic ecosystem. Despite the challenges...

Read moreBinance account sign up: What is binance account? how to create binance account?

Numerous cryptocurrencies are supported by Binance and its proficiency in ensuring swift exchange operations between volatile coins and fiat currencies...

Read moreWhat is a defining feature of the Metaverse Crypto? What does the term Metaverse refer to?

We have heard numerous prominent figures, such as Mark Zuckerberg, CEO of Facebook, and Satya Nadella, CEO of Microsoft, expound...

Read moreWhat are AI Tokens? Best AI Coins & Tokens to Invest in

The predicted impact of artificial intelligence (AI) is expected to revolutionize various sectors, including the field of cryptocurrency. The AI...

Read moreWhat are Fan Tokens? How Binance Fan Tokens are Revolutionizing the World of Sports and Entertainment?

The Fan Token is a term that has been shared by the CEO of the cryptocurrency exchange CZ on Twitter,...

Read more