Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the growth of Defi platforms. Despite the existence of various stablecoins, each type has its own limitations. Therefore, Fei Protocol was created to solve the present challenges of stablecoins.

Table of Contents

ToggleWhat is Fei Protocol’s TRIBE cryptocurrency?

Parallel to the growth of the DeFi platforms, the development of stablecoin platforms is also advancing. Fei Protocol postulates that the current market encompasses a plethora of stablecoins; however, each of these stablecoins exhibit distinct shortcomings.

For instance, stablecoins such as USDT and USDC are subject to centralized control, while stablecoins collateralized by tokens such as DAI encounter scalability issues. Furthermore, stablecoins like ESD are prone to centralized power in terms of rewards provided by the platform. These factors lead to an unequal distribution in the growth of stablecoins.

Fei Protocol has introduced a decentralized, liquid, and scalable stablecoin called FEI, which has parity with USD value, to enable individuals to access Defi platforms with complete freedom and safety. Fei Protocol has successfully minted 420 million FEI stablecoins at present, while increasing demand for the stablecoin due to the surge in ETH growth can potentially amplify the market cap of FEI in the future.

The salient aspect of Fei Protocol

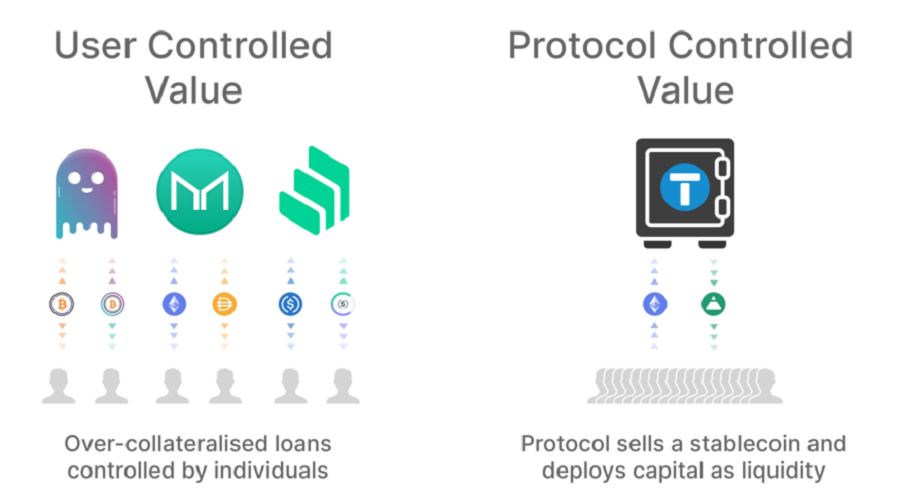

Presently, Defi platforms employ TVL (Total Value Locked) as a metric for measuring the success of a project. Nevertheless, Fei Protocol contends that as the amount of capital locked in a platform increases, the platform must also provide greater incentives to sustain that capital. When incentives are no longer distributed, users will migrate their capital elsewhere. This will render the projects untenable in the long term.

Fei Protocol has developed the Protocol Controlled Value (PCV) model, which involves a platform that entirely owns assets locked in smart contracts. This model provides the protocol with greater flexibility to engage in non-profit-oriented activities, which may align with basic objectives such as maintaining price stability.

The second notable aspect of Fei Protocol is its strategic collaborations with multiple parties aimed at bolstering the adoption of FEI Protocol in the market. Currently, Fei has established partnerships with Ondo Finance (Structured Finance) and Rari Capital (Yield Aggregator & Manager).

Detailed information about TRIBE token

It is possible for misunderstandings to arise among the community that the FEI is the prominent token of the Fei Protocol. However, it must be noted that TRIBE, in fact, functions as the primary token for both Utility and Governance within the Fei Protocol ecosystem.

Key Metrics TRIBE

- Token Name: Tribe.

- Ticker: TRIBE.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: 0xc7283b66eb1eb5fb86327f08e1b5816b0720212b

- Token Type: Utility, Governance

- Circulating Supply: 413,712,248 TRIBE.

- Total Supply: 1,000,000,000 TRIBE.

- Marketcap: 313,000,530 TRIBE.

