To acquire a comprehensive grasp on the efficiency and drawbacks of the Balancer V2, along with understanding the potential of the BAL token, one may refer to the article below which sheds insightful perspectives on the subject matter. The article outlines the development and advancements made to the Balancer V2, providing a detailed explanation of its operational framework. The strengths and weaknesses of the system are carefully assessed, providing a well-rounded and informed perspective for readers.

Table of Contents

ToggleBalancer Overview (BAL)

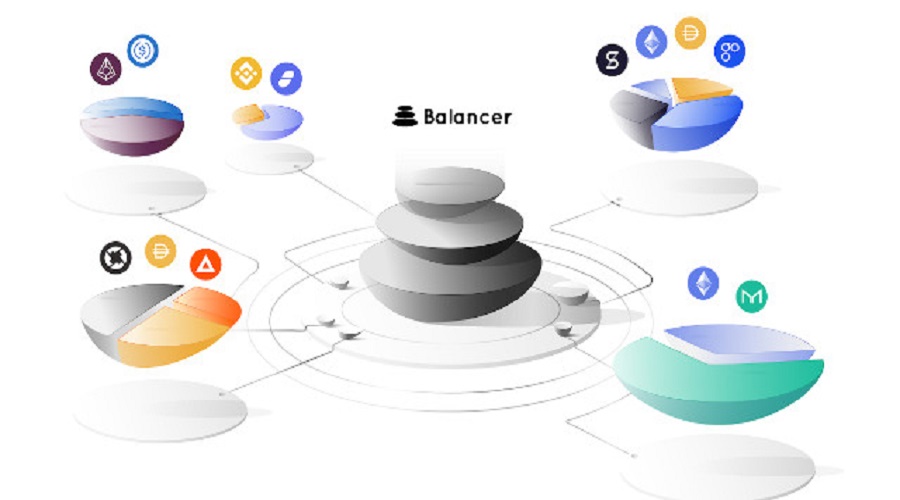

The Balancer is an automated market maker platform that empowers its users to indulge in trading, swapping and providing liquidity for a variety of assets with various ratios. Balancer comes in two main versions, V1 (Q2/2020) and V2 (11/5/2021).

Within this context, it should be noted that Balancer V2 exhibits numerous distinct and unique characteristics when compared to its predecessor, Balancer V1. Therefore, in the following discussion, we will carefully analyze the strengths of Balancer V2, its approach to capturing value for BAL, and the potential of its native token, BAL. Adopting a formal and informative tone, we aim to provide a comprehensive evaluation of these key elements of Balancer V2.

Pros and cons of Balancer V1

Advantage

During Q2/2020, DeFi experienced a significant boom with the introduction of Automated Market Makers (AMM) and related products. As users gained exposure to these innovative technologies. They began to recognize the many advantages of AMM, as well as some of its limitations, such as Impermanent Loss and the monotonous nature of AMM at that time.

During this phase, the Balancer V1 was introduced, which offers users an Automated Market Maker (AMM) with versatile options and flexible utilization in various situations, while also mitigating issues related to Impermanent Loss (IL). Notable examples of its capabilities include:

- The presence of numerous ratios and tokens in Liquidity Pools enables users to have more flexibility in their selection and use. For instance, in addition to the 50%-50% pool. There are pools with ratios such as 80%-20% and 90%-6%-2%-2%. This characteristic proves to be beneficial for users as it empowers them to make informed decisions and maximize their gains.

- We offer a variety of different pools, as our product, Balancer, provides users with three main pool types. Including the Shared Pool, Private Pool, and Smart Pool, each featuring unique characteristics and attributes.

Restrict

Despite offering users a wide range of choices and holding promising products, the Volume and TVL of Balancer V1 suggest that the project has not been particularly successful. Specifically, when compared to the TVL and Volume of Uniswap, Balancer lags 6-8 times behind, as of the end of 2020.

