The Altcoins market has experienced significant spikes of up to 50 to 100 times the initial investment, leading investors to indulge in lavish spending and incessant joyrides. To clarify, Altcoin refers to any cryptocurrency other than Bitcoin, and identifying the most opportune time to invest and relish in such a delightful period warrants attention. Refer to the subsequent article to acquire an in-depth understanding of Altcoin, as well as to identify the most ideal moments for investing in such cryptocurrencies.

Table of Contents

ToggleWhat are Altcoins?

Altcoins, also known as alternative coins, refer to cryptocurrencies other than Bitcoin. As the first cryptocurrency, Bitcoin laid the foundation for the crypto landscape. Therefore, all coins that came after Bitcoin are considered alternative options to either Bitcoin or traditional fiat money. Accordingly, Ethereum is also regarded as an altcoin.

Altcoin Classification

Currently, the crypto market offers a plethora of diverse altcoins, which are classified into four main categories, namely Top Coins, Platform Coins, Exchange Coins, and Stablecoins.

Top Coins

These are Altcoins with a high market capitalization, exceeding one billion USD. They are considered relatively secure and are less likely to disappear from the market due to their significant 24-hour trading volume and high liquidity. These types of coins are typically sought after by large investors as they provide long-term value and are supported by updated documentation and analyses. Examples of topcoins include Ethereum, Cardano, Ripple, and Solana, which are currently ranking among the highest according to Coinmarketcap’s statistics.

Platform Coins

Coins that operate on their own Blockchain and are used for transaction fees, Dapps and Smart Contract development are called platform coins. These coins are considered safe, have long-term value, and involve minimal risk. Examples of platform coins include SOL from the Solana network, DOT from Polkadot, and others.

Exchange Coins

Tokens or cryptocurrencies issued by exchanges, commonly known as exchange tokens or exchange crypto, offer several benefits to the holders while participating in trading activities on the exchange. As a result, exchange tokens are classified into two small categories, namely CEX exchange tokens and DEX exchange tokens. For instance, Binance’s BNB is a perfect example of a CEX exchange token, while Uni, Cake, Bsw, and sushi are the various DEX exchange tokens available.

Stablecoin

This particular type of cryptocurrency, as its name suggests, was created with the aim of price stability. Typically, this digital asset is pegged to the value of a particular currency. The main features of this coin include, but not limited to, price stability, decentralized trading, high security, and excellent scalability. Some examples of Stablecoins with high market capitalization are USDT, USDC, MKR, DAI, and so on.

The reason why users opt for stablecoins is that this type of asset can potentially minimize transaction costs, can be utilized without the assistance of banks. And offers swift transfer speeds, thus providing a convenient and cost-effective mode of transaction.

Altcoins and Bitcoins

The question arises as to why alternative currencies are needed to replace Bitcoin, which is currently considered the king of the crypto market. The reason for this is that Bitcoin has certain limitations, such as high transaction fees and insufficient functionality. With this opportunity in mind, many developers have created different blockchain platforms to improve upon or replace Bitcoin, resulting in the development of Altcoins and increasing potential investment opportunities for investors.

Features of Altcoins vs Bitcoin

- The level of price volatility was high in 2017. This year was widely regarded as the year of cryptocurrencies, as Bitcoin saw a remarkable 1200% increase in value and Ethereum and Litecoin, two high market capitalization Altcoins, also experienced significant growth. Notably, this was also a time when Altcoins demonstrated a strong impression of price volatility. To put this into perspective, if Bitcoin’s growth was 1000% in a year, Ripple’s price fluctuations reached the same level in just one month, specifically in December 2017.

- The altcoin market is significantly more volatile than Bitcoin’s, making it challenging to navigate. Since their introduction to the market, altcoins have experienced substantial fluctuations, primarily due to their diverse range, fierce competition, and the impact of supply and demand.

- Information may not always be readily available for all cryptocurrencies. While there is a wealth of information on the development plans and future predictions for Bitcoin, this is not necessarily the case for Altcoins. Some Altcoins may not be updated with complete information, as Bitcoin tends to receive more attention from large investors, while not all Altcoins are closely monitored.

Risks of Investing Altcoins

Given the vast, diverse and constantly changing market, it is natural that Altcoins carry certain investment risks. One such risk is the prevalence of fake ICOs, which involve the issuance of coins at a cheap price and inflated growth potential. But are in fact fraudulent schemes perpetuated by individuals lacking technological expertise. It is important to exercise caution and conduct thorough research before committing to any Altcoin investment. In order to avoid falling prey to such fraudulent practices.

Investors should exercise caution when dealing with Pump & Dump schemes in their Altcoin investments. This tactic involves a group of investors deliberately inflating the demand of a particular Altcoin, resulting in a rapid increase in its supply. They also spread positive information about the coin in the market, driving up its price. As the price continues to soar due to the fear of missing out (FOMO) mentality among investors, the fraudsters will then sell their shares simultaneously, reaping a profit while causing the market to plummet uncontrollably, ultimately leading to its collapse.

