What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while also leveraging their received derivative assets. Liquid Staking is a current and future market trend in cryptocurrency. Let us explore more about the Stader Labs project.

Table of Contents

ToggleWhat is Stader Labs (SD)?

The Stader Labs project is aimed at facilitating the staking process for users, while also providing them with optimized returns adjusted according to the level of risk taken by the delegator.

Stader Labs plans to broaden their staking activities by gaining profits from derivative assets in addition to traditional assets. As a long-term goal, Stader aims to establish itself as a DAO platform and enable development teams to construct expansive staking solutions.

The salient feature of Stader Labs

Stader Labs presents a viable solution to issues associated with delegation, including but not limited to:

- Node Selection: The majority of authorized individuals exhibit limited understanding of the intricate performance metrics and associated risks attributed to staking.

- Performance monitoring and re-authorization: The authorized agent shall oversee the performance of validators and respond to any subpar performance according to established criteria.

- Reward: The delegator is required to invest time and effort in monitoring, supervising, and allocating rewards to validators in an equitable manner.

In what manner does Stader Labs address the aforementioned concerns? Stader Labs offers a performance staking management platform for delegators, as follows:

- Empower delegator: The delegation committee shall make determinations regarding node and liquidity pool selections predicated on their evaluations.

- Improve UX/UI of delegators: The interfaces, products, and tools are customized to ensure optimal performance, effective asset management, and efficient resolution of related issues.

- Generates a yield equivalent to the staking risk and liquidity of the staking asset: This technical statement proffers the provision of access privileges to a range of cross-chain Lending protocols, liquid staking methods, derivative assets, and gamified staking pools.

Stader Labs (SD) Token Information

Key Metrics SD

- Token name: Stader Labs

- Ticker: SD

- Blockchain: Terra

- Token Standard: ERC-20

- Contract: 0x30d20208d987713f46dfd34ef128bb16c404d10f

- Token Type: Utility, Governance

- Total Supply: 150,000,000 SD

- Circulating Supply: 26,870,573

SD Token Allocation

- Rewards + Community Farming: 40%

- Team & Advisors: 17%

- DAO Managed Fund: 15%

- Ecosystem Development Funds: 15%

- Private Sale Investors: 13%

SD Token Sale

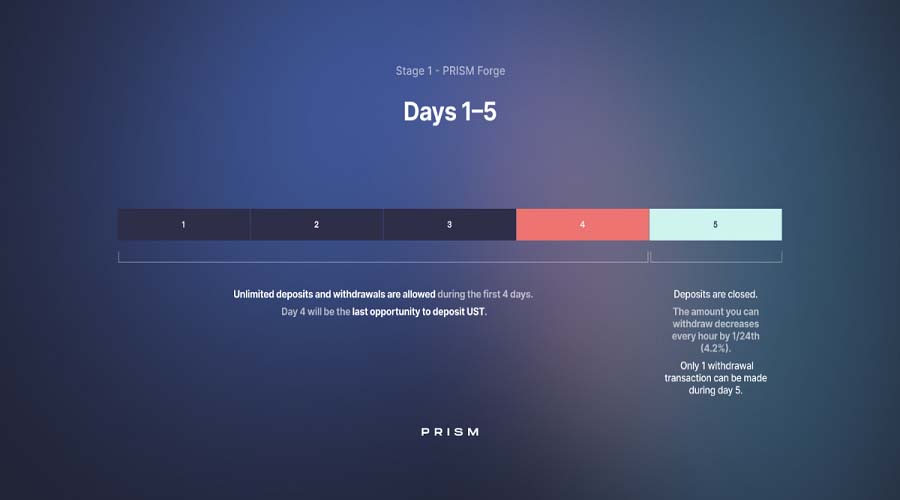

SD Token will be launched through the Prism Forge platform.

Phase 1: 14:00 (Vietnam Time), January 25, 2022

Within a period of 5 days, a total of 70,000,000 tokens, accounting for 7% of the entire supply, will be distributed among users who provide liquidity using UST in a designated pool.

The end-users shall be entitled to receive a proportionate quantity of SD tokens corresponding to the percentage of UST tokens provided by them earlier.

The process is as follows:

- Stage 1 (deposit UST Token): takes place within 96 hours, ending at 14:00 on January 29, 2022.

- Stage 2 (withdrawal only): starts immediately after Stage 1, takes place within 24 hours.

SD Token Release Schedule

The project has released the schedule for SD Token issuance as follows:

- TGE of SD token is on March 15, 2022.

- Rewards + Farming: Release schedule depends on individual rewards program.

- Team + Advisors: 6 months cliff vesting in 36 months.

- Private Sale: TGE: 0-5% TGE allocation. Vesting: 36 months after TGE.

- TGE DAO Fund: Determined through governance.

- Ecosystem Fund: TGE unlock 0.5%-1.5%. The remaining allocation is determined through admin votes.

- Public Sale: Follow 2 different options on Coinlist. Specifically, you can see the ICO SD sale information section below

SD Token Use Case

SD is a token used to:

- Staking receives rewards from the project.

- Making Insurance assets.

- Be a reward for LPs, discounts,…

- Make transaction fees on the system.

- Is the project’s governance token.

