The blockchain platform known as Sei Network has recently captured the attention of the community, garnering a valuation of an astonishing 800 million USD. Given such a substantial market value, one cannot help but wonder what distinguishing features Sei possesses that warrant such investor interest

Table of Contents

ToggleWhat is Sei Network?

Sei Network is a Layer-1 blockchain specifically designed for trading activities, such as derivatives trading and spot trading. To achieve this goal, the organization has opted to construct their system on top of Cosmos SDK, a technology that leverages the Tendermint protocol and IBC to create a completely decentralized and scalable trading ecosystem.

Additionally, Sei is currently in the testing phase and has confirmed that it will allocate 1% of its total supply for an Airdrop distribution to participants of the Incentivized Testnet program, to provide them with firsthand experience of the network.

Products of Sei Network

Sei’s product is a Layer 1 blockchain which possesses the following characteristics:

The Twin-Turbo concurrence mechanism is deployed to achieve optimal performance

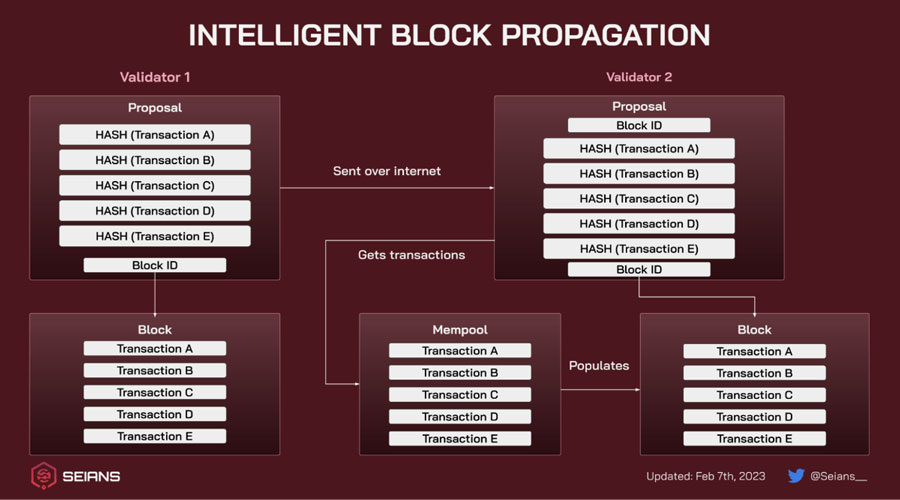

- One mechanism for accelerating transaction speed and ensuring the integrity of the network is through the creation of a list of unconfirmed transactions that are stored in a validator’s mempool, prior to being added to the blockchain. This method helps to maintain the validity of the network and promote efficient processing of transactions.

- After a transaction is added to the mempool, it awaits confirmation through the consensus process before being added to the blockchain. Validators aim to quickly add transactions from their mempool to the blockchain to earn transaction fees.

- This is a consensus mechanism designed to increase transaction processing speed by processing multiple blocks simultaneously. However, processing multiple blocks simultaneously requires significant resources and may result in a lack of synchronization among blocks, leading to delays in the network.

