Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum, BNB Chain, Avalanche, Fantom, and non-EVM compatible blockchains like Terra and Solana. In pursuit of its objectives, Symbiosis Finance stands apart by offering distinctive features and capabilities. To gain further insights into the project, please refer to the SIS token documentation here.

Table of Contents

ToggleWhat is Symbiosis Finance?

Symbiosis Finance is a decentralized multi-chain liquidity protocol that aims to aggregate liquidity for all Ethereum Virtual Machine (EVM) compatible chains such as Ethereum, BNB Chain, Avalanche, Fantom, and non-EVM compatible blockchains like Terra and Solana.

Moreover, the protocol feature enables users to carry out transactions and swap assets across various blockchains. Unlike the existing DEXes in the market, Symbiosis eliminates the inconvenience of exchanging tokens between different blockchains. The current Symbiosis support for four blockchains, including Ethereum, Polygon, Avalanche, and BNB Chain, facilitates seamless and hassle-free swapping of assets.

The salient feature of Symbiosis Finance

Each swap transaction within the Symbiosis system takes place through centralized liquidity pools. Each pool comprises:

- One option to swap stablecoins is to use either a group of two pools or a group of three pools. For instance, when swapping between BNB Chain and Ethereum (or vice versa), one would acquire a liquidity pool comprising BUSD and sUSDT, where sUSDT is the wrapped version of USDT.

- Native assets are paired together.

The swap feature of Symbiosis protocol is modeled after 2 Automated Market Makers (AMMs) in the following manner:

- The AMM model is similar to Curve: Features can swap stable assets such as stablecoins or assets at the same price (eg: BTC for wBTC).

- AMM model similar to Uniswap: Feature to be able to swap any assets.

The functionality thereof serves as a means to optimize significant issues, such as:

- The AMM model is similar to Curve:

- Provide liquidity for stablecoins like BUSD, USDC, USDT for any other tokens on those blockchains.

- Provide liquidity for stablecoins with minimal slippage for users and no risk for liquidity provoders.

- Providing liquidity for equally priced assets on both networks, like BTCB-wBTC.

- AMM model similar to Uniswap:

- By supplying liquidity to fundamental blockchain assets such as BNB-ETH, they may be utilized as a vehicle for conducting native asset swap transactions and for gas pool purposes.

In summary, the principal characteristics of Symbiosis encompass:

- The Symbiosis protocol, designed based on the user-friendly AMM DEX model similar to Uniswap and Curve, stands out with its unique capability of functioning on different blockchains.

- Our platform ensures complete decentralization and security, thereby guaranteeing that user accounts are not subjected to scrutiny by any intermediary entity. Additionally, no personnel at Symbiosis possess the authority to access user funds.

- Symbiosis provides support for numerous token pairs across all blockchains and offers the best exchange rates for swapping any preferred token pair, thereby enabling limitless cross-chain liquidity.

By considering its features, it can be observed that Symbiosis presents a completely sustainable and decentralized model. This innovative wave represents a significant leap forward from previously established AMM models.

Detailed information about SIS Token

Key Metrics SIS Token

- Token Name: Symbiosis Token

- Ticker: SIS

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xd38BB40815d2B0c2d2c866e0c72c5728ffC76dd9

