Alongside POW and POS algorithms, the Proof of Authority (POA) mechanism is frequently referred to for its fast and comprehensive transaction capabilities. Hence, it is crucial to understand in-depth what Proof of Authority is and its distinctions when compared to POW and POS. To gain a better understanding of this algorithm, kindly refer to the following article.

Table of Contents

ToggleWhat is Proof of Authority?

Proof of Authority (POA) is a consensus mechanism that values the reputation and credibility of Validators. The individuals authorized to authenticate and add new blocks to the blockchain. POA is generally considered a variation of Proof of Stake (POS). However, while POS requires you to stake a certain amount of assets within the system as a mandatory condition to become a Validator. POA requires you to verify your identity, reputation, and community endorsement.

Identity:

In order to establish accountability in all Blockchain activities, validators will be required to authenticate their personal information.

Reputation:

Establishing oneself as a responsible, reputable, and trustworthy individual within a community often takes extensive effort and time. These qualities are crucial in building a positive reputation, which could be achieved through maintaining a clean record and holding a prominent position within a network.

Selected as a representative by the community:

In order to become a Validator for the Blockchain system, it is imperative that you possess the necessary qualifications and also receive the endorsement of the community within the Blockchain. Without both of these, your chances of becoming a Validator would be significantly diminished.

When was Proof of Authority born?

The aforementioned algorithm was created in approximately 2017 and was named by Gavin Wood – former CTO and co-founder of Ethereum and Parity Technologies. Although it is a “late-born” consensus mechanism compared to POW and POS, the POA emphasizes the level of trustworthiness of Validators, which makes its system operate more efficiently. Moreover, it has received considerable acceptance and trust from the community.

What are the ways in which Proof of Authority has overcome the limitations of its predecessors?

As previously mentioned, POA is an algorithm that emerged after the implementation of two widely-used consensus mechanisms in cryptocurrency, namely POW and POS. Consequently, Proof of Authority is developed and designed to provide superior features and address the limitations of the two preceding consensus mechanisms.

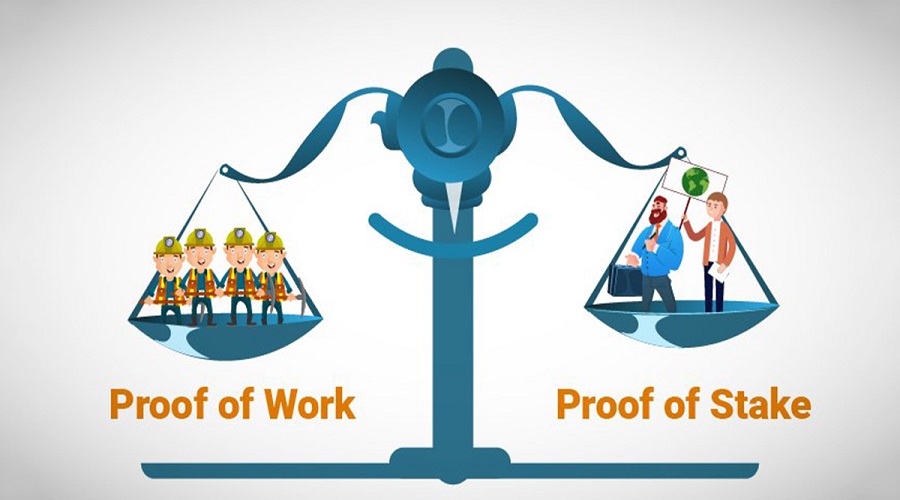

Proof of work – Safe but slow and polluting

POW requires all miners to engage in a race to use the most powerful computing devices to perform accurate and speedy hash calculations. This characteristic promotes decentralized control, attracts a large number of nodes, ensures transparency, and maintains security against attacks. However, it also results in slower processing speeds. Therefore, it is important to note that there is no absolute perfect solution in the world of Blockchain technology.

As the oldest algorithm, POW is still in use, with the most prominent example being Bitcoin. However, there are several limitations of POW, such as:

High transaction fees

The primary reason for the slow transaction speed is the decryption of the hash function (SHA-256), which takes an average of 10 minutes for a new block to be added to the chain. Due to the low processing time and number of transactions per second (TPS). The transaction fee for users can be costly when there is a large amount of simultaneous transactions as the system prioritizes the confirmation of high fee transactions.