Parallelization

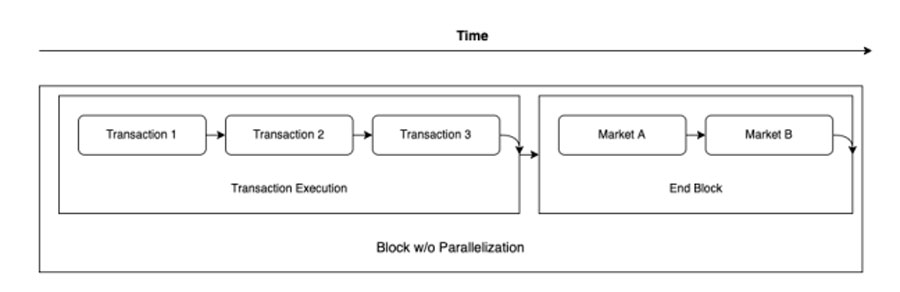

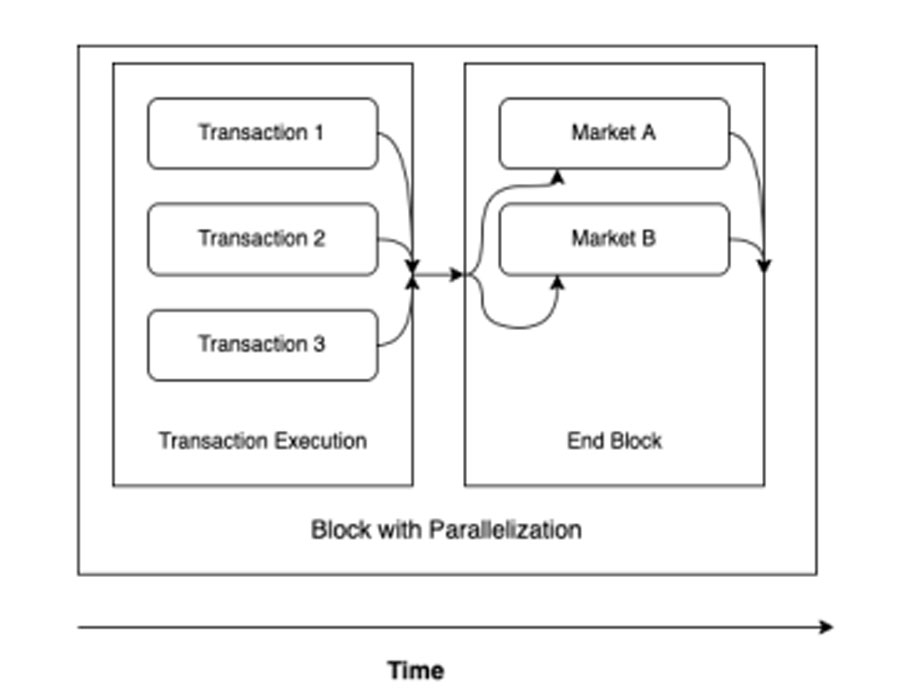

- Parallelization refers to the division of a large process into smaller processes, which are then carried out simultaneously in order to increase processing speed and reduce response time.

- Shortening the processing time using Parallelization method also aids in preventing the occurrence of front-running, thereby ensuring transparency and fairness for all market participants.

- However, Parallelization still has certain shortcomings. For instance, concurrent processing can result in conflicts between transactions and lead to errors during network state updates. Furthermore, the synchronization among validators can also be affected if parallel transaction processing is not executed with due diligence.

Native Price Oracles

The Native Price Oracles constitute an integrated set of tools within the Sei system which support asset valuation. Validators are obligated to participate in the capacity of oracles in order to ensure the reliability and accuracy of asset pricing.

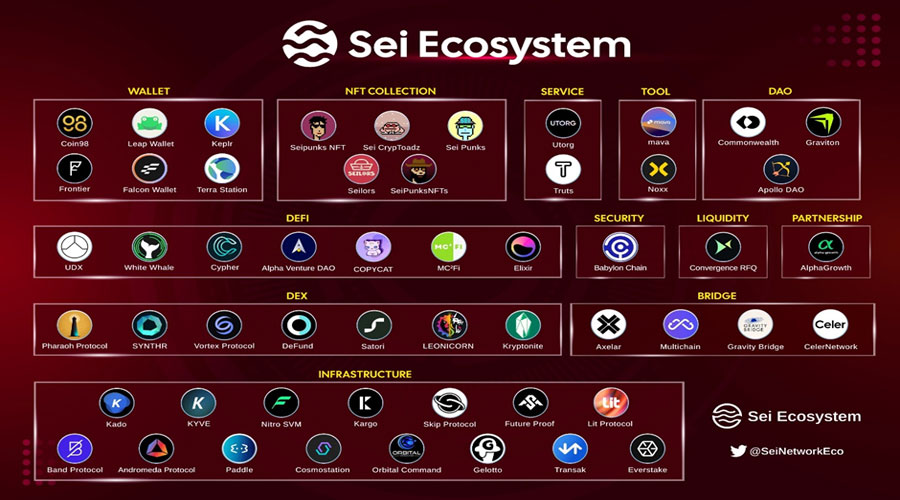

Sei Network Ecosystem

Presently, Sei is in the developmental phase and has yet to establish a substantial ecosystem. Nonetheless, Sei has garnered interest from several prominent partners who have joined its network, especially within the domain of DEX (Decentralized Exchange). Below are some notable projects hosted on Sei.

