One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO guarantees a 100% likelihood of success. IDO crypto has become a familiar term in the Crypto market due to its potential profitability for participants. However, it remains questionable whether investing in IDO would inevitably result in a 100% win. In this article, we shall delve into the definition of IDO and explore the factors behind its widespread popularity.

Table of Contents

ToggleWhat is Initial DEX Offering (IDO crypto)?

An Initial DEX Offering (IDO) is a fundraising method that involves selling tokens on decentralized, automated market maker platforms. IDOs usually consist of two separate pools, one for the community and the other for the platform’s token holders (e.g., POLS, DAO, etc.).

For those who may be curious, AMM stands for Automated Market Maker, which refers to a trading mechanism that utilizes algorithms to calculate the token’s value at the time of purchase. This is accomplished through the use of smart contracts that act as intermediaries. Sellers deposit their assets into a liquidity pool, and buyers swap their assets with those in the pool using the smart contract. This approach to trading is efficient and streamlined due to the employment of the AMM system.

In addition, the currency used for IDOs is also quite diverse, it can be USDT, USDC or ETH.

An assessment of the advantages and disadvantages of IDO crypto

Advantage

- New projects raise capital more easily than IEOs on CEX.

- From IDO, many other capital raising methods have developed, including the very successful IFO at PancakeSwap.

Disadvantages

- Like other trends, scam projects created to pump & dump spring up a lot.

- Activities such as IDO registration or subsequent purchases (most DEX listings) depend on gas fees (especially in Ethereum).

Why has IDO become so popular?

In order for a project to progress, community engagement is an essential requirement. As such, what is the significance of IDO in facilitating this process?

During the years 2017-2018, tokens were disseminated to users via ICO and IEO, where users could obtain tokens at a relatively affordable cost. Fortuitous users who were successful in purchasing tokens eagerly anticipated a positive market trend upon listing, in the hopes of attaining a profit margin of five to ten times the initial investment. However, such levels of profitability necessitated substantial capital investment.

For instance, in the case of Konomi IDO with an Initial Cap of $200,000, multiplication by a factor of 2 requires a capital injection of $200,000, while for a multiplication of 4, the required amount is $800,000, and for a factor of 10, it is $2,000,000. However, the current development of AMM systems enables a relatively low-cost upward price push.

This is an incredibly effective marketing strategy due to the fact that the project will receive significant attention and a substantial Return on Investment (ROI), as well as potential positive or negative interest from the community. Additionally, the project’s level of popularity can be measured by tracking whether the ROI meets expectations.

Furthermore, the project does not incur the cost of listing on costly CEX exchanges. Instead, with Uniswap and Sushiswap, projects can easily and freely list their tokens. Consequently, both the project and its users benefit from IDO.

Popular IDO platforms

At the onset of 2021, when these platforms were still in their nascent stage and had limited user recognition, only a handful of projects such as Polkastarter and DAO Maker were noteworthy.

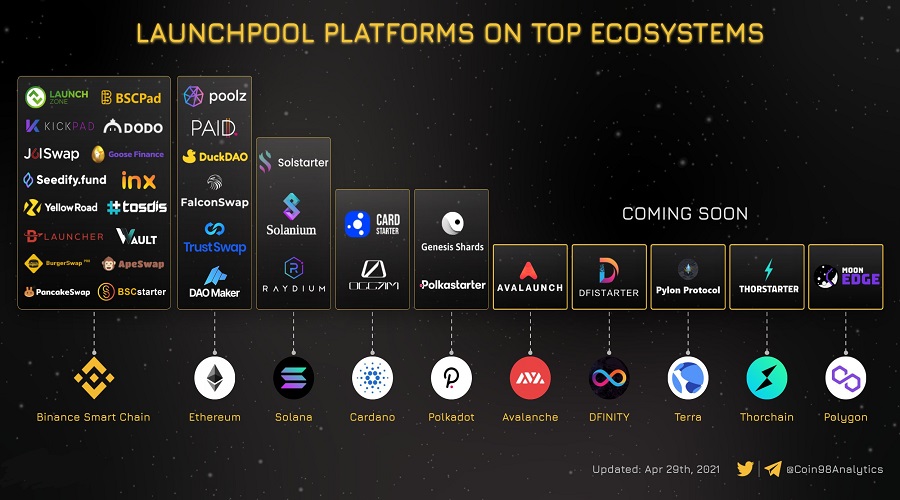

As of April 2021, no less than 20 IDO Platform projects have emerged, as depicted in the accompanying image.

These projects exhibit minimal distinctions, to the point where several were established during the 19/5 correction and have yet to introduce any IDOs even after a span of 3-4 months.

Factors affecting token price when opening IDO sale

By participating in Whitelist, you will have the opportunity to purchase tokens for the platform with a fairly common incentive: locked tokens that enable you to access a separate Pool designed exclusively for token holders.

However, the question here is: What is the right way to invest in IDO?

The image presented displays several investment platforms and the project token’s ATH ROI. By locking the tokens for exclusive access to the Pool allocated for token holders, these tokens have demonstrated a significant increase in ROI.

By being a pioneer and having about 70 IDO projects as of the time of writing:

- POLS is having ROI x15 calculated from Public Sale price.

- Although Falconswap solves the problem of high transaction fees, as well as slow transaction speed; However, with only 3 IDOs, FSW does not have as good growth as the other platforms.

- DAO Maker and Poolz currently have 16 SHOs and 8 IDOs respectively with the highest profits x8.5 and x6 respectively.

It appears that the price of the project’s token will not be determined by the platform’s outstanding features, but instead it will be influenced by the incentive lock for token participation in the Special pool, as well as the number of projects undergoing Initial DEX Offerings (IDO).