Why Investors Choose Altcoins?

Investors may cause the value of Bitcoin to soar, potentially exceeding profitable thresholds, by focusing solely on investing in it. Alternatively, the volatile market of Altcoin offers a favorable advantage for investors to seek safer haven assets or ride the wave during times when Bitcoin prices are being inflated. Furthermore, while Altcoin can be highly volatile, the costs of owning it are significantly lower than Bitcoin’s.

Investors can use the diversity of Altcoins to mitigate risks and increase profit opportunities, optimizing their investment portfolio. Additionally, savvy investors can also capitalize on the “Altcoin season” to achieve profitable returns without compromising excessive opportunity costs.

What is Altcoin Season?

The season of Altcoins is poised as an opportune time for investors to strategically begin their investments. It is a period when Altcoins experience strong and simultaneous price surges, yielding returns of up to 2, 3, and sometimes even 100 times their initial value within a few short weeks. September of 2017 serves as a typical example of such a season, during which any and every Altcoin asset witnessed rapid growth within that timeframe.

How to recognize Altcoin season?

During a single Altcoin season, Ethereum has demonstrated the potential to increase from $300 to $4,000. And Ripple has seen lucrative returns of up to 2,000%. Such colossal surges have been documented in history when investors have seized the signs of an impending Altcoin season. Thus, what indicators should fellow investors look out for to anticipate the arrival of the Altcoin season?

Altcoins simultaneously bottomed

In every industry, market operations follow cyclical patterns. Following a collective bottom out, the prices of Altcoins will initiate a fresh growth cycle, reclaiming their highest price points, and potentially surpassing their previous capital thresholds to achieve new records. This observation serves as one of the indicators that may aid in identifying Altcoin seasons.

Bitcoin’s influence

Bitcoin bottoms

With a market share of around 45%, Bitcoin is considered a dominant currency that exerts a significant influence on Altcoin, even sparking a season of Altcoin with notable price dips. The time when Bitcoin reaches its bottom and gradually grows again is considered an ideal milestone to start an Altcoin season.

The reason for this is that, in this particular scenario, most investors will first hold onto Bitcoin and only gradually shift towards purchasing Altcoin. In June 2019, for instance, when Bitcoin hit its lowest point, many investors sold off their Altcoin holdings to buy Bitcoin. As Bitcoin begins to fluctuate to a moderate degree and show signs of slight growth. Investors will then sell off their Bitcoin holdings and revert back to investing in Altcoin. With money flowing in this manner, the market cap of Altcoin will rise rapidly, generating a positive growth trajectory that will signal the return of altcoin season.

Bitcoin Dominance Drops

Bitcoin Dominance refers to the percentage share of Bitcoin’s market capitalization and serves as a crucial indicator for investors to identify and invest in Altcoin season. This figure explicitly represents the amount of investors holding Bitcoin. As Bitcoin Dominance increases, investors tend to hold more Bitcoin and less Altcoin, leading to a decline in Altcoin value. Conversely, when Bitcoin Dominance decreases, investors are likely to sell Bitcoin and invest in Altcoin (in the case of Stablecoin) or Digital tokens. Thus, detecting a decrease in Bitcoin Dominance can provide a sure indication to investors that the Altcoin season is imminent.

Signals from the market

Various indicators such as technological innovations, investor psychology, and political changes play a significant role in driving prices. Consequently, obtaining timely market information can greatly aid one in seizing opportunities during the Altcoin season.

Sustainable Altcoin Investment Strategies for Long-Term Growth

Maximizing Profit Potential by Tracking Altcoin Money Flows

As previously indicated, the fluctuation of Bitcoin serves as an indicator for identifying the Altcoin season, given the close correlation between Bitcoin and Altcoin. Essentially, the Altcoin season is characterized by capital shifting from the Bitcoin market to the Altcoin market, resulting in a variety of scenarios with regards to the possible transition of funds during this period.

In the event that a substantial amount of capital flows into the market, funds will be distributed throughout the various corners of the crypto world, encompassing BTC, high to low market cap altcoins. This scenario presents an ideal scenario where profits can be gained from altcoins even with closed eyes. However, in the case where the capital influx is limited, funds may flow towards large-cap, mid-cap, and low-cap altcoins prior to flowing back towards BTC and ending the cycle with a sharp pump or dump, causing investors to sell off in tandem.

Each cash flow scenario will determine the length of the Altcoin season, making it a crucial factor that investors should keep in mind for maximizing profits during this period.

Altcoin Season: Maximizing Your Wealth with Strategic Investments

First and foremost, it is imperative for us to determine the scenario and stage of capital flow. If the stage has potential and feasibility, a thorough examination of the coins that have garnered attention and trust is still necessary, as the market does not always offer a vast amount of capital, and indiscriminately selecting coins may not yield favorable returns.