The inability of Balancer V1 to successfully perform in its race could stem from the following reasons:

- The ability to attract users and initial bootstrap are weak points for Balancer as compared to its competitors such as Uniswap, who have excelled in retroactively rewarding users with thousands of dollars. However, the Initial Network Effect of Balancer V1 has not been as effective in generating high efficiency.

- The products of Balancer are characterized by a wide range of features and a complex knowledge base. While these features are diverse and numerous, effective utilization of them requires a strong understanding of the AMM product.

- The interface of Balancer V1, in essence, has not yet been developed to its full potential in terms of providing optimum user experience. Some feedback suggests that the interface may be perceived as convoluted and confusing.

Balancer V2

With an improved version, Balancer V2 has successfully overcome the limitations of its previous version and introduced a range of advanced features such as:

- Protocol Vault – one vault for all.

- Gas efficiency is improved.

- Flash loans & Flash Swaps (arbitrage trading).

- AMM with custom recipe.

- Asset Managers – increase capital efficiency.

Protocol Vault

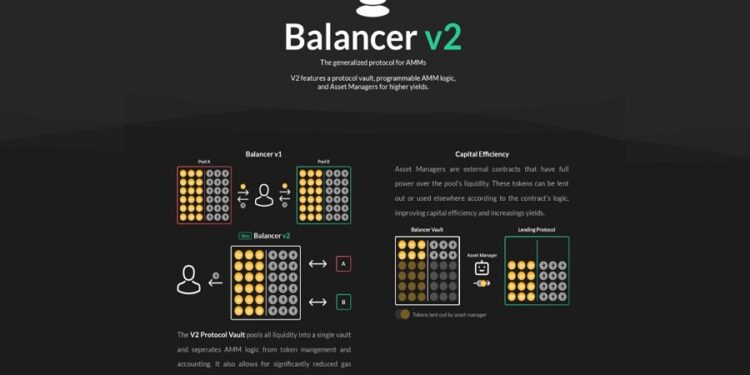

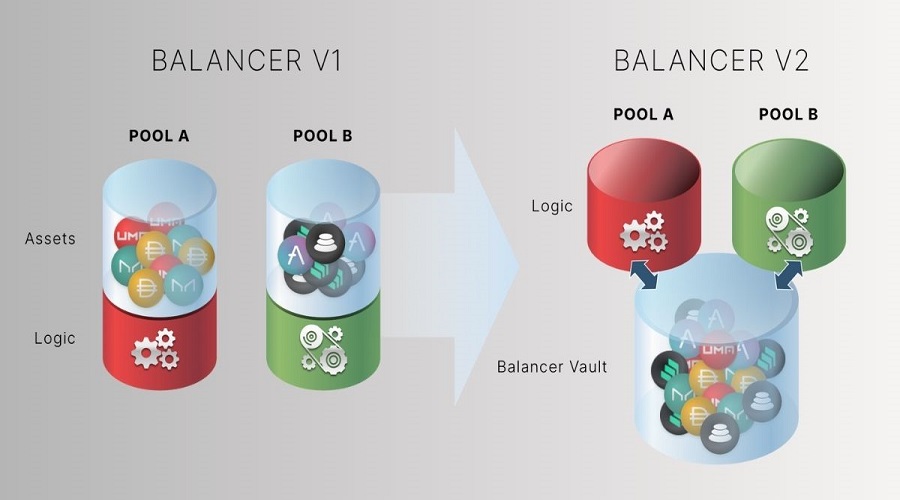

In contrast to V1, the main architecture of V2 utilizes a single vault to contain and manage assets belonging to Balancer Pools. Specifically, the AMM logic has been separated from the token management and accounting for Balancer V2. This means that the AMM logic will be executed individually for each pool, while the token management and accounting will be handled by the vault.