- Token Type: Utility

- Total Supply: 100,000,000

- Circulating Supply: Updating…

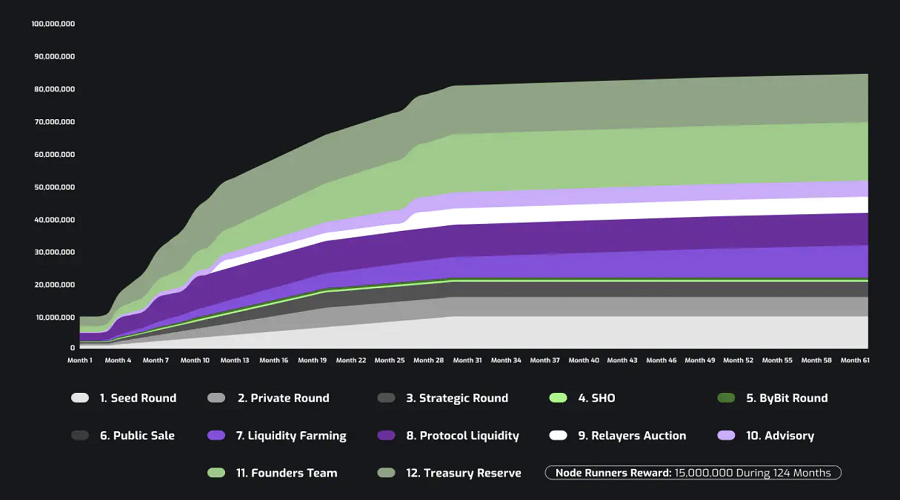

SIS Token Allocation

- Founders Team: 18%

- Treasury Reverse: 15%

- Node Runners Reward: 15%

- Protocol Liquidity: 10%

- Liquidity Farming: 10%

- Seed Round: 10%

- Private Round: 6%

- Advisory: 5%

- Relayers Auction:5%

- Strategic Round: 4.7%

- Public Round Y: 0.65%

- Public Round DaoMaker: 0.55%

- Public Round Z: 0.10%

SIS Token Sale

SIS Token Release Schedule

- Seed Round: Pay 10% after the first 4 months, then pay 3.333% each month

- Strategic Round: Pay 10% after the first 4 months, then pay 5.294% each month

- Private Round: Pay 0% after the first 4 months, then pay 5.294% each month

- IDO: Pay 25% after the first 4 months, then pay 25% every quarter

- IEO: Pay 25% after the first 4 months, then pay 25% every quarter

Products of Symbiosis Finance

Cross-chain Liquidity Engine

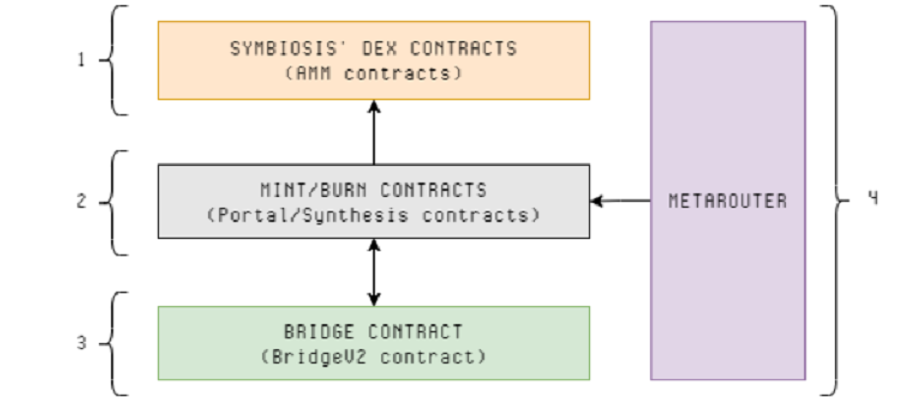

This tool comprises a collection of smart contracts utilized for the purpose of asset exchange between chains. The smart contracts will be deployed and managed by the administrators of Symbiosis Finance.

Symbiosis DEX contract

The purpose of this contract is to facilitate the exchange of sToken and stablecoin. The swap feature of Symbiosis is structured based on the automated market maker (AMM) model and consists of four applicable scenarios as follows:

- Primarily, AMM functions akin to Curve in furnishing liquidity for stablecoins, such as BUSD, USDC, and USDT, for all other tokens across said blockchains.

- Secondly, AMM is similar to Uniswap in providing liquidity for underlying blockchain assets, such as BNB-ETH, with the intention of utilizing these assets to support asset exchange transactions, as well as pools containing gas fees.

- Third, AMM resembles Curve to provide liquidity for stablecoins with minimal slippage for users, as well as reduced risk for liquidity providers.

- Fourth, AMM is like Curve to provide liquidity for equally priced assets on both networks, such as BTCB-WBTC.

Mint/burn contract

This contract will be used to mint and burn sTokens.

Bridge contract

This contract represents an authorization agreement between Relayer Network and the Portal/Synthesis contracts.

Metarouter

This is an intelligent contract that manages transmitted transaction orders across various contracts. It represents the user during the exchange of assets between different blockchains.

Development team and investors of the Symbiosis Finance project

Development team

The development team of Symbiosis Finance comprises members as illustrated below.

Investors

The project has successfully raised 2 million US dollars during its seed round, with the participation of prominent investment funds including DAO Maker, Gate.io, Blockchain.com Ventures, Wave Financial Group, Injective Protocol, KuCoin, Primitive Ventures, and Kairon Labs.

Symbiosis Finance’s development roadmap

First quarter of 2022

- Launched Symbiosis mainnet and supported 2 more networks: Solana and Polkadot

- Launch of Symbiosis Correspondent Network backed by crypto-economic mechanisms

- Launching mobile application SDK v.2, smbUSD collateralized with currencies such as: USDC, SMB, BNB, ETH

Quarter 1 and 2 of 2022

- Supports many other networks

Summary

The above information pertains to the Symbiosis Finance project and its associated token, SIS. The aim of this project is to cater to the demand for interconnection between various blockchains to facilitate investor access to a broader range of ecosystems. This connection between blockchains will create opportunities for investors to generate higher profits.

247btc.net has provided detailed information regarding the Symbiosis Finance project and SIS token. We encourage you to thoroughly research and evaluate the project to make the most informed investment decisions. Wishing you the best of luck.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more