Consumes a lot of energy

The presence of machinery is indispensable to the POW consensus mechanism. As a Miner requires dedicated equipment to continuously test random Nonce numbers until a suitable one is found. This significant increase in power consumption, especially as more individuals decide to invest in machinery to participate in the Miner game, will have negative implications for the environment due to the high energy consumption.

Proof of stake – Optimal but not absolute

In order to overcome the drawbacks of POW, such as slow transaction speed and high energy consumption. POS utilizes the method of staking coins or tokens in the system to acquire the right to verify data. This approach enables the blockchain technology to operate without requiring all participants to solve the same cryptographic puzzle. Instead, the system randomly selects a Validator to add a new block to the chain. Such a method increases the efficiency and scalability of the blockchain network, and contributes to the development of the digital economy.

Furthermore, POS adopts penalty measures that are directly related to the amount of assets initially staked by Validators in order to prevent malicious intentions of fraudulent individuals.

This characteristic ensures the security of the system and the safety of transactions. Thereby facilitating faster transaction processing and cost savings for users. However, it also entails certain risks for Validators and users of the blockchain.

Staking Coin Risks

The price of tokens/coins is known to be highly volatile, with fluctuations of up to 30% per day. This poses a significant risk when locking a substantial amount of assets in the system. Validators seeking to withdraw their funds must wait for a period of 7-14 days to ensure the system is free from any malicious activity that could harm the network. This characteristic makes it more challenging for users to actively manage their assets.

Risks of centralized governance

The number of Nodes participating in the POS system will be significantly lower than that of POW, as they must stake coins/tokens and bear possible risks instead of participating for free. The lower number of nodes implies more centralized governance, which could be a significant drawback if those with a significant stake abuse their power by making detrimental decisions for the system.

Risk of loss of equality

The system randomly selects a Validator to work based on their asset amount within the system. This characteristic creates a disparity between those with a high amount of assets and those with a low amount. As this gap grows larger, fewer Validators are willing to participate in protecting the network of the system.

What are the benefits of the presence of POA?

By utilizing the identity and reputation of an individual as a mandatory requirement to become a Validator. POA has made significant improvements and introduced a new direction, while understanding the limitations of both POW and POS. A number of reputable Blockchain platforms such as Vechain and Cronos employ the POA system. POA has successfully addressed the limitations that POW and POS face, contributing to the enhancement of larger Blockchain platforms. Factors that make this possible include: [list the factors].

Stable security

The process of verifying one’s identity and undergoing a credibility assessment to become a Validator ensures that having a bad Node within the system is impossible. Therefore, based on the fundamental principle of the POA mechanism. Blockchain systems that employ POA will possess a stable level of security, guaranteeing accurate. Valid verification results that are not subject to anyone’s manipulation or control, especially in centralized Blockchains.

Great scalability

Comparable to how a POS operates, Validators within POA do not participate in a race together. But rather are randomly selected by the system to carry out their tasks. With a limited number of Validators, POA can easily ensure efficient time-saving verification processes and the quickest consensus among Nodes. This also implies the Blockchain’s ability to exponentially scale, where each newly created Block takes an average of 5 seconds. This aspect also results in the transaction costs of blockchains that use POA being significantly lower than those using different algorithms.

Limit energy consumption

Given its limited number of Validators and its operating mechanism, which selects Validators at random. POA has successfully implemented the strengths of Proof of Stake (POS) in terms of energy consumption limitation. Moreover, because Validators are selected by the system itself, they do not need to possess supercomputers with immense computing power to compete with one another, as is the case with Proof of Work (POW).

Ensure fairness and motivation for Validator to join the system

In contrast to POS, POA does not select Validators based on the discrepancy of assets. This ensures better fairness and equality among Validators, thereby motivating them to work responsibly towards securing the network. Upon successful completion of their work, Validators are also rewarded with similar incentives as POW and POS.

Is belief an essential factor for a perfect algorithm?

Although Tuy has overcome many limitations of previous algorithms, there is no perfect mechanism that can fully meet all aspects of Blockchain. As previously discussed, a Blockchain has three main factors: decentralization, security, and scalability. As of 2022, each Blockchain can only choose and truly excel in two of these factors. This characteristic is not an exception for POA.