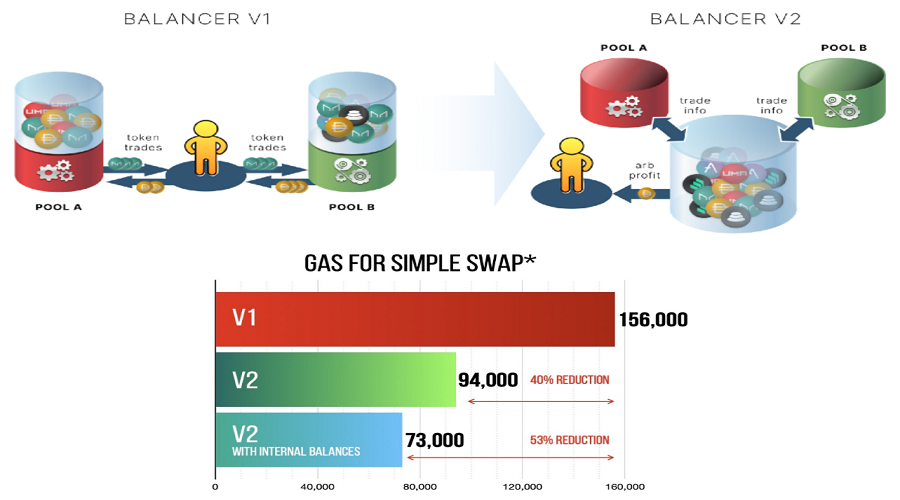

Gas – Improve usage efficiency

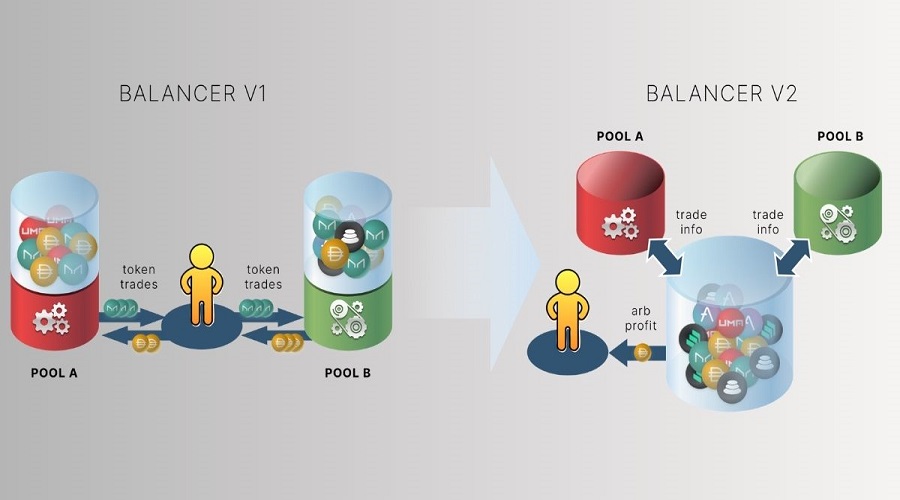

For V1, users are required to send and receive ERC 20 tokens from various groups in order to carry out two-way transactions. And conducting multiple transactions across pools is not efficient. However, with V2, the final net amount is transferred to the Vault despite the transactions being executed in batches and across various pools.

In simpler terms, despite engaging in numerous transactions with various pools, the end result is the transfer of tokens out of the Vault. This process can offer cost-saving benefits for users and create more speculative opportunities through price differentials in trading.

In addition, Balancer V2 possesses the capability to support internal token balances that offer several benefits to traders. For instance, if one desires to exchange token A for token B and then trade B back for A. They can avoid multiple transactions by not receiving token B during the first trade and allowing Balancer to hold both tokens in the vault. This feature can significantly enhance the trading process and efficiency for users.

Reduce Gas and Oracle fees stably

Balancer V2 has integrated an Oracle system with two types of price data in order to decrease the likelihood of a cyber attack.

- Instant: Prices are constantly updated but are vulnerable to attacks.

- Resilient: Prices are not constantly updated but stability is better.

