Gary Gensler, who is the Chairman of the US Securities and Exchange Commission (SEC), has a background in teaching blockchain alongside leading high-profile legal cases between the SEC and various cryptocurrency financial firms. It begs the question: who is he and how did he come to be involved in the world of crypto?

Table of Contents

ToggleWho is Gary Gensler?

Gary Gensler currently holds the position of Chair of the Securities and Exchange Commission (SEC) in the United States. He was appointed to the role by President Joe Biden in April 2021.

Born on October 18, 1957 in Baltimore, Maryland, United States, Gary Gensler graduated from the Wharton School at the University of Pennsylvania with a Bachelor’s degree in Economics.

From 1979 to 1997, the individual initiated their professional journey at the Federal Reserve and Goldman Sachs Investment Bank.

During the period from 1997 to 2001, Gary Gensler was appointed by President Bill Clinton as the Deputy Chairman of the Commodity Futures Trading Commission (CFTC). While serving in this position, Gensler became exposed to and developed an interest in emerging financial technologies, particularly blockchain and cryptocurrencies.

Having departed from CFTC in 2014, Gensler assumed the position of professor at MIT Sloan School of Management, delivering courses related to blockchain and cryptocurrency.

Gary Gensler – “The Villain’s Past” in Crypto

Formerly a Professor at MIT, teaching about Blockchain

Following his departure from the Commodity Futures Trading Commission (CFTC) in 2014, Gary Gensler entered into the field of blockchain education. He subsequently became a Professor at the prestigious MIT Sloan School of Management, offering his expertise and knowledge on the subject matter.

During a lecture on “Blockchain and Money” at MIT, Gensler stated in 2018 that…

We are aware that in the United States and several other jurisdictions, around three quarters of the market (with BTC and ETH accounting for approximately three quarters of the market share) are not ICOs (Initial Coin Offerings) or considered securities, even in the jurisdictions of the United States, Canada and Taiwan, which have similar conditions to the Howey Test we have previously discussed.

Approximately three-fourths of the market is not related to the stock exchange, rather it functions merely as a commodity, essentially a digitalized version of currency.

At present, he opines that the market share of BTC and ETH constitutes approximately three-fourths of the market and that these assets cannot be categorised as securities.

The Howey Test serves as an examination that aids the SEC in identifying any assets or activities that are linked to securities. In the event that these are indeed securities, they must adhere to the regulations set forth by the SEC.

Gary Gensler has been consistently suppressing cryptocurrency companies in the United States since assuming the position of SEC chairman

Upon confirmation as Chairman of the SEC, Gary Gensler proffered several viewpoints and proposals pertaining to cryptocurrencies and financial markets. Notably, he reiterated the necessity of enhancing the SEC’s workforce to effectively tackle issues related to digital assets and other forms of virtual currencies.

During his speech at the Piper Sandler Global Exchange & Fintech Conference on June 8, 2023, Gensler drew a comparison between the present-day cryptocurrency market and the US stock market of the 1920s, characterizing the former as rife with fraudsters, scammers, and Ponzi schemes.

The speaker emphasized that just as the National Assembly has “cleaned up” the securities market by enacting securities laws, the SEC could also clean up the cryptocurrency market by applying these laws to “crypto asset securities.”

During Gensler’s tenure as head of the SEC, he consistently targeted crypto companies and caused them to suffer significant losses through repeated attacks.

- The lawsuit between the SEC and Ripple Labs: The legal dispute initiated in December 2020, which was subsequently intensified by Gensler upon his assumption of power, has triggered a great deal of controversy and led to a continuous decline in the value of XRP.

- Fines against crypto finance company BlockFi: In February 2022, the Securities and Exchange Commission (SEC) imposed a fine of up to $100 million on BlockFi for violating securities regulations related to lending and deposit activities.

- SEC accuses Coinbase of listing securities: The Securities and Exchange Commission (SEC) has filed a complaint against a senior employee of Coinbase, alleging that the company violated securities regulations by listing securities-like assets without complying with the regulations. In March 2023, the SEC targeted Coinbase as a warning shot to the entire crypto market.

- SEC fines Kraken exchange: In February 2023, Kraken was assessed a penalty of 30 million USD by SEC for violating securities regulations related to the sale of security contracts.

- SEC warns Binance’s BUSD stablecoin: In February 2023, the SEC issued a warning to BUSD, stating that it was an unregistered security, and required Binance to comply with securities regulations. This action resulted in over 100 billion USD worth of stablecoin coming under pressure.

- SEC sues cryptocurrency exchange Bittrex: In April 2023, the SEC filed a lawsuit against Bittrex exchange for allegedly listing securities-like assets without proper registration.