Is IDO a sure bet to win?

According to Theo’s analysis of the return on investment (ROI) of various projects, it appears that almost everyone who buys at the public price is profitable, albeit to varying degrees. Additionally, the platform’s tokens have also appreciated in value, as mentioned earlier. As a result, many individuals believe that initial DEX offerings (IDO) are a lucrative opportunity for everyone to make money. However, is this really the case?

In the event that you have never participated in an Initial Dex Offering(IDO), you may be unaware of the requirement for a Whitelist selection process to identify fortunate individuals who will have the opportunity to purchase tokens at the Public Sale price. It remains challenging to determine the odds of being selected for the Whitelist; nonetheless, based on my personal experience and extensive research, the likelihood of being selected is typically quite low.

For example: Tidal Finance IDO has 183,221 registrations, however the number of people selected is 200 ⇒ The winning rate is… 0.01%.

If the Whitelist is not successfully obtained, despite the increase in platform token price, why is it still not a guaranteed win situation?

In actuality, the probability of profit is higher only if the fraternal party is among the INCEPTIONAL purchasers of these tokens at the Public Sale price or prior to the release of the first IDO. Should the party engage at an intermediate or belated stage, the likelihood of encountering the following combination of scenarios is greater:

- Buy platform tokens at prices xxx compared to Public Sale and xxxx compared to Private Sale.

- Whitelist crashes continuously like AK47.

- BTC dumps like a flood.

- Some platforms have been hacked or rug pulled, leading to tokens in the same array being affected.

- Sentiment is weak, assuming there are no more IDOs happening on the platform.

- Capital stuck.

All combined created a stressful chain of events, leading to a token sale at a loss. Next, things were not as expected: IDO still happened, BTC sideway,… leading to token increase ⇒ Fomo bought back. You guys are probably familiar with this cycle, right?

IDO is in the bag

This article is not intended for the past or present, but rather as a reference for the future. Specifically, it is highly likely that the IDO trend will continue until the end of this year, or possibly even further, as users still greatly favor this form.

In order to truly master the IDO game, in addition to relying on the aforementioned factors, it is recommended that individuals engage in a new game where they are positioned to be at the forefront. This can be achieved through newly established platforms such as Samurai and Zeedo, or even within a new ecosystem such as Solana with Solanium and Solstarter, rather than utilizing outdated projects like Polkastarter or DAO Maker.

Summary

IDO is an intriguing game that appeals to experienced players and serves as a valuable tool for those with less experience. It is a game that can help change the fate of those who are disadvantaged, making it a dynamic and exciting option for all. We have introduced you to the concept of IDO and answered the question of whether it guarantees a 100% win rate or not. If you still have any queries or suggestions, please feel free to leave a comment below. Our team at 247btc.net will strive to respond to you as soon as possible.

What is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Initial DEX Offering (IDO crypto)? Does playing IDO really give you a 100% chance of winning?

One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO...

Read moreWhat is ERC – 20? Advantages, disadvantages & how to create ERC- 20 network tokens

In this article, we will explore ERC-20 and ERC-20 tokens along with their applications and advantages and disadvantages. For those...

Read moreWhat is Airdrop Crypto? Instructions for making airdrop coins in the Crypto market

What is Airdrop and how many forms of Airdrop Crypto exist? Discover the limitations and effective instructions on how to...

Read moreWhat is DAO? Limitations and Investment Potential of DAO in Crypto

Understanding the terminologies used in the field of cryptocurrency is crucial for individuals involved in Crypto market participation or intending...

Read moreWhat is zkEVM? Classification of groups zkEVM

ZkEVM is an abbreviation for the term "Zero-Knowledge Ethereum Virtual Machine". It is a protocol that enables the execution of...

Read moreWhat is web3 technology? How to invest in Web3 in 2023

The emergence of Web 3.0 following Web 2.0 has brought about increased flexibility and superior interaction capabilities compared to its...

Read moreWhat is move to earn? best move to earn crypto in 2023

In the current GameFi market, it is possible to combine the seemingly unrelated tasks of earning money and improving one's...

Read moreWhat does NFT crypto stand for: Clarifying the Significance of Non-Fungible Tokens (NFTs) through technical examination

Non-fungible token (NFT) art are digital assets stored on a blockchain that depict physical or non-physical items, such as digital...

Read moreWhat are play to earn (P2E) Games? How to earn money with play game crypto?

Play to Earn has emerged as a popular trend in mid-2021, leading to a notable increase in the activity of...

Read moreWhat is an oracle in blockchain? Top blockchain oracle projects 2023

The intended function of blockchain technology was never to operate in isolation from the larger economic ecosystem. Despite the challenges...

Read moreBinance account sign up: What is binance account? how to create binance account?

Numerous cryptocurrencies are supported by Binance and its proficiency in ensuring swift exchange operations between volatile coins and fiat currencies...

Read moreWhat is a defining feature of the Metaverse Crypto? What does the term Metaverse refer to?

We have heard numerous prominent figures, such as Mark Zuckerberg, CEO of Facebook, and Satya Nadella, CEO of Microsoft, expound...

Read moreWhat are AI Tokens? Best AI Coins & Tokens to Invest in

The predicted impact of artificial intelligence (AI) is expected to revolutionize various sectors, including the field of cryptocurrency. The AI...

Read moreWhat are Fan Tokens? How Binance Fan Tokens are Revolutionizing the World of Sports and Entertainment?

The Fan Token is a term that has been shared by the CEO of the cryptocurrency exchange CZ on Twitter,...

Read more