The selection of a specific type depends on the individual use case, as resilient would be preferred for the Lending Protocol, while Instant is prioritized for Prediction markets. Therefore, it is within the discretion of the users to choose the appropriate option best suited to their context.

AMM with custom recipe

Balancer V1 features three main types of pools which are the Public Pool, Private Pools, and Smart Pools. With the release of V2, the number and diversity of the pools have increased significantly. Currently, the two primary pools are the Weight Pools and Two-token weighted oracle pools that are being initiated.

- Weighted Pools: This is a permissionless pool containing 8 tokens, similar to Public Pools in V1. One notable trait of this pool is its capability to save on gas costs, and also to expand the number of tokens to a maximum of 16 in the future.

- Two-token weighted oracle pools: Similar to pairs on Uniswap, this pool is a 50% – 50% distribution.

Various types of pools are currently being tested and developed such as Stable pools, Liquidity Bootstrapping Pool, and Smart Versions of Weighted Pools and Stable Pools. Specifically, Stable Pools are designed for stablecoins while Liquidity Bootstrapping Pool is applied to IDO and Launchpad of new tokens.

This project is pioneering in creating a Launchpad for customized AMM, providing greater creative capabilities for developers. This allows for the development of unique AMM strategies tailored to the specific needs of the project. Initially, Balancer V2 will support two pool types, Weighted Pool (with stable weights) and Stable Pool (suitable for Stablecoin or equivalent stable tokens). Subsequently, Smart Pool will be supported to enable flexible parameter changes. Other pools will be designed by partners.

Assets Managers

The majority of assets within an Automated Market Maker (AMM) are often left unused, resulting in a low capital efficiency. Addressing this issue, the Balancer V2 platform has launched a solution known as the Assets Manager feature. This feature involves an external Smart Contract, which is authorized to manipulate the amount of tokens that have been deposited into the Vault with the Pool. This improves the capital efficiency of the AMM, providing a more efficient investment experience for users.

By reallocating underutilized capital from Balancer Pools to Lending Pools, Asset Managers can increase yields and profitability for certain Balancer Pools. This established solution can be observed in pioneering projects such as the Curve with Pompound Pool and Y Pool. Nevertheless, for the Curve, high costs continue to represent a significant challenge.

For instance, it may be necessary for you to expend up to 800,000 units of gas in order to transfer TUSD to USDC via Curve. However, the amount required for the same transaction on Uniswap is limited to roughly 100,000-120,000 gas units.

Administration of fees in Protocol

Fees on Balancer V2 will be decided by the BAL token holder. Specifically:

- Trading Fees: When the user performs a transaction, a portion of the fee will be collected.

- Withdrawal fees: A fee will be charged for withdrawing tokens from the vault, while no fees will be incurred for transferring funds across pools.

- Flash Loan fees: When executing flash loans from the vault, a certain amount of fees will also be incurred.

During the initial stage, users will be exempted from Trading fees and withdrawal fees. The only fee assessed to generate initial revenue on Balancer is the Flash loan fee. These fees will be held in the Vault initially and community voting will determine their utilization.

The progress of Balancer V2’s development

V2 Launch boasts numerous improvements compared to V1 and features several significant functionalities, including the following:

- The interface has been redesigned, resulting in a more visually appealing and user-friendly presentation compared to Balancer V1.

- The migration of liquidity from Balancer V1 to V2 was executed with meticulous care and deliberate slowness, as evidenced by the Vaults V2 having a TVL of approximately $130 million while the entire Balancer ecosystem has a TVL of $2.3 billion.

- There are two main types of pools utilized on Balancer V2, namely Weighted Pools and Two-token Weighted Oracle Pools, which do not operate under a permissionless system. This implies that users are unable to independently create pools but instead can only engage in trading or liquidity addition within the existing pools.

- Asset Managers (not live yet).

