On August 11th, BlackRock issued a statement announcing its intention to offer Bitcoin spot investment services to its clients through Coinbase. As a company managing assets worth trillions of dollars, it raises the question of how this move will impact the cryptocurrency market. This article will delve into the potential implications.

Table of Contents

ToggleWhat is BlackRock?

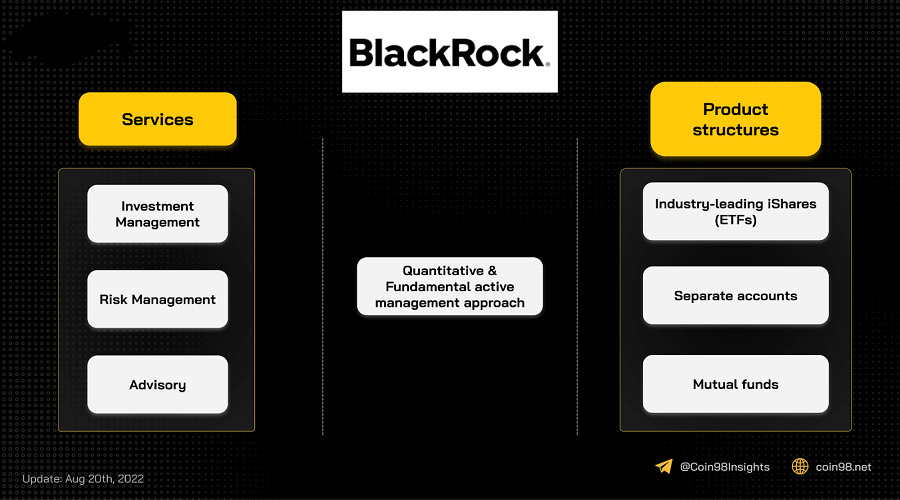

BlackRock is a global asset management company based in New York City, United States. In general, BlackRock offers a wide range of investment portfolio management solutions, risk management, and various other financial advisory services to clients worldwide.

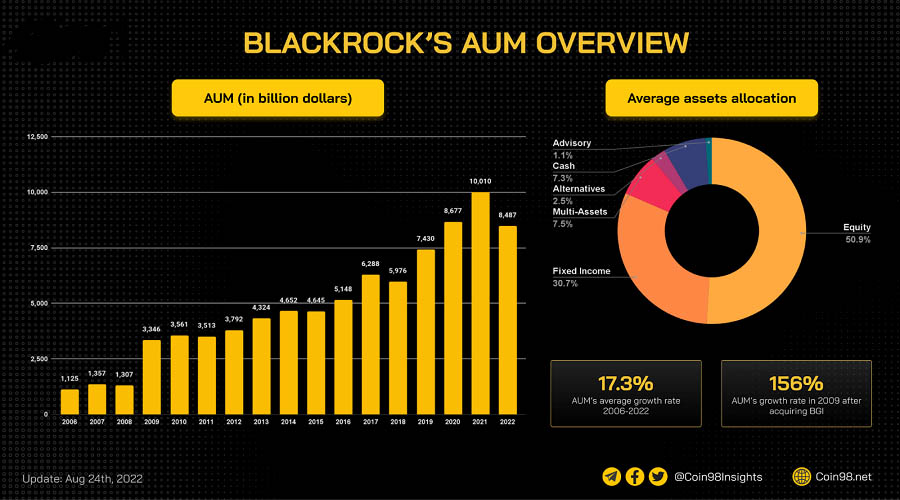

At the conclusion of 2021, BlackRock managed an asset volume exceeding 10 trillion USD, with Equity and Fixed Income assets comprising a significant portion of the company’s portfolio.

The average growth rate of assets under management or AUM, under the management of BlackRock, has reached 17.3% since 2006. This demonstrates that BlackRock’s portfolio management solutions have achieved certain benefits and gained the trust of its clients.

When compared to the GDP of the United States, the world’s leading economy, the value of BlackRock’s AUM is equivalent to almost 50% of the total GDP in 2021. This data provides us with an overview of the scale and influence of the company on the financial market in general.