It can be said that POA is a consensus mechanism that operates on the basis of trust. While theoretically, POA can ensure security and scalability by limiting the number of Validators involved, it also operates more centrally, lacking decentralization and distributed authority. Therefore, POA carries similar risks and vulnerabilities to centralized models where Validators with “reputable” labels may collude for profit. Specific limitations of POA include:

Ability to be easily manipulated

Prior to participating in the system, the reputation and credibility of Validators are thoroughly vetted. However, since all information is made public, there is a possibility of third party exploitation and manipulation of information. In such a scenario, a third party may attempt to persuade Validators to engage in fraudulent behavior or disrupt the system through tactics such as canceling orders or double spending.

The ability to prevent fraud is not thorough

If fraudulent actions within POS result in partial or complete forfeiture of assets, this principle cannot be applied to POA since Validators do not need to stake coin/tokens in the system. The application of penalties to participants based on their trustworthiness is also challenging because it is difficult to quantify such a value. Therefore, implementing penalties that are truly effective in preventing fraudulent actions within the network will pose a significant challenge for POA. Furthermore, we cannot entirely eliminate the possibility of an operator sacrificing their reputation to flee with assets worth tens or hundreds of million dollars.

Hard to be a Validator

Due to the fact that only individuals with long-established credibility are accepted, it is highly likely that the trend of “the son of a king will become a king” will occur. This means that if you are new or an ordinary person, it will be extremely difficult for you to become a Validator. Even if you possess integrity, honesty, and the necessary skills to perform data verification, participating in the POA system as a Validator will still prove to be a challenging endeavor. The centralization of power in the Blockchain is largely due to this characteristic, resulting in a low degree of decentralization within the system.

The role of POA is notable for enhancing security and scalability for centralized platforms. Although frequently implemented in supply chain and logistic frameworks, it has received limited attention from the crypto investment community due to the high demand for decentralization and autonomy in the cryptocurrency market.

With the information shared, it is likely that you have gained a clearer understanding of what the POA algorithm entails, as well as a comparison highlighting the advantages and limitations of the three consensus mechanisms: POW, POS, and POA. Hopefully, this newfound knowledge will aid you in comprehending how a Blockchain operates once you become familiar with its algorithm and enable you to make informed decisions concerning the most suitable application of Blockchain. We wish you success in your endeavors.

What is Animoca Brands? Investment trends of Animoca Brands fund

The investment fund, Animoca Brands, specializes in the areas of NFT, gaming, and metaverse. An analysis has been conducted on...

Read moreWhat is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is OpenSea? A comprehensive guide on how to use the NFT Marketplace OpenSea with detailed instructions

OpenSea is a state-of-the-art tool that caters to the new demand of humans in today's era, which involves the buying...

Read moreWhat is Friend.tech? Overview of the electronic currency Friend.tech

The Base is a layer constructed by the Coinbase team that has been mainnet for a considerable amount of time...

Read moreWhat is Highstreet? Complete information about HIGH & STREET Token

The ongoing explosive growth of Metaverse is anticipated to continue through the end of 2021, and it is predicted to...

Read moreWhat is Ancient8 (A8)? Complete information about A8 cryptocurrency

The robust growth of Axie Infinity and the GameFi model in general in 2021 remains a topic of utmost importance...

Read moreWhat is Yield Guild Games (YGG)? This comprehensive article elucidates the intricacies of the YGG cryptocurrency

The recent surge of the Trend Play to Earn phenomenon has provided a launching pad for numerous game development projects...

Read moreWhat is BlackRock, and what are the implications of the financial giant’s foray into the world of cryptocurrencies?

On August 11th, BlackRock issued a statement announcing its intention to offer Bitcoin spot investment services to its clients through...

Read moreWhat is Digital Currency Group (DCG) and what are the investment trends of the DCG fund?

The Digital Currency Group is a prominent investment fund established in 2015 that has made successful investments in numerous projects...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Octopus Network (OCT) ? A comprehensive overview of the OCT cryptocurrency

The NEAR Protocol currently hosts an immensely significant project for its ecosystem, which regrettably has yet to garner the attention...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Ripple ( XRP coin )? An general introduction to the Ripple coin

Bitcoin is the largest digital currency in the world, with a limit of 21 million units, and it is well-known...

Read more