The methods for earning and possessing SD Tokens are the subject of inquiry

Currently, users can check and own SD Token by:

- Join Community Farming: users stake LUNA to receive a reward of SD Token.

- Participate in Liquidity Staking: LPs will receive SD Token as reward.

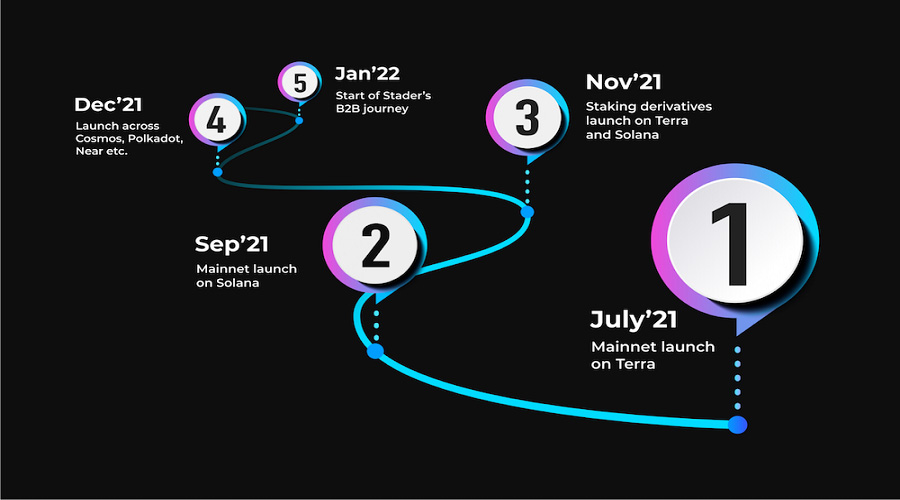

Roadmap

At present, the project presents a development roadmap as follows (without any accompanying timeframes):

- Stader V1: Audit contract.

- Launching Stader V1: Launched during the community farming event.

- Stader V2: Unlock many types of staking assets such as liquid staking on LUNA.

- Focus on developing and connecting with 3rd parties on Terra.

- Launched and integrated many other blockchains such as Solana, NEAR, EVM chains,…

Project team, investors & partners

Project team

- Amitej, CEO and Co-Founder: 10+ years in Startup Management and Strategy consulting | Ex Swiggy, ATKearney | IIT & IIM Alumni.

- Sidhartha, CTO and Co-Founder: Deep Expertise in Cryptocurrency Mining | More than 10 years of building and expanding technology applications | Columbia and IIT Alumni.

- Dheeraj, Protocol Lead and Co-Founder: 10+ Years of Engineering in Silicon Valley | Ex LinkedIn, Blend, PayPal | UT Austin and IIT Alumni.

- Vijay, Product Manager: 10+ years of product management and operations | For example: Booking.com. IIT and NIT alumni.

- Gautam, Incoming Head of Strategy & Expansion: 10+ years in i-banking, consulting and investing | Ex Kearney, Deutsche Bank and JP Morgan | IIT and IIM alumni.

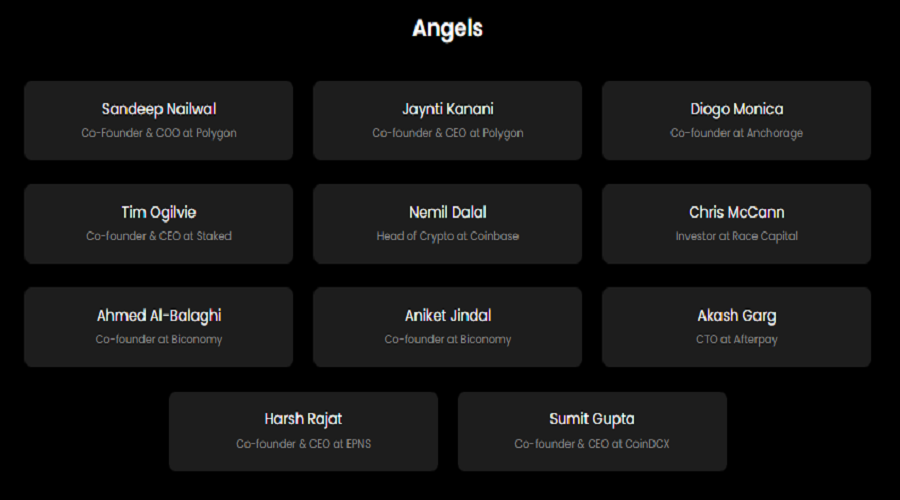

Stader investors

Stader has successfully raised a total funding of USD 16.5 million from prominent venture capital firms and blockchain platforms.

Additionally, numerous noteworthy individuals such as Sandeep Nailwall (Co Founder & COO of Polygon), Jaynti Kanati (Co Founder & CEO of Polygon), have invested in Stader Labs.

Stader partner

Currently, Stader has engaged in partnerships with over 15 funds, more than 4 blockchain entities, and 11 distinct angel investors.

Summary

As the DeFi ecosystem continues to expand, strategies that optimize capital usage and promote consistent cash flow will be increasingly adopted. Stader Labs serves as a solution to meet the current demand for Staking.

The above information was researched by the team at 247btc.net. We hope that this information will be helpful to our readers. However, please note that this is not investment advice, but rather an informational channel. Therefore, investment decisions should be carefully considered.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more