The historical progression of BlackRock’s evolution

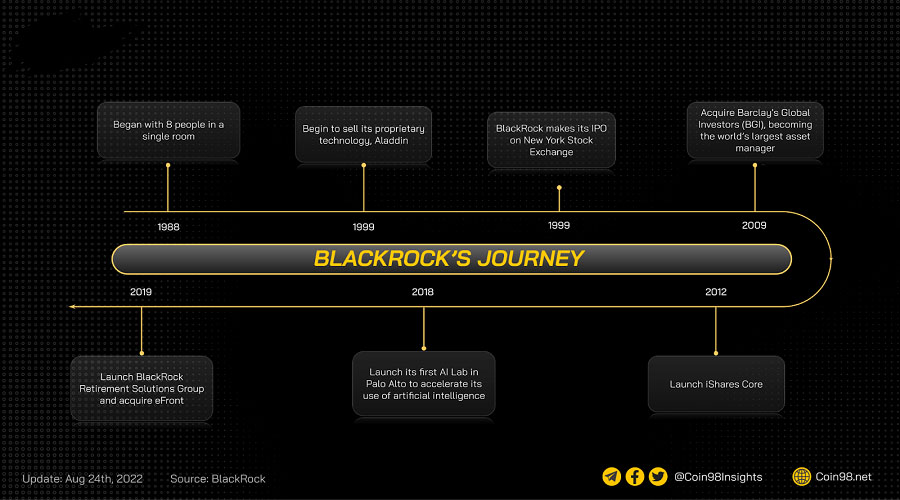

BlackRock, a company with a profound history of over 30 years in asset management, was established in 1988. It has gained extensive expertise in the financial market and has grown into a reputable entity.

Several noteworthy milestones in the development history of the company can be enumerated as follows:

- 1988: Established company.

- 1999: Commencing the sharing of its proprietary technology, Aladdin is a technological platform that assists in risk management activities. Presently, Aladdin has been employed by various enterprises, rendering the total asset value managed through the platform to exceed 20 trillion USD.

- 1999: In 1999, on October 1st, BlackRock listed its company shares on the New York Stock Exchange. During that time, BlackRock’s total Assets Under Management (AUM) amounted to 165 billion USD.

- 2009: Following the acquisition of Barclay’s Global Investors (BGI), BlackRock emerged as the largest asset management company in the world, witnessing a significant surge in its Assets Under Management (AUM) by 156% from USD 1.307 trillion to USD 3.346 trillion during that year.

- 2012: With iShare’s initiation and provision of ETF products, the assets under management (AUM) have witnessed an approximate growth rate of 12% from 2012 to 2021.

- 2018: Establishing an AI research facility in Palo Alto which employs cutting-edge technological tools such as artificial intelligence and techniques like machine learning and data science, aims to optimize client profit.

- 2019: BlackRock has initiated the launch of its Retirement Solutions Group, providing comprehensive lifelong financial solutions. Additionally, it has made the strategic acquisition of eFront, a leading platform providing alternative investment solutions.

Based on the historical development of BlackRock, we are able to derive several valuable insights.

- Our company’s primary focus lies in constructing and advancing our capabilities in the asset management industry. We have yet to observe any indications of expansion into various other financial domains.

- By means of establishing index funds (yielding cost and tax benefits), retirement financial plans and wealth management services, BlackRock’s objectives are largely focused on delivering long-term benefits to its clients.

- Furthermore, the company has taken steps to keep up with technological trends by researching tools such as artificial intelligence to enhance investment performance.

- Due to managing a significant amount of assets, BlackRock is continuously seeking new investment opportunities with high returns to enhance their performance. As such, they are currently focusing on cryptocurrencies.

An overview of the operational model of BlackRock

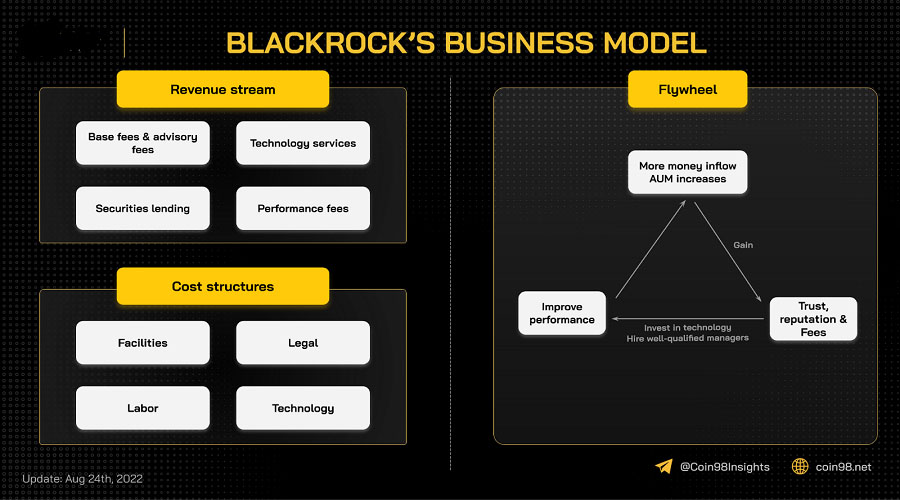

The revenue model of BlackRock involves generating income through the collection of fees for its services, which encompass:

- Fund management fee as well as performance fee (partially collected from customers)

- Financial consulting fee

- Fees for providing technology services (through Aladdin)

- Securities lending fees

- Other fees

Consequently, the Assets Under Management (AUM) are directly correlated to the revenue of BlackRock. In brief, the larger the AUM, the better the operational performance, resulting in BlackRock generating higher profits.

