In order to facilitate a better understanding for users on the nature of TVL, its significance within DeFi, and how it is calculated, we invite you to delve into the article below with 24btc.net.

Table of Contents

ToggleWhat is total value locked?

TVL is an acronym for Total Value Locked, referring to the total value of assets locked in a specific DeFi protocol. This term represents the amount of money held within a particular ecosystem. The higher the TVL, the stronger the DeFi application and the greater the number of users utilizing it.

In simplistic terms, TVL resembles that of a financial institution in terms of its capital scale. It is indicative of the monetary capacity of a referenced system. The aggregated locked-in value includes several categories such as:…

- Assets in the form of digital currency are lent through lending platforms such as AAVE, Compound, and MakerDAO.

- Digital assets can be staked with L1 blockchain networks such as Ethereum, BSC, Polkadot, Solana, Cosmos, and Tron.

- Digital assets in the form of cryptocurrencies are sent through various liquidity pools on platforms such as Uniswap, PancakeSwap, Curve Finance, and the like, grouped together under liquidity pools.

- Cryptocurrencies are deposited through Yield Farming protocols, such as Yearn Finance and Beefy Finance, in the process of generating returns on investment.

The Total Value Locked (TVL) in DeFi protocols and Yield Farming markets can fluctuate based on the value of the underlying Fiat currency or Tokens. Typically calculated in USDT (Tether), BTC (Bitcoin), and ETH (Ethereum). TVL is a key statistic utilized to measure the overall health of the DeFi ecosystem. And it offers a convenient metric to track the total amount of assets locked on various On-chain Web platforms. In essence, TVL serves as a crucial indicator of the state of the DeFi market and enables investors to keep a close eye on the value of their investments.

Meaning of Total Value Locked TVL

Upon examining the TVL of a given protocol, one can glean insightful information such as the following:

- A higher TVL indicates a stronger protocol with high liquidity, meaning that Tokens can be easily exchanged within the protocol without the need for long waiting periods.

- If the total value locked (TVL) increases gradually over time, such as by quarter or year. It is a positive signal that the DeFi protocol is increasingly attracting attention and trust from the community. This is why they have deposited their tokens and boosted the TVL’s value.

- A project with a minimum Total Value Locked (TVL) of 1 billion USD can be considered a large-scale endeavor, whereas projects with low TVL may be ones that are either new or have yet to gain widespread acceptance from the public.

- When DeFi projects frequently urge investors to join with high percentage profit rates. Investors should always verify the Total Value Locked (TVL) of the project. DeFi projects with low TVL but are marketed as having high profit potential are evidently abnormal. Therefore, it is crucial for investors to conduct thorough research and analysis before investing in any DeFi project.

- Investors are frequently enticed to invest in DeFi projects that offer high percentage profit rates, however, it is essential to verify the Total Value Locked (TVL) in order to gauge the project’s credibility. DeFi projects that claim to have high profit potential but possess low TVL are considered anomalous. Therefore, it is prudent for investors to perform in-depth research and analysis prior to investing in any DeFi project.

- The TVL (Total Value Locked) of a protocol is subject to change based on the USD value of the assets deposited or withdrawn by users from the said protocol.

Why is TVL important to the DeFi protocol?

The TVL plays a crucial role as a measuring tool of a project’s strength, predicting the impact of capital on profitability and capital utilization for traders and investors within DeFi. Moreover, the TVL’s value directly reflects the development level and future potential of a project.

The Total Value Locked (TVL) is an important metric in the DeFi landscape, particularly in the lending and swapping sectors. Its value can directly impact profitability structures. Investors can use TVL to assess the extent to which the protocol is being utilized and to inform their investment decisions.

Each project will have a Total Value Locked (TVL). With access to this specific data, investors can evaluate the project’s liquidity and abundance of funds directly, enabling them to make appropriate investment decisions. Currently, TVL can be viewed through five categories: decentralized exchanges (DEX), digital assets (Assets), payment protocols (Payment Protocols), derivatives trading (Derivatives), and lending (Lending).

How is TVL calculated?

In order to evaluate the potential of a certain DeFi project, investors will calculate the TVL through various indicators.

- The circulating supply of tokens is the total number of tokens that are actively available in the market for trading or usage.

- Current Price

Công thức:

Total Market Cap = Circulating Supply x Current Price

Total Value Locked (TVL) = Total Token Locked x Current Price

TVL Ratio = Total Market Cap / TVL

The method for calculating TVL in DeFi involves computing the total value of Tokens that have been placed on the respective protocol, multiplied by the present USD value of each Token.