Balancer Component

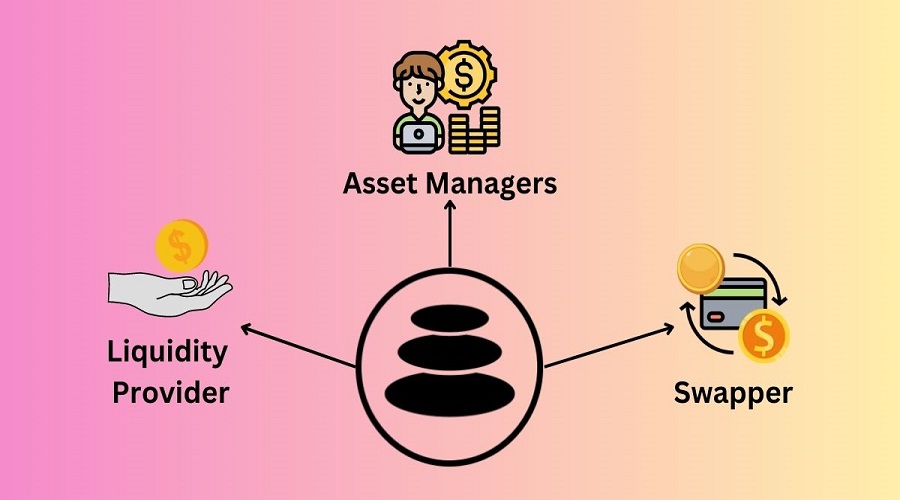

So, basically, the 3 main components of Balancer V2 can be mentioned as:

- Liquidity Provider: This entity serves as the primary source of liquidity for the market.

- Swapper: Users execute transactions based on their demands and pay fees for each transaction, which range from 0.01% to 10% per trade, depending on the fixed fee of the Pool.

- Asset Managers: One strategy to increase profitability for Balancer Pools is to redeploy some of their underutilized capital outside of the pools.

Liquidity Provider

Balancer V2 is similar to Uniswap in that Liquidity Providers (LPs) supply liquidity by adding tokens to the Pool in proportion and receive LP fees. The LP token can be used for farming to support a group of Pools. Balancer V2 differs from Uniswap in two ways: it offers more types of Pools, and its LP fee is dynamic. Additionally, the LP fee can be changed through governance and set by Gauntlet.

Swapper

When conducting a transaction on Balancer V2. Swapper will send a specific quantity of token A and LP fee, to receive an equivalent amount of token B (with the possibility of additional Protocol Fee at a later stage).

The distinguishing factor of Balancer lies in the variable LP fee that users are required to pay for each pool, rather than a fixed amount. Hence, it is imperative for users to take note of the fees for each pool they intend to swap.

Assets Managers

As previously stated, the Assets Managers will allocate unused capital from the Pool to generate profit. To clarify, Aave has been confirmed as an Assets Manager for Balancer. Specifically, Aave will bring the unused capital of Balancer Pools to Aave’s Lending Protocol to attract additional yield for Balancer’s Pools.

How Balancer V2 transfers value for BAL tokens

Currently, the sole function of the BAL token is to serve as a Governance Token, which enables BAL holders to exercise their voting rights. However, in the future, BAL holders may be entitled to other incentives, besides the Governance function, which will be launched and operate stably. Of course, this will be the case only after these features have been officially implemented.

The process of Balancer V2 can go like this:

Focus on product creation process — > Attract TVL to create Volume and Revenue Stream — > Charge Protocol fee — > Protocol fee and other revenue Stream put into Treasury like yield from lending protocol — > Distribute money from treasury to BAL staker.

At present, the default setting for the protocol fee is zero. And there are numerous ways to utilize the diverse range of funds available, including:

- Fund Gitcoin Grants: protocol improvements.

- Fund Advertising Campaigns.

- Fund grants: attract strategic partnerships.

- To safeguard against unfavorable circumstances, it is recommended to acquire insurance coverage for the Balancer.

- Lending Protocol

- Distribute for BAL staker.

