Table of Contents

ToggleWhat is a liquidity pool crypto?

How does liquidity pool crypto work

In order to operate efficiently and smoothly, the Liquidity Pool will require the following elements:

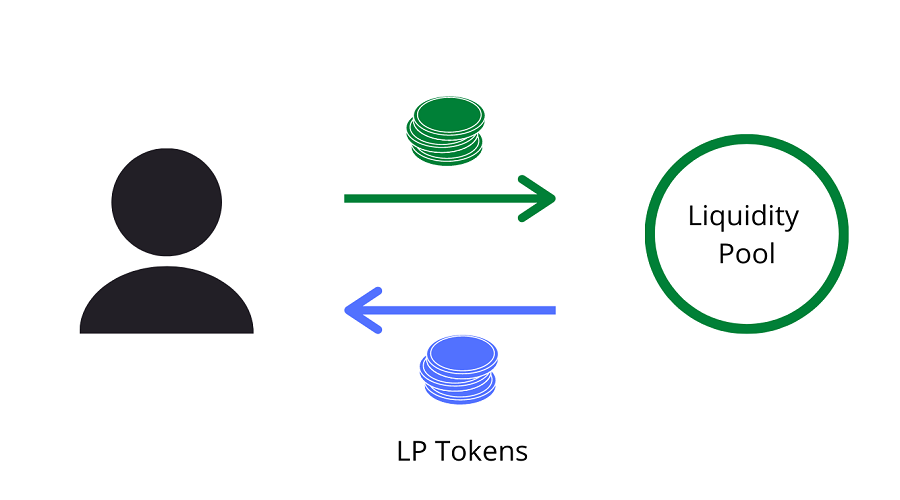

The first essential element that we need to address is the liquidity provider, who plays a crucial role in maintaining the liquidity of the pool. Simply put, liquidity providers are individuals or groups who own assets and provide those assets to the pool to ensure the smooth functioning of the Smart Contract operations. Their contribution is imperative to guarantee the uninterrupted execution of the Smart Contract, and they are a vital asset to the pool. However, no one wants to provide their assets without any benefit. Therefore, projects need to have incentive designs to provide Liquidity Providers with certain benefits when they supply liquidity. Typically, one of the most basic incentives is that Liquidity Providers will receive a certain amount of LP tokens or transaction fees. These tokens can be used to participate in Yield Farming to earn profits with idle assets. In addition, LP tokens also represent the amount of assets they provide, or in other words, the shares they have in the Pool. Based on this, they can also vote or participate in decisions related to the ecosystem. These designs also depend on the mechanisms and policies of each project. When Liquidity Pools utilize Automated Market Makers (AMM), a transaction fee is held within the pool and distributed among LP token holders at a predetermined ratio. The AMM also serves as an algorithm to maintain the market value of tokens within the pool. Depending on the project, this algorithm may differ. For example, Uniswap uses the constant product formula of x*y=k to maintain the exchange rate. Whereas Curve Finance adjusts its algorithm to better suit Stable Assets.Role of Liquidity Pool

Popular Applications of Liquidity Pool in DeFi

In addition to its main function of providing liquidity, Liquidity Pool offers many other applications to the DeFi ecosystem and particularly to the DEX exchange, such as speed, convenience, and numerous other benefits. Some of these applications include:Dex crypto

Yield Farming

Lending & Borrowing

DAO Crypto

Is Liquidity Pool Risky?