For instance, the DeFI protocol ABC comprises three tokens namely X, Y, and Z. Currently, X holds 1000 tokens valued at $10, Y holds 2000 tokens valued at $20, while Z holds 3000 tokens valued at $30. Thus, the Total Value Locked (TVL) for the ABC project equals to the multiplication of the respective number of tokens held by their market prices which equals $140,000 USD.

Difference between total value locked and Market Cap

Based on the aforementioned analysis of TVL, it is evident that there exists some degree of similarity between TVL and Market Cap. However, it is important to note that in reality, these two concepts are fundamentally different. Market Cap is calculated by multiplying the circulating supply of a coin with its market price at a given point in time. On the other hand, TVL is computed by multiplying the number of locked tokens with the current price of the underlying asset.

The two concepts are interrelated and are utilized by users in a variety of situations, as evidenced by the following examples:

At first, it should be noted that the ratio between market capitalization and total value locked (TVL) provides key insights into the fundamental value of a given asset. Indicating whether it is overvalued or undervalued. As is often observed in equity markets, market capitalization can surpass a company’s book value. And the same is true for the digital asset market. Therefore, a lower ratio between market capitalization and TVL would be beneficial, while a higher ratio would offer less favorable outcomes.

Currently, as of the time of writing, the Aave protocol has a market capitalization of 1.9 billion USD and a total value locked (TVL) of 10.7 billion USD on CoinGecko. The ratio between the market capitalization and TVL of Aave on CoinGecko is 0.17. In contrast, the ratio for Uniswap is 0.7 and PancakeSwap is 0.44. Based on this metric, it can be concluded that the AAVE token is the cheapest among the three aforementioned options. This information is presented in a formal manner, providing necessary details and maintaining a neutral tone.

On the second note, the aforementioned ratio can be employed to evaluate the psychological state of present-day investors in the DeFi market. This can determine whether, at the present moment, an investor is either staggering with excitement or disinterested in the protocol.

The correlation between total value locked and Circulating Supply

When it comes to assessing the total value locked (TVL) of a particular project, many people often confuse it with the circulating supply, as these two concepts are closely interconnected.

The TVL encompasses all Tokens, including governance tokens and other assets locked within the protocol. For instance, if you provide liquidity on Uniswap through the UNI/ETH currency pair, the total TVL would be the sum of UNI and ETH. On the other hand, the Circulating Supply is different, as it only considers the number of UNI tokens currently permitted to circulate in the market. This information serves to inform individuals on the specific calculations involved in determining TVL and Circulating Supply within this context.

The issuance of Tokens in a project is generally limited to a specific maximum amount. This mechanism is put in place to maintain a balance between the supply and demand of Tokens, thereby ensuring the stability of their value. Additionally, it helps to facilitate steady growth by reducing the circulating supply through Token burning and creating Pool Farms, which allows users to earn more profits.

When analyzing a DeFi project, it is common to estimate the actual circulating supply by analyzing the amount of tokens used for staking in relation to the overall supply. This on-chain data is selected to help determine the accumulating or selling trend of the project.

Does TVL help to value the project?

Many theories suggest that the higher the TVL (total value locked) Ratio, the lower the asset value, and vice versa. However, this is not always true in reality. The easiest way to calculate the TVL is to examine whether the DeFi content is undervalued or overvalued and to do so by considering the ratio. If the ratio is less than 1, the project is undervalued in the market.

Furthermore, it should be noted that each Token Virtual Layer (TVL) within the protocol possesses unique mechanisms. Consequently, when analyzing dApp applications, experts must compare and contrast them and provide varying evaluations. For instance, in the case of Uniswap and Kyber, although both are preferred platforms for trading, Uniswap is favored over Kyber due to its lower slippage design within the protocol.

At present, Uniswap’s total value locked (TVL) has reached over 6 billion USD, whereas Kyber’s TVL stands at only 379 million USD. This demonstrates that a project’s reliability among users increases with a higher TVL, indicating its worth.

It is possible to quickly categorize TVL in DeFi protocols, such as Lending, DEX, Synthetic-Asset, AMM, and Payment. Furthermore, the analysis can extend beyond DeFi protocols and can include calculating TVL on Proof of Stake blockchains, such as the exceptional case of Ethereum’s Stake ETH during the transition to Ethereum 2.0.

Who are TVL’s top market players?