Subsequently, the analysis of charts will be carried out by the team, with the goal of selecting the most promising 1-2 coins for investment. It is crucial, of course, to decide on entry and exit points, stop-loss orders. And other critical factors at this stage, to achieve anticipated profits and avoid the undue losses resulting from impulsive and uninformed decisions. After achieving the predetermined target, the team may choose to invest in other Altcoins during the ongoing Altcoin season, in order to capitalize on the compounding interest.

Notes when investing Altcoins

As you may have learned, the Altcoin market is highly diverse and presents numerous opportunities for growth, but it also carries certain risks that may be difficult for investors to discern and avoid. Therefore, if you are new to the world of cryptocurrencies, it is advisable not to rush into investing a large sum of capital into any particular Altcoin, but rather to approach the investment process with caution, allocating only a reasonable amount of funds, and maintaining a preparedness for potential losses. Furthermore, it is recommended that you carefully consider and evaluate the risks associated with any potential investment.

Furthermore, in the case of Altcoin, it is crucial for one to exercise utmost caution in researching investment opportunities to avoid falling victim to fraudulent tactics such as fake ICOs or Pump & Dump schemes. While conducting a thorough analysis of the project or seeking up-to-date information about the market is essential, it is imperative to focus on credible sources and factual data-driven analysis when making investment decisions. This is because misleading information can easily lead one astray, resulting in ill-advised investments.

During the Altcoin investment season, it is crucial for investors to remember to set stop-loss orders to mitigate risks. While profiting is undoubtedly essential for achieving investment goals, it is crucial to recognize that fluctuating values are mere figures until realized through profit-taking. Investors must bear in mind their investment objectives when investing to ensure the safest and most secure path to avoid losses.

We hope that by sharing this information, you have had the opportunity to gain knowledge about what Altcoin is, its potential, and what investment opportunities it offers that differentiate it from Bitcoin. We also hope that through this piece of writing, you acquire a more sound investment strategy for both Altcoin and Bitcoin. We wish you success in your endeavors.

What is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Initial DEX Offering (IDO crypto)? Does playing IDO really give you a 100% chance of winning?

One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO...

Read moreWhat is ERC – 20? Advantages, disadvantages & how to create ERC- 20 network tokens

In this article, we will explore ERC-20 and ERC-20 tokens along with their applications and advantages and disadvantages. For those...

Read moreWhat is Airdrop Crypto? Instructions for making airdrop coins in the Crypto market

What is Airdrop and how many forms of Airdrop Crypto exist? Discover the limitations and effective instructions on how to...

Read moreWhat is DAO? Limitations and Investment Potential of DAO in Crypto

Understanding the terminologies used in the field of cryptocurrency is crucial for individuals involved in Crypto market participation or intending...

Read moreWhat is zkEVM? Classification of groups zkEVM

ZkEVM is an abbreviation for the term "Zero-Knowledge Ethereum Virtual Machine". It is a protocol that enables the execution of...

Read moreWhat is web3 technology? How to invest in Web3 in 2023

The emergence of Web 3.0 following Web 2.0 has brought about increased flexibility and superior interaction capabilities compared to its...

Read moreWhat is move to earn? best move to earn crypto in 2023

In the current GameFi market, it is possible to combine the seemingly unrelated tasks of earning money and improving one's...

Read moreWhat does NFT crypto stand for: Clarifying the Significance of Non-Fungible Tokens (NFTs) through technical examination

Non-fungible token (NFT) art are digital assets stored on a blockchain that depict physical or non-physical items, such as digital...

Read moreWhat are play to earn (P2E) Games? How to earn money with play game crypto?

Play to Earn has emerged as a popular trend in mid-2021, leading to a notable increase in the activity of...

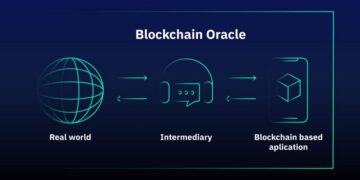

Read moreWhat is an oracle in blockchain? Top blockchain oracle projects 2023

The intended function of blockchain technology was never to operate in isolation from the larger economic ecosystem. Despite the challenges...

Read moreBinance account sign up: What is binance account? how to create binance account?

Numerous cryptocurrencies are supported by Binance and its proficiency in ensuring swift exchange operations between volatile coins and fiat currencies...

Read moreWhat is a defining feature of the Metaverse Crypto? What does the term Metaverse refer to?

We have heard numerous prominent figures, such as Mark Zuckerberg, CEO of Facebook, and Satya Nadella, CEO of Microsoft, expound...

Read moreWhat are AI Tokens? Best AI Coins & Tokens to Invest in

The predicted impact of artificial intelligence (AI) is expected to revolutionize various sectors, including the field of cryptocurrency. The AI...

Read moreWhat are Fan Tokens? How Binance Fan Tokens are Revolutionizing the World of Sports and Entertainment?

The Fan Token is a term that has been shared by the CEO of the cryptocurrency exchange CZ on Twitter,...

Read more