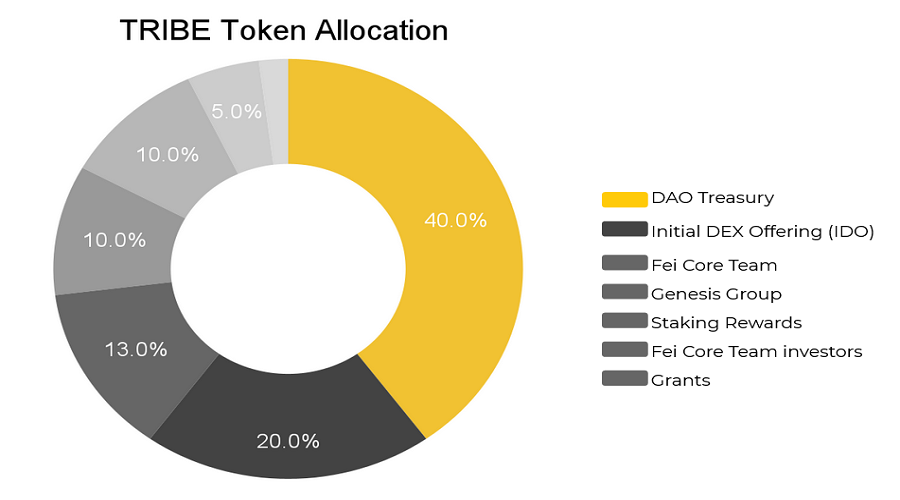

TRIBE Token Allocation

- DAO Treasury: 40%

- IDO: 20%

- Fei Core Team: 13%

- Genesis Group: 10%

- Staking Rewards: 10%

- Fei Core Team Investors: 5%

- Grants: 2%

TRIBE Token Sale

Fei Protocol will be distributing TRIBE and FEI to its users on March 22, 2021. The amount of FEI generated and supplied by Fei Protocol to Genesis Group at Genesis will be subject to the vertical distance along the bonding curve. The bonding curve will have a scale of 100,000,000 FEI and will initiate at a level of 0.5 USD. The maximum price that Genesis Group members can pay is 1.01 USD/FEI.

Unlike FEI, the quantity of TRIBE received by Genesis Group is a fixed number of tokens that corresponds to 10% of the total supply, equivalent to 100 million TRIBE, as stipulated.

In order for users of the Genesis group to acquire TRIBE tokens following receipt of FEI, there exist two methods. The first involves exchanging FEI for TRIBE tokens directly within the Fei Protocol pool, while the second entails performing the exchange on Uniswap. According to the Fei Protocol, conducting the exchange through the former approach incurs fees that are approximately two-thirds less than those associated with token swapping on Uniswap.

TRIBE Token Release Schedule

The TRIBE token shall be categorized into three groups, each of which will possess distinct lock-up and release periods during each respective phase.

- Not locked: Tokens sold in IDO rounds and tokens sold in Genesis group.

- Locked for 5 years, the number of unlocks increases gradually: Token for Fei Protocol team.

- Locked for 2 years, decreasing number of unlocks: Token for staking rewards.

- Locked for 4 years, equal number of unlocks: Token for investors.

TRIBE Token Use Case

TRIBE holders will be granted the right to propose and vote within the Fei Protocol ecosystem. In an effort to increase decentralization, Fei Protocol has implemented a mechanism whereby users with 2% of total supply become delegates, and those with 0.25% of total supply are granted the ability to make proposals. This approach permits greater participation in the governance of the Fei Protocol system.

Roadmaps & Updates

On December 15th, 2021, Fei Protocol launched version V2, featuring the following updates:

- Can start Redeem FEI with ETH and DAI at $1.

- TRIBE Backstop: In the event that the reserve ratio target (100%) is not upheld by the protocol, a capital replenishment through TRIBE shall ensue. In other words, TRIBE will be sold to offset reserve assets if the reduction goes beyond the predetermined threshold.

- TRIBE Mint Cap: TRIBE annual inflation limit.

- PCV Guardian: The Guardian has the ability to relocate the PCV as deemed necessary. Fei Guardian serves as a Multi-signature address, initially under the supervision of the Fei Core Team, and eventually to be transferred to the Multi-signature address of the community.

On April 20th, 2022, Fei unveiled the Tribe Turbo feature, enabling projects seeking to open a Pool on Fuse of Rari to obtain a significant amount of Stablecoins for lending purposes. Fuse is a functionality that permits other projects to create Pools on Rari Capital, where they can list their own borrowing and lending assets and adjust the Lending parameters without requiring approval from others.

Project team, investors, partners

Project team

- Joey Santoro – Founder of Fei Protocol.

- Sebastian Delgado – Co-founder of Fei Protocol. Worked again for Dharma and Uber.

- Branna Montgomery – Co-founder of Fei Protocol. Used to work at ConsenSys Audit.

Investors

Fei Protocol has received investment from several notable entities, such as a16z, Coinbase, and Framework, among others.

Fei protocol Partner

This collaborative effort between Ondo Finance and Fei Protocol enables Fei Protocol to assume the role of an “Olympus DAO” and “Tokemak” and grant parties access to the liquidity provided by its PCV. Meanwhile, Rari Capital serves as a comprehensive Yield aggregator platform and asset management system that seeks to maximize profitability.

Summary

I have provided you with all the necessary information regarding the Fei Protocol and its associated token, TRIBE. May I ask for your opinion on the potential for growth and development of this project? Please feel free to comment below and engage in further discussion with 247btc.net.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more