Balancer can utilize the following distribution methods as part of its functionality:

- The company intends to execute a buyback from the market followed by the process of burning, as a means to reduce outstanding shares and return capital to shareholders.

- Do the same as Sushi.

- To emulate the Curve model, it is advised to apply a similar technique of distributing and augmenting temporal weights.

Summary

In summary, the improvements made to the AMM space for Balancer V2 can be encapsulated as follows.

- Ensuring security is achievable through a simple architecture.

- By consolidating all assets into a single vault, users are able to execute transactions and provide liquidity with just one approval. This simplifies the process and streamlines trading activities while also increasing security measures.

- The gas optimization feature provides users with the opportunity to efficiently conserve gas usage and potentially reduce their gas expenses to a maximum level.

- The effective use of funds entails that the power to regulate the amount of tokens added to the vault belongs to the Pool, thereby creating a larger scope for asset utilization. This enables users to reap the benefits of a more expansive utilization of resources.

- Being flexible: Those who contribute and create pools on Balancer will be rewarded more generously.

With the improvements mentioned above, Balancer has demonstrated its ambition to become a crucial piece for DeFi projects. However, while providing many new features in its design. Balancer has not fully implemented all of its standout features yet. Consequently, it is uncertain whether it can operate stably or not. Additionally, Balancer is competing against strong rivals such as Uniswap V3 and SushiSwap multichain, which have launched features with impressive numbers. Launching features and competing with these rivals is something that we need to continue to observe in Balancer V2 in order to assess its success.

An additional significant concern is the expansion of Layer 2 or the compatibility with other chains’ EVM. Currently, the AMM market on Ethereum is considered quite congested and shows no sign of expansion, while emerging markets such as Layer 2 are becoming increasingly open.

With the aforementioned sharing, it is likely that you have gained an understanding of the key highlights of Balancer V2, as well as how this project captures value for BAL. However, this is also a delicate stage for the project that requires careful observation and prudence in seeking investment opportunities in order to make the most informed decisions.

Who discovered electrons protons and neutrons?

The discovery of neutrons, which possess no electric charge and nearly the same mass as protons while remaining electrically neutral,...

Read moreWho is the painter of The Mona Lisa?

The Louvre Museum houses one of the most iconic portraits in the history of art, namely the Mona Lisa painting....

Read moreWho makes Genesis vehicles?

The Hyundai Motor Group produces luxurious automobiles under the name of Genesis. In 2015, the company announced its intention to...

Read moreWho discovered United States of America?

The response to the aforementioned inquiry appears to be apparent for the majority of individuals, as they were educated in...

Read moreWho created the first atomic bomb formula?

The journey towards the creation of the atomic bomb was initiated by a moment of profound realization in London. Subsequently,...

Read moreWho has the most followers on instagram in the world?

In response to an inquiry of utmost interest, it has been revealed that the individual with the most followers on...

Read moreQuotes about friends who are fake

The end of a friendship can be an excruciatingly painful experience, potentially overshadowing other kinds of heartbreak. The betrayal of...

Read moreWho is the top 10 richest people in Asia?

The ever-changing wealth landscape in Asia has continually garnered international attention, as a vast number of individuals have left their...

Read moreWho is the most richest person in the world currently?

With a net worth of $239.3B, Elon Musk currently holds the top position on the list of the world's wealthiest...

Read moreHow deep is the wreck of The Titanic?

On April 15, 1912, the RMS Titanic endured a tragic fate in the North Atlantic Ocean as it collided with...

Read moreThe biggest country in the world by population

Data published by the World Bank reveals that in 2021, the 25 most populous countries in the world accounted for...

Read moreWhat is Kraken exchange? A comprehensive review of Kraken trading platform from A to Z.

Kraken exchange is positioned among the top 10 global cryptocurrency trading platforms. Its most significant feature is the provision of...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is 1inch Network and what are the key considerations for investment in 1INCH?

The 1Inch Network is among the first Aggregators in the market and has operated with remarkable efficiency over time. Additionally,...

Read more