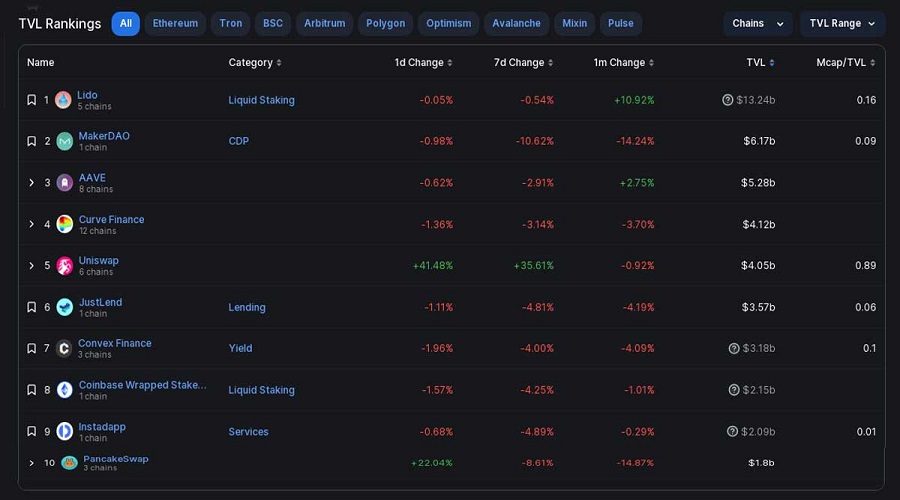

The world’s top 125 DeFi applications hold an aggregate TVL of approximately $45.6 billion. Although calculating the total TVL of all projects included in the DeFi protocol is almost impossible, it is safe to say that these 125 applications can represent the majority of industry TVL projects.

Due to the low TVL ratio of projects located at 126 or above, which falls under 1 million USD. DeFi is highly concentrated on the top 10 projects within the protocol and accounts for over 80% of the total TVL in the market. Notable DeFi protocols with the highest TVL ratio currently include MarketDao, AAVE, Lido, Curve, and Uniswap.

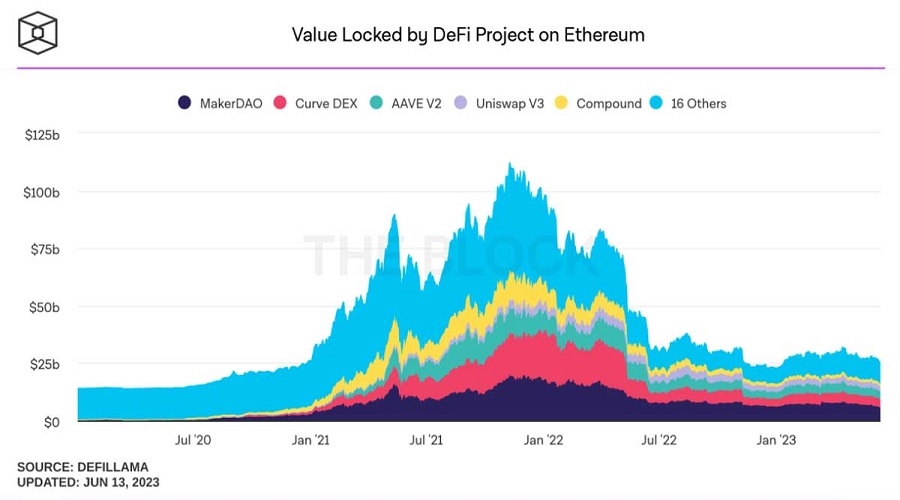

When considering the aspect of Blockchain, Ethereum still exhibits unparalleled dominance with a TVL (Total Value Locked) of 32.33 billion USD. The subsequent positions are held by Tron, Binance Smart Chain, Arbitrum, and Polygon, respectively.

Top 3 most standard TVL information lookup Web sites

In order to obtain data on DeFi TVL, individuals can refer to reputable sources such as DeFi Pulse, DeFi Llama, and The Block.

DeFi Pulse

This website enables users to access a wide range of analyses and rankings pertaining to various DeFi protocols. DeFi Pulse’s ranking system tracks the total value of assets locked (TVL) within the smart contracts of popular DeFi protocols, rather than the entirety of protocols available.

This website will monitor the basic smart contracts of each protocol on the Ethereum blockchain. The data will be updated every hour by collecting the total balance of Ethereum and ERC-20 Token codes held by the smart contracts. TVL will be calculated by multiplying the balance by its USD value.