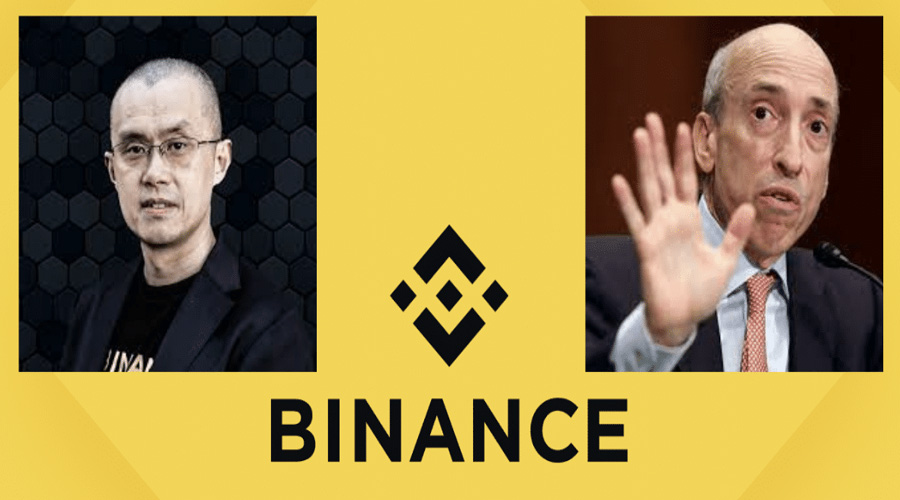

- SEC sues Binance US: In June of 2023, Binance US and CEO Changpeng Zhao were accused by the SEC of contravening securities regulations.

The primary cause for these lawsuits is the unauthorized listing of securities-like assets without registration. These legal disputes have had a significant impact on related cryptocurrency companies and the overall cryptocurrency market.

The aforementioned elucidates Gary Gensler’s objective to enhance regulation and compliance within the industry. Nevertheless, the SEC’s regulations are increasingly excessive, leading to considerable discontentment.

It is worth noting that BTC and ETH are two major cryptocurrencies that have not yet been scrutinized by regulatory bodies. The SEC is currently exerting significant efforts to suppress the crypto market by declaring a series of tokens, including BNB, BUSD, SOL, as securities. As a result, the question arises as to when BTC and ETH will be subject to the same scrutiny.

The controversy surrounding Gary Gensler is the subject of discussion

Conflicting statements about BTC and ETH

Prior to assuming the role of Chairman of the SEC, Mr. Gensler held the belief that Bitcoin (BTC) and Ether (ETH) – encompassing three-fourths of the cryptocurrency market share – did not classify as securities.

However, subsequent to assuming the Chairmanship of the SEC, he forthrightly criticized the cryptocurrency market employing strong language.

Gensler emphasizes that certain forms of cryptocurrency, such as Bitcoin and Ethereum, can be considered securities and are therefore subject to the regulations and protocols of traditional securities markets.

The individual presented an argument suggesting that categorizing these types of digital currencies as securities would offer users with a higher level of protection, ensuring transparency and accountability in the trading and distribution of digital currencies.

During a congressional hearing on April 18, 2023 before the US House of Representatives, Gary Gensler was unable to provide a clear answer when asked by Congressman Patrick McHenry whether ETH should be classified as a commodity or security.

It can be observed that Gensler’s stance on the issue of whether BTC and ETH classify as securities or not exhibits a complete reversal both prior to and subsequent to assuming the position of Chairman of the SEC.

SEC sued Coinbase for violation, Coinbase countersued SEC for not providing clear rules

In March 2023, the SEC accused Coinbase of violating securities laws. In early April 2023, Coinbase counter-sued the SEC for failing to provide clear positions and legal guidelines on assets recognized as securities. This can be likened to a situation where a person receives a speeding ticket without clear knowledge of what the maximum speed limit is.

Following Coinbase’s request for legal action, the US Court received their petition and subsequently requested a clarification from the Securities and Exchange Commission (SEC). In response, the SEC stated that they are not obliged to provide any information to Coinbase.

During the trial, the United States Court demanded that the Securities and Exchange Commission (SEC) reaffirm their stance on the proposal to develop a legal framework for crypto assets traded on the Coinbase exchange. The SEC has been granted a period of seven days to respond to Coinbase’s lawsuit and must provide justification for their decisions along with an anticipated timeline for resolution.

According to documents submitted to the court by SEC at the beginning of May 2023, SEC asserted that it was not obligated to comply with the requests made by Coinbase in the lawsuit and that the regulatory concerns raised by Coinbase were unfounded. In fact, SEC went so far as to request that the court dismiss Coinbase’s claim.

The Securities Law and the Administrative Procedure Act (APA) do not impose an obligation on the U.S. Securities and Exchange Commission (SEC) to issue new regulations related to digital assets that Coinbase demands.

SEC Responds to Coinbase’s Complaint

This indicates non-cooperation on the part of the SEC in elucidating the legal framework regarding securities as asset classes.

However, when Gary Gensler assumed the position of Chairman of the SEC, he made the following statement:

It is a widely known fact that registering on our website entails completion of a simple form which is accessible to all. Our personnel are readily available for any enquiries on the matter.