- Dagora: The NFT Marketplace, developed by Coin98, is supported by Sei Network and Dagora, and is available on various other chains such as Polygon, BNB Chain, and Solana.

- SushiSwap: The decentralized exchange has achieved a Total Value Locked (TVL) of 9 billion USD on its platform.

- Pyth: The solution provided by Oracle, along with collaborations with major partners such as Amber and Wintermute, are noteworthy strategic measures.

Features of Sei Network

- It has been observed that the total number of users of Sei’s testnet has exceeded the threshold of 3 million users.

- By integrating MEV and implementing measures against front-running, we aim to enhance transaction speed and user experience.

- Despite achieving a relatively high threshold of 500 milliseconds, the transaction speed is rapid. However, Sei has exhibited a considerable amount of latency despite this fast pace.

What is SEI Token?

EI Token Key Metrics

- Token name: Sei Token

- Ticker: SEI

- Blockchain: Sei Network

- Contract: Updating…

- Token type: Governance, Utility

- Total Supply: 10,000,000,000 SEI

- Circulating Supply: 1,800,000,000 SEI

SEI Token Use Cases

SEI holders have the following benefits:

- Payment of transaction fees on the SEI network.

- Participate in governance and vote.

- Staking aims to protect the network.

Sei Network Tokenomics

The allocation of SEI Tokens is as follows:

- Private Sale Investors: 20%

- Binance Launchpool: 3%

- Team: 20%

- Foundation: 9%

- Ecosystem Reserve: 48%

SEI Token Sales

On the 2nd of August 2023, Binance has announced that SEI will be listed on Binance Launchpool. To participate, users are required to stake BNB, TUSD and FDUSD in order to earn SEI (maximum stake period of 30 days).

The number of SEIs to be added to each group is as follows:

- BNB pool: 240,000,000 SEI

- TUSD pool: 45,000,000 SEI

- FDUSD pool: 15,000,000 SEI

The farming period shall commence on August 2nd, 2023, and conclude on August 31st, 2023.

Roadmap

Herein lies a list of prominent chronological events pertaining to Sei, as follows:

- 18/5/2022: Sei officially debuted.

- 23/5/2022: Start the Seinami Incentived Testnet program.

- 24/8/2022: Cooperate with Alexar Network.

- 5/9/2022: Cooperation with KYVE – data storage solution on web3.

- 15/9/2022: Cooperation with LEAP – e-wallet exclusively for Cosmos.

- 8/11/2022: Cooperate with Coin98 Super App.

- 15/12/2022: Gravity Bridge builds on Sei.

- 1/8/2023: SEI up Binance Launchpool.

- Q3/2023: SEI official mainnet.

Project team, investors and partners

Project team

The team behind Sei Network includes:

- Jayendra Jog: Co-Founder of Sei Labs, spent 3 years as an engineer at Robinhood.

- Jeffrey Feng: Co-Founder of Sei Labs, graduated with honors from the University of California, Berkeley. In addition, has worked for many years at Coatue Management and Goldman Sachs.