DeFi Llama

The DeFi Llama website calculates Total Value Locked (TVL) across most DeFi chains, not just Ethereum. It can compute TVL on Binance Smart Chain, Terre, Cronos, and Fantom, among others. This website monitors more than 800 DeFi protocols from over 80 different blockchains. Users can easily track TVL for each individual blockchain.

The data in question has been evaluated as reasonably accurate and has been cited in numerous studies and reports. Notably, these data are completely free of charge and individuals can access the website to track and analyze DeFi protocols.

The Block

At present, this is also the name used to search for a considerably large Total Value Locked (TVL). In order to view the TVL of the DeFi market, you may navigate to the Data section on the Block.

The Mục TVL of The Block is divided into various categories such as DEX, Lending, Yield Farming. Or allocated by different Blockchains like DeFi Project on Ethereum, DeFi Project on Binance Chain, resulting in a diverse and expansive investment portfolio.

How to distinguish between total value locked of Validator Proof of Stake and TVL of Dapp

As previously analyzed, TVL refers to the total locked value of tokens within the DeFi protocol. Nevertheless, many individuals also recognize TVL through the calculation methods used by various POS blockchains.

This particular Proof of Stake protocol can be understood as having Validators running Full Nodes that verify transactions on the Blockchain to help maintain network operations. To start a Node, each Validator must stake a minimum amount of Tokens according to the regulations. If any fraud occurs during the transaction process, malicious Nodes will be penalized based on the initial amount of Tokens staked. As a result, transactions are always secure, transparent, and free from fraudulent activities.

The TVL data of Proof of Stake Blockchains provides insights into the security level of a project. This ratio allows users to instill trust when staking or delegating their tokens to validators.

However, there are also numerous instances where Total Value Locked (TVL) data becomes meaningless, particularly in Blockchain networks that lack high levels of decentralization. An example of this scenario is the Binance Smart Chain; this project only has 21 Validators and no TVL ratio, but instead provides data for comparing its circulating supply against its total supply.

Summary

The Total Value Locked (TVL) is a critical metric that reflects the reliability and potential of users towards a project. The TVL varies depending on each DeFi protocol and indicates different usage levels, allowing investors to make informed decisions. However, it is important to note that this is a general perspective and not a core indicator that assures investment confidence.

247btc.net has recently shared an informative article titled “TVL (Total Value Locked): What is it? How to Calculate TVL in DeFi” with their readers. We hope this content will be beneficial for you. Should you have any queries, please leave a comment below the article, and our team at 247btc.net will be happy to assist you. Also, don’t forget to follow our website for more useful articles.

What is Animoca Brands? Investment trends of Animoca Brands fund

The investment fund, Animoca Brands, specializes in the areas of NFT, gaming, and metaverse. An analysis has been conducted on...

Read moreWhat is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is OpenSea? A comprehensive guide on how to use the NFT Marketplace OpenSea with detailed instructions

OpenSea is a state-of-the-art tool that caters to the new demand of humans in today's era, which involves the buying...

Read moreWhat is Friend.tech? Overview of the electronic currency Friend.tech

The Base is a layer constructed by the Coinbase team that has been mainnet for a considerable amount of time...

Read moreWhat is Highstreet? Complete information about HIGH & STREET Token

The ongoing explosive growth of Metaverse is anticipated to continue through the end of 2021, and it is predicted to...

Read moreWhat is Ancient8 (A8)? Complete information about A8 cryptocurrency

The robust growth of Axie Infinity and the GameFi model in general in 2021 remains a topic of utmost importance...

Read moreWhat is Yield Guild Games (YGG)? This comprehensive article elucidates the intricacies of the YGG cryptocurrency

The recent surge of the Trend Play to Earn phenomenon has provided a launching pad for numerous game development projects...

Read moreWhat is BlackRock, and what are the implications of the financial giant’s foray into the world of cryptocurrencies?

On August 11th, BlackRock issued a statement announcing its intention to offer Bitcoin spot investment services to its clients through...

Read moreWhat is Digital Currency Group (DCG) and what are the investment trends of the DCG fund?

The Digital Currency Group is a prominent investment fund established in 2015 that has made successful investments in numerous projects...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Octopus Network (OCT) ? A comprehensive overview of the OCT cryptocurrency

The NEAR Protocol currently hosts an immensely significant project for its ecosystem, which regrettably has yet to garner the attention...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Ripple ( XRP coin )? An general introduction to the Ripple coin

Bitcoin is the largest digital currency in the world, with a limit of 21 million units, and it is well-known...

Read more