In recent years, the crypto market has witnessed a remarkable surge of digital currencies, which have become more diverse than ever before. One of the main drivers of this diversity has been the introduction of Initial Coin Offerings (ICOs), which have provided ample opportunities for larger and smaller investors to earn significant returns. However, it is important for investors to avoid common mistakes when participating in ICOs. Therefore, in this article, 247btc.net will provide an informative and formal assessment of what ICOs are and the five common mistakes that investors should avoid.

Table of Contents

ToggleWhat is an ICO?

An ICO (Initial Coin Offering) is commonly recognized by the community as the first issuance of a particular cryptocurrency. This is a fundraising method for newly released digital assets (cryptocurrencies).

During an ICO event, project groups create tokens on a blockchain to sell to interested and supportive individuals. This serves as the initial stage of community fundraising, where investors receive tokens that they can either use immediately or save for future use. Ultimately, the ICO project receives funds necessary for future development.

Since 2014, this method has become increasingly popular after it was used to raise capital for the development of Ethereum (ETH). Since then, thousands of blockchain projects have adopted this approach (especially in 2017), with varying degrees of success. Although the name ICO may sound similar to IPO (Initial Public Offering) at first glance, essentially, both are very different methods of raising funds.

IPO is generally applied to established and operating businesses, where they sell a portion of their shares as a way to raise capital. Conversely, ICO serves as a fundraising mechanism, allowing companies to raise funds for their projects at a very early stage. When investors participate in ICO and purchase tokens, it does not necessarily mean that they have ownership rights in the company; this is the key difference.

Initial Coin Offering (ICO) presents a viable alternative solution to traditional fundraising methods for technology startup ventures. Typically, it is challenging for entrepreneurs to secure capital without a concrete product. However, in the blockchain space, it is uncommon for companies to invest in projects solely based on values outlined in the White Paper. Furthermore, the lack of regulations pertaining to digital currencies inhibits many from considering blockchain startups.

However, it should be noted that this approach is not limited to newly established StartUp companies. Established businesses may also opt for a reverse ICO, which functions similarly to a traditional ICO event. In this scenario, the company already has a product or service in place and issues tokens to decentralize their ecosystem. Additionally, they may organize an ICO event to engage a larger pool of investors and raise capital for a newly built blockchain-based product.

What are the advantages and disadvantages of ICOs?

Advantage:

When a company initiates an Initial Coin Offering (ICO) to create a Token, online services permit the creation of cryptocurrency within a few seconds. Tokens do not possess any inherent value and lack legal guarantees compared to stocks. ICO managers generate Tokens according to the terms of the ICO and distribute them as per a planned approach by transferring them to individual investors. During an ICO, investors typically buy Tokens on the prospect that the project will be successful upon launch. If this happens, the Tokens purchased during the ICO will increase in value by multiple times. And yield sizeable profits for investors. Therefore, ICOs offer immense potential to generate high returns and have helped many investors attain millionaire status.

In addition, there are other advantages such as:

- It’s easy for investors and startups to join.

- It is possible to join online.

- Less cumbersome paperwork.

Defect:

Numerous scammers and fraudsters have taken advantage of the ICO (initial coin offering) phenomenon to deceive and defraud unsuspecting investors of significant sums of money.

Due to the lack of strict financial oversight by relevant authorities, funds lost to fraudulent activities may not receive legal protection.

The exponential growth of initial coin offerings (ICOs) in 2017 garnered significant reactions from both governmental and non-governmental organizations in early September of that year. However, these ICO activities were officially banned by the People’s Bank of China as they were deemed to have adverse effects on economic and financial stability.

How does an ICO work?

StartUps can leverage the ICO funding model to raise capital by issuing Tokens on a secure blockchain platform. Following this, Tokens are distributed in exchange for contributions towards a financial pool, enabling StartUps to raise much-needed funds. The confidential nature of the blockchain ensures the security of all records and transactions.

These tokens can be transferred across various network systems, such as ERC and BSC, and traded on cryptocurrency exchanges. ICOs can serve a range of functions, from granting the owner access to specific services, to agreeing to receive dividends from the company.

Depending on their function, Tokens can be classified as Utility Tokens or Security Tokens.