There are inherent risks associated with every aspect of the financial system or the Crypto ecosystem. While centralized platforms face risks from their managerial systems, Liquidity Pool is exposed to risks arising from DeFi’s features. As all operations here are decentralized, there is no company or organization that is accountable for managing or controlling any issues that may arise. The Smart Contract is the key to efficient operation, but no one can guarantee that it will be flawless and error-free. There are additional risks related to governance issues, including administrator key malfunctions or system risks, for example. Furthermore, Liquidity Pool possesses two distinct risks, namely Impermanent Loss and hack Liquidity Pool. Impermanent Loss refers to the amount of loss calculated in USD. In other words, when it comes to idle assets, investors have two options: holding coins or providing liquidity. Depending on the market fluctuations, providing liquidity may result in losses compared to holding coins in the wallet. Typically, Impermanent Loss is relatively insignificant. However, in cases where the market experiences severe fluctuations, this penalty could bring unexpected consequences. Currently, there have been numerous initiatives aimed at mitigating Impermanent Loss and minimizing asset slippage within Liquidity Pools. Despite these efforts, Liquidity Pools inherently carry certain risks. Therefore, it is imperative to exercise caution and conduct thorough research prior to deciding to utilize or participate in any Pools. After reading the aforementioned information, it is likely that you have gained a comprehensive understanding of what Liquidity Pool is, how it operates, and its role in the DeFi ecosystem. By doing so, we hope that you are able to identify potential opportunities while also being aware of the risks associated with Liquidity Pool. We wish you all the best in your endeavors!What is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Initial DEX Offering (IDO crypto)? Does playing IDO really give you a 100% chance of winning?

One may inquire as to why the Initial DEX Offering (IDO) has gained widespread popularity and whether investing in IDO...

Read moreWhat is ERC – 20? Advantages, disadvantages & how to create ERC- 20 network tokens

In this article, we will explore ERC-20 and ERC-20 tokens along with their applications and advantages and disadvantages. For those...

Read moreWhat is Airdrop Crypto? Instructions for making airdrop coins in the Crypto market

What is Airdrop and how many forms of Airdrop Crypto exist? Discover the limitations and effective instructions on how to...

Read moreWhat is DAO? Limitations and Investment Potential of DAO in Crypto

Understanding the terminologies used in the field of cryptocurrency is crucial for individuals involved in Crypto market participation or intending...

Read moreWhat is zkEVM? Classification of groups zkEVM

ZkEVM is an abbreviation for the term "Zero-Knowledge Ethereum Virtual Machine". It is a protocol that enables the execution of...

Read moreWhat is web3 technology? How to invest in Web3 in 2023

The emergence of Web 3.0 following Web 2.0 has brought about increased flexibility and superior interaction capabilities compared to its...

Read moreWhat is move to earn? best move to earn crypto in 2023

In the current GameFi market, it is possible to combine the seemingly unrelated tasks of earning money and improving one's...

Read moreWhat does NFT crypto stand for: Clarifying the Significance of Non-Fungible Tokens (NFTs) through technical examination

Non-fungible token (NFT) art are digital assets stored on a blockchain that depict physical or non-physical items, such as digital...

Read moreWhat are play to earn (P2E) Games? How to earn money with play game crypto?

Play to Earn has emerged as a popular trend in mid-2021, leading to a notable increase in the activity of...

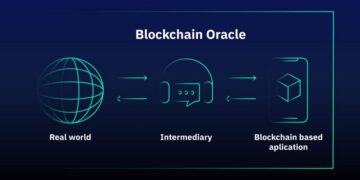

Read moreWhat is an oracle in blockchain? Top blockchain oracle projects 2023

The intended function of blockchain technology was never to operate in isolation from the larger economic ecosystem. Despite the challenges...

Read moreBinance account sign up: What is binance account? how to create binance account?

Numerous cryptocurrencies are supported by Binance and its proficiency in ensuring swift exchange operations between volatile coins and fiat currencies...

Read moreWhat is a defining feature of the Metaverse Crypto? What does the term Metaverse refer to?

We have heard numerous prominent figures, such as Mark Zuckerberg, CEO of Facebook, and Satya Nadella, CEO of Microsoft, expound...

Read moreWhat are AI Tokens? Best AI Coins & Tokens to Invest in

The predicted impact of artificial intelligence (AI) is expected to revolutionize various sectors, including the field of cryptocurrency. The AI...

Read moreWhat are Fan Tokens? How Binance Fan Tokens are Revolutionizing the World of Sports and Entertainment?

The Fan Token is a term that has been shared by the CEO of the cryptocurrency exchange CZ on Twitter,...

Read more