According to Paul Grewal, the General Counsel of Coinbase, they had reportedly met the representatives from the concerned agency over 30 times within a span of 9 months prior to being sued by Coinbase. However, most of their proposals were left unaddressed.

Coinbase has requested the SEC to specify the particular assets on its platform which they believe to be securities, yet the SEC has declined to fulfill such a request.

Paul Grewal, Chief Legal Officer of Coinbase

Under the leadership of Gary Gensler, the Securities and Exchange Commission (SEC) is exhibiting poor communication and action, which inadvertently leads to a dead end for the crypto industry in the United States. Consequently, these companies are compelled to seek new markets such as China for further development.

Has Gary Gensler ever proposed serving as an advisor to Binance?

During the legal dispute between the SEC and Binance US, the legal team of Binance made arguments on two separate occasions – in early February 2023 and again on June 4, 2023 – asserting that Gary Gensler should withdraw from the case due to his prior interactions with Binance and its CEO, Changpeng Zhao (CZ).

Binance has stated that in March 2019, Gary Gensler had proposed to work as an advisor for the exchange before being appointed as the Chairman of the SEC by the government. During their lunch meeting in Japan in March 2019, Gensler had discussed BNB and Binance US with CZ. Subsequently, CZ was interviewed for a cryptocurrency course at MIT by Gensler. Furthermore, the two parties are still in contact.

Binance has confirmed that prior to appearing before the House Financial Services Committee, Gary Gensler sent a copy of his testimony to CZ.

Binance refuted Gary Gensler’s involvement in the lawsuit by utilizing the aforementioned justifications.

The specific motor driving the SEC’s litigation against Binance is uncertain; nonetheless, a certain ambiguity is discernible in the actions of SEC Chairman Gary Gensler himself.

Who is Jed McCaleb? A biographical profile detailing the founder of Ripple, Mt. Gox, and Stellar

Recently, Ripple is a name that should not be unfamiliar to cryptocurrency users as it has been a long-standing name...

Read moreWho is Phil Town? A biography of the man who required only $1000 to become a billionaire

Although not being a prominent investor in million-dollar deals, Phil Town is known for his dedication and discipline in investment....

Read moreWho is Jihan Wu? This is a biographical profile of the person who is famously known as the king of cryptocurrency mining

Jihan Wu was once a well-positioned individual with a broad path to advancement in the financial industry. It's surprising that...

Read moreWho is Warren Buffett and what are his life and career accomplishments as a genius in the investment industry?

While other children of his age were playing with childish games, Warren Buffett earned his first dollars by selling chewing...

Read moreWho is Dan Larimer? Biographies of the founders of Bitshares, Cryptonomex, steemit, Block.one and EOS

Dan Larimer is a well-known figure among the cryptocurrency investment community during the 2017 - 2020 period. This is because...

Read moreWho is Nakamoto Satoshi? The enigmatic mask of the Bitcoin wizard

Who is Nakamoto Satoshi? This article will provide fascinating information about Satoshi Nakamoto, and the process of his creation of...

Read moreWho is Gavin Wood? Overview of Polkadot founders

On October 22, 2022, Gavin Wood made an official announcement via Twitter that his fellow co-founder of Parity, Björn Wagner,...

Read moreWho is Hayden Adams? And His Total Net Worth

Hayden Adams is the founder of Uniswap, a decentralized exchange (DEX) for Ethereum tokens. Let's take a closer look at...

Read moreWho is Chris Larsen? Biography of the world’s richest crypto billionaire

In today's article, 247btc.net invites readers to explore the life and career of Chris Larsen, one of the influential figures...

Read moreWho is Barry Silbert? He is the founder and CEO of Digital Currency Group

In a recent statement made by Cameron Winklevoss, chairman of Gemini, he stated that "Digital Currency Group (DCG) will not...

Read moreWho is Vitalik Buterin? He is a solitary genius and the creator of the Ethereum empire

Vitalik Buterin, the founder of Ethereum - the second-largest market cap blockchain platform worldwide after Bitcoin, displayed his innate talent...

Read moreElon Musk – Billionaires influence the crypto market through tweets

Elon Musk is known as one of the wealthiest billionaires in the world, having achieved great success with companies such...

Read moreWho are the Winklevoss brothers? Biography of Bitcoin billionaires Tyler Winklevoss – Cameron Winklevoss

Tyler and Cameron Winklevoss, who are identical twins, rose to fame for their lawsuit against Mark Zuckerberg for stealing the...

Read moreWho is Gary Gensler, the Chairman of the SEC, and his journey towards becoming a critic of cryptocurrencies?

Gary Gensler, who is the Chairman of the US Securities and Exchange Commission (SEC), has a background in teaching blockchain...

Read moreWho is Brian Armstrong? Biography of the founder and CEO of Coinbase Exchange

Coinbase was established in June 2012 by Brian Armstrong and Fred Ehrsam, with its main headquarters in San Francisco, California....

Read more