Utility tokens

The term “Utility Tokens” can be understood as “User Tokens” that signify the right to access a company’s future products or services. These tokens represent a convenient and portable form of access, giving the holder the ability to seamlessly engage with the company and its ecosystem.

By utilizing utility tokens, startup companies conducting initial coin offerings can procure funding to support the development of blockchain projects, in exchange for granting users access to their services at a later date. This strategy enables them to raise capital while also securing a customer base for their future services.

The purpose of utility tokens is not to serve as a standardized investment option for a company’s shares.

Security Tokens

In contrast to utility tokens, security tokens derive their value from an external asset and can be traded or increase in value based on the efforts of others. Notably, they fall under the purview of federal securities regulations.

Neglecting to comply with these regulations can result in substantial penalties and may pose a threat to a project’s viability. Therefore, it is imperative for companies to meet all of their regulatory obligations. Properly classifying Tokens and obtaining approval for multiple applications holds promising potential for issuing Tokens representing company shares in the future.

Many industry observers hold the belief that at some point in the future, reputable companies will issue stocks through an initial coin offering (ICO). These practices are expected to either replace or supplement traditional fundraising methods.

Stages of developing an ICO project

In order to achieve the current successful and progressive state of the project. The Initial Coin Offering (ICO) underwent four distinct phases.

ICO setup stage

This is considered the initial phase during which a company or organization will conduct research. And analysis to establish a database system, tokens, and a Blockchain wallet to legalize all aspects prior to releasing coins to the public.

Building an ICO Ecosystem

In this phase, developers will implement integrated links in order to enable their coins to bring more benefits to users or be recognized in the community, until users acknowledge payment with those coins.

The breadth of an ecosystem is a determining factor for the value, speed of success, and development of a project. Generally, three types of ecosystems exist.

- Social media ecosystem, type of social network community: Steem Coin.

- Ecosystems that accept banking transactions: Ripple, Digibyte.

- Ecosystem with the same model as Bitconnect, Yocoin, Onecoin: Multi-level Marketing

Crowdfunding stage

During this phase, they plan to promote their ideas and projects through various media channels, groups, large associations. And information forums such as icoinfo.net, coinschedule.com, and cointelegraph.com in order to persuade investors. By selling tokens or coins, they can raise funds and expand their ecosystem when their funding is strong enough. Moreover, they will focus on promoting and listing their project’s coin on a trading platform.

Index Phase (Coin on the exchange)

This is a crucial phase, where the official coin is listed on various exchanges such as CoinExchange, Poloniex, Okcoin, Bittrex, NovaExchange or Etherdelta. At this point, the value of a coin will rely on the supply and demand factors of the market. As previously mentioned, if the ecosystem is extensive enough, the token’s value can experience exponential growth at a swift pace.

How can I find out which ICOs to participate in?

To closely follow the latest ICO projects, there is no set formula. However, the best approach for investors is to check online platforms for new projects, which are readily available. Additionally, there are numerous forums that facilitate investor discussions, enabling them to exchange opinions on investment opportunities. Some specialized websites compile ICO projects, allowing investors to explore new ICOs and compare various services. These platforms can assist in identifying potential ICO projects, such as:

CoinGecko

CoinGecko is a widely trusted tool worldwide, offering numerous valuable features for traders. It currently provides a ranking of various cryptocurrencies, allowing users to gain an overview of the market capitalization, influence, real-time prices and volatility of each coin.

Coinmarketcap

The website, Coinmarketcap, catalogs the most prevalent cryptocurrencies in the Digital Currency marketplace, which every investor should be familiar with.

At present, Coinmarketcap has scheduled several upcoming initial coin offerings (ICO) for newly launched projects, offering viewers the opportunity to swiftly track these initiatives.

Coinlist

CoinList is a renowned application platform that specializes in providing Token Sale services for numerous companies and projects in need of capital mobilization. The platform supports individuals who are interested in promoting the development of their new projects such as NYM, Solana, and Flow. This is achieved through empowering the community and transacting with digital assets to strengthen the platform.

ICO Drops

Icodrop is a platform that facilitates the implementation of ICOs and independent token sales. This website offers a diverse range of coin projects for users to track, aiming to generate greater profits across various technology sectors.

5 Mistakes to avoid when participating in ICO

ICO is currently leading the cryptocurrency and blockchain industry, but it is also facing numerous challenges, risks, and unexpected opportunities.