Sei Network Investors

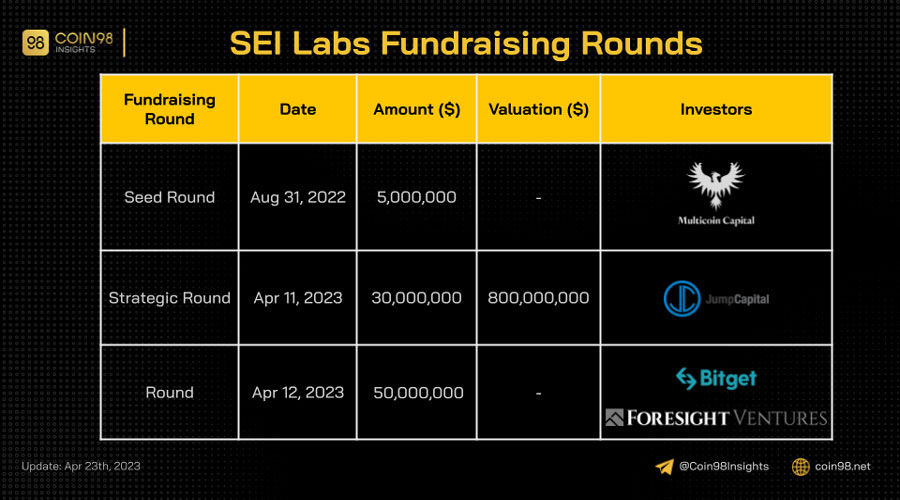

Sei Network has successfully completed two rounds of fundraising, totaling $35 million USD in capital raised

- 31/8/2022: A successful capital call of 5 million dollars was led by Multicoin Capital in the Seed round.

- 11/4/2023: Led by Jump Capital, a round of Strategic funding has been initiated with a valuation of up to $800 million and a targeted capital raise of $30 million.

Partner

Sei Network has strategic partners who function as validators within its network, namely Everstake, Blockscope, ActiveNodes, and so on.

What is Octopus Network (OCT) ? A comprehensive overview of the OCT cryptocurrency

The NEAR Protocol currently hosts an immensely significant project for its ecosystem, which regrettably has yet to garner the attention...

Read moreWhat is Ripple ( XRP coin )? An general introduction to the Ripple coin

Bitcoin is the largest digital currency in the world, with a limit of 21 million units, and it is well-known...

Read moreWhat is Venom Network? It is the first blockchain to be monitored by the UAE regulatory authorities

What is Venom? Venom Network is the UAE's (United Arab Emirates) first Blockchain project initiated by the International Financial Center....

Read moreWhat is Mina Protocol (MINA)? Complete set of cryptocurrency MINA Token

The blockchain platform, Mina, has garnered significant attention from users for a considerable period, having been sold on Coinlist. Furthermore,...

Read moreWhat is Injective Protocol (INJ)? All you need to know about INJ coin

Injective was initially introduced in October 2020 as a cross-chain protocol. Since June 2021, the project has evolved into a...

Read moreWhat is Sui Crypto? Details About SUI Token

The emergence of Sui blockchain has brought forth a new generation of blockchain technology. Its groundbreaking features and notable advantages...

Read moreWhat is Polygon zkEVM? Layer 2 zkEVM is a class rival of zkSync

On March 27, 2023, Polygon zkEVM was officially launched on Mainnet Beta, joining the ranks of other prominent Layer zkEVM...

Read moreWhat is StarkNet Crypto? StarkNet Ecosystem Overview

Inquiring about the ecosystem of StarkNet crypto, we seek information on its various components and current development phase. Furthermore, we...

Read moreWhat is Astar Network & Shiden Network? Complete set of ASTR, SDN Token

This article will provide comprehensive information on Astar Network and Shiden Network, including their prominent features and tokenomics details of...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat is Moonbeam Crypto? Complete set of GLMR & RIVER Cryptocurrencies

Moonbeam is a smart contract platform that has been built and developed to work compatibly with EVM on Polkadot. It...

Read moreWhat is Flow Crypto? Detailed information about FLOW token

In 2017, CryptoKitties, an NFT game on the Ethereum platform, experienced explosive growth that resulted in a sharp increase in...

Read moreWhat is Cardano ( ADA coin ) ? The complete information regarding the ADA coin

The Cardano platform is a blockchain program that provides smart contracts for the development of dApps. With its associated ADA...

Read moreWhat is Wemix (WEMIX)? Learn about the NFT Gaming platform from “the land of kimchi”

The emergence of the thriving NFT game trend has led to the creation of Wemix (WEMIX) as a means to...

Read moreWhat is Klaytn (KLAY)? Learn KLAY Cryptocurrency

Klaytn crypto is a public blockchain that offers security and transparency for businesses. The project's standout feature can be found...

Read more