Numerous investors have purchased coins during the initial coin offering (ICO) with the anticipation of generating tremendous profits rapidly. Consequently, successful ICOs in recent years are attributed to the substantial expectations of investors towards the appreciation of their coin or tokens holdings.

In addition, it must be noted that these investments are susceptible to rapid loss in the event that they are directed towards fraudulent projects, or towards cryptocurrencies that lack merit, such as speculative or fraudulent coins.

It is impossible to guarantee that investors will not encounter failure or deception in both the current and future markets. As such, it is crucial for all individuals to be aware of the 5 common mistakes to avoid when participating in an ICO (Initial Coin Offering).

- Insufficient research was conducted on the project, as the team’s development activities were not fully understood and a complete transparency was not established with the information regarding the ongoing ICO project before an impulsive decision was made to invest.

- It is essential to ensure that the development team accurately and precisely identifies the project’s objectives to determine the value it provides. Successful ICO projects typically present clear objectives that demonstrate the value they bring to users. Consequently, it is crucial to ascertain the value proposition of the project to understand the impact and potential outcomes of the initiative.

- Many individuals who strive for speed and efficiency in decision-making opt for the investment strategy of putting all their assets into one investment opportunity, commonly referred to as “All-in”. However, this approach can cause them to miss out on numerous potential opportunities and expose themselves to significant losses if their entire portfolio is at risk and becomes entirely unrecoverable.

- The psychology of winning: Often, individuals underestimate the complexities of making profit in the crypto market. Despite being a novice and participating in ICOs without much experience, one may still possess the confident mindset of a winner.

- It is important to understand that both Crypto and other financial markets are zero-sum games. This means that, in theory, the total assets of the winner will be exactly equal to the total losses of the other players. In other words, the money lost by the losers will be transferred to the winner. It is essential to keep this concept in mind when participating in these types of markets.

It is imperative to ensure that the funds raised through the ICO are securely stored in a reserve wallet that requires multiple layers of security measures for access. This is considered to be a valuable safeguard against fraudulent activities, particularly when a third party intermediary holds one of the security keys.

Are there any regulations regarding ICOs?

Providing a suitable answer for everyone is a challenging task due to several variables that need to be considered. The regulations in different financial territories and unique characteristics of each project may affect the government’s perspective and assessment of the project.

It is important to note that the absence of regulations in certain areas does not signify that community-funded projects may freely raise capital through ICO activities. Therefore, it is crucial to seek professional legal advice prior to selecting this form of community funding.

In certain cases, regulatory agencies have fined fundraising groups in the sector because legislators subsequently regarded it as a securities service. If regulators determine that tokens are securities, then the issuing organization must adhere to the strict measures applicable to traditional assets in this category. In this regard, the US Securities and Exchange Commission (SEC) has provided some detailed information.

In general, the development of regulations tends to occur at a slower pace compared to the rapid growth of blockchain technology. This is a common issue in the technology industry with regards to legal systems. Nevertheless, numerous government organizations are presently discussing the implementation of a more transparent legal framework for blockchain technology and digital currencies.

Although many blockchain enthusiasts are wary of the potential for excessive government intervention (which could impede development), most recognize the necessity of protecting investors. Unlike traditional finance, raising capital from people all over the world will always present significant challenges.

What are the risks with ICOs?

Investing in a new token is alluring due to the expectation of yielding a substantial profit; however, not all cryptocurrencies have the capability of fulfilling this expectation. Like any other form of crypto investment, investing in an Initial Coin Offering (ICO) holds no guarantees that a positive return on investment (ROI greater than 0) will be obtained.

Determining the feasibility of a project can be challenging, as there are numerous factors involved in the evaluation process. It is essential for prospective investors to conduct due diligence and thoroughly research the tokens they are interested in purchasing. This process should include a detailed fundamental analysis. Below are a few essential questions investors should ask themselves when exploring ICO projects.

- Is this model feasible? What issues does the project address for humanity?

- What is the allocation method of the token supply source?

- Does the project objective require the utilization of blockchain technology and/or tokens for realization?

- Does the team possess credibility? Do they possess sufficient skills and resources to transform the project into a reality?

One of the most important rules is to never invest more money than you can afford to lose. The crypto market is highly volatile and carries significant risks, which means that the amount you hold may decrease significantly if you are not cautious.

Who can organize an ICO sale?

The technology for creating and distributing tokens is now widely accessible to the public. However, it is crucial to consider certain legal issues before an organization conducts an ICO.

As a general observation, the cryptocurrency landscape currently lacks adequate guidance and regulations, with certain crucial legal questions still unresolved. While some countries have completely barred ICO-related activities, even the most crypto-friendly jurisdictions have yet to establish clear laws surrounding these matters. Consequently, it is imperative for individuals to thoroughly comprehend and be familiar with their respective national legal frameworks before embarking on any ICO ventures.

Summary

The preceding information is the comprehensive data that Coinlize has shared to enable you to have a better understanding of what an ICO is and the 5 mistakes that one should avoid when participating in an ICO. The purpose of this information is to guide you towards informed and successful participation in the ICO ecosystem.

The efficacy of ICOs has been proven; they serve as a valuable means for early-stage projects to attract funding. Following the successful Ethereum ICO in 2014, several organizations were able to recoup investments, subsequently developing new protocols and ecosystems.

It is important to have a clear understanding of the investments you are making, as there is no guarantee of 100% profit. With the emerging market of cryptocurrency, investing in ICOs poses high risks and there is little protection for investors if a project fails to deliver a viable and valuable product for humanity.

What is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Initial DEX Offering (IDO crypto)? Does playing IDO really give you a 100% chance of winning?

One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO...

Read moreWhat is ERC – 20? Advantages, disadvantages & how to create ERC- 20 network tokens

In this article, we will explore ERC-20 and ERC-20 tokens along with their applications and advantages and disadvantages. For those...

Read moreWhat is Airdrop Crypto? Instructions for making airdrop coins in the Crypto market

What is Airdrop and how many forms of Airdrop Crypto exist? Discover the limitations and effective instructions on how to...

Read moreWhat is DAO? Limitations and Investment Potential of DAO in Crypto

Understanding the terminologies used in the field of cryptocurrency is crucial for individuals involved in Crypto market participation or intending...

Read moreWhat is zkEVM? Classification of groups zkEVM

ZkEVM is an abbreviation for the term "Zero-Knowledge Ethereum Virtual Machine". It is a protocol that enables the execution of...

Read moreWhat is web3 technology? How to invest in Web3 in 2023

The emergence of Web 3.0 following Web 2.0 has brought about increased flexibility and superior interaction capabilities compared to its...

Read moreWhat is move to earn? best move to earn crypto in 2023

In the current GameFi market, it is possible to combine the seemingly unrelated tasks of earning money and improving one's...

Read moreWhat does NFT crypto stand for: Clarifying the Significance of Non-Fungible Tokens (NFTs) through technical examination

Non-fungible token (NFT) art are digital assets stored on a blockchain that depict physical or non-physical items, such as digital...

Read moreWhat are play to earn (P2E) Games? How to earn money with play game crypto?

Play to Earn has emerged as a popular trend in mid-2021, leading to a notable increase in the activity of...

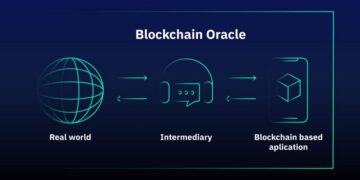

Read moreWhat is an oracle in blockchain? Top blockchain oracle projects 2023

The intended function of blockchain technology was never to operate in isolation from the larger economic ecosystem. Despite the challenges...

Read moreBinance account sign up: What is binance account? how to create binance account?

Numerous cryptocurrencies are supported by Binance and its proficiency in ensuring swift exchange operations between volatile coins and fiat currencies...

Read moreWhat is a defining feature of the Metaverse Crypto? What does the term Metaverse refer to?

We have heard numerous prominent figures, such as Mark Zuckerberg, CEO of Facebook, and Satya Nadella, CEO of Microsoft, expound...

Read moreWhat are AI Tokens? Best AI Coins & Tokens to Invest in

The predicted impact of artificial intelligence (AI) is expected to revolutionize various sectors, including the field of cryptocurrency. The AI...

Read moreWhat are Fan Tokens? How Binance Fan Tokens are Revolutionizing the World of Sports and Entertainment?

The Fan Token is a term that has been shared by the CEO of the cryptocurrency exchange CZ on Twitter,...

Read more