As of present, BlackRock has issued numerous fund products of varying forms on a global scale to cater to its clientele.

BlackRock’s overall business model exhibits minimal deviation from that of other asset management firms. Nevertheless, BlackRock’s competitive advantages derive from technology, management techniques (via Aladdin), longstanding reputation, as well as profound political connections and influence.

The business situation of BlackRock

Prior to delving into events related to BlackRock’s approach to crypto, it is imperative to conduct an analysis of several business aspects of the company in order to determine:

- Customer structure

- Revenue structure

- Which assets are the fund’s current capital allocation focused on?

By doing so, it forms the basis for any forecasts pertaining to potential market penetration strategies within the crypto industry.

Regarding client structure, in BlackRock’s Q2 2022 report, based on AUM:

- 57% of BlackRock’s AUM belongs to institutional investors.

- 10% belongs to individual investors.

- The remaining 33% are the company’s ETFs.

If based on the amount of fees collected, the following statement can be inferred:

- 30% belongs to institutional investors.

- 31% belongs to individual investors.

- 39% are ETFs.

From the aforementioned data, it can be observed that although individual investors of BlackRock account for only 10% of AUM, they contribute to 31% of the total fees earned. This leads to the prediction that these particular individual investors possess considerable net worth.

Overall, with regard to customer segmentation, BlackRock is inclined to concentrate on the following segment:

- Mainly institutional and high net worth individual clients.

- Small individual clients are typically provided direct service offerings by the company through ETF funds or indirectly through organizations.

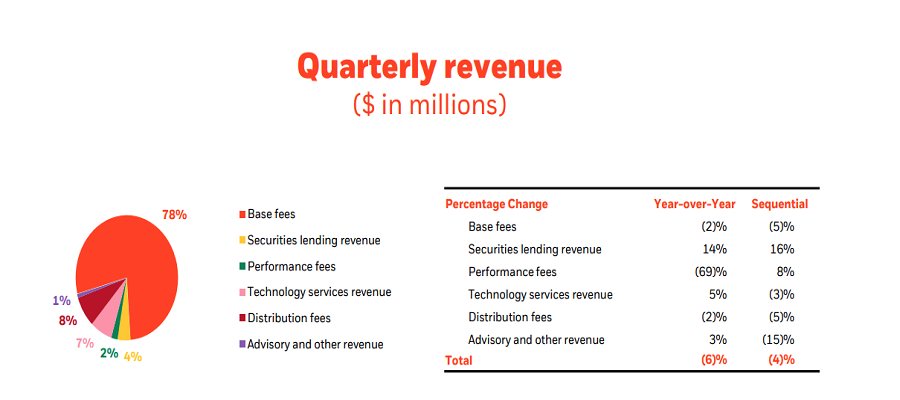

In terms of revenue structure, the basic fees (such as fund management fees) still contribute significantly to BlackRock’s revenue, accounting for 78% of total revenue in Q2 2022. As a result, BlackRock’s revenue is highly dependent on the scale of assets under management.

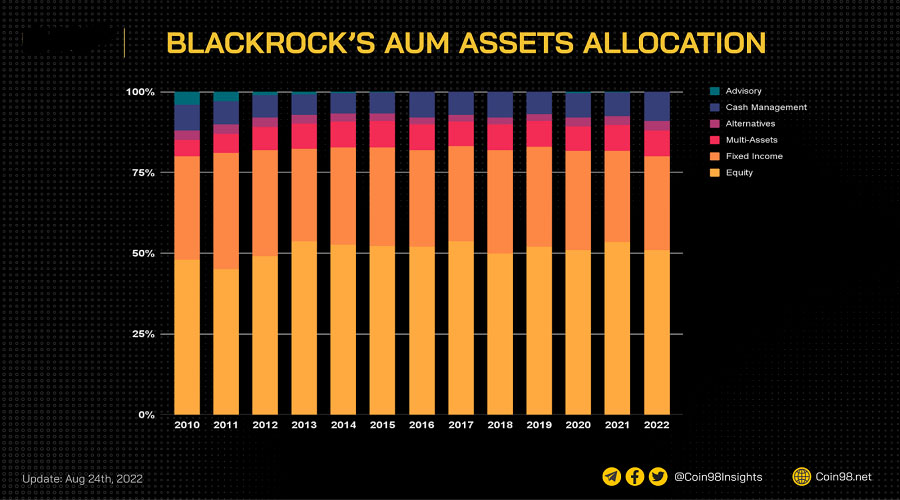

Regarding asset composition, BlackRock primarily allocates capital to equities (usually more than 50%) and approximately 30% to bonds. Data from the past 12 years indicates that this composition has not undergone significant changes.

Multi Asset and Alternatives typically represent approximately 10% of the portfolio, with the majority of the remaining allocation allocated to Cash Management. It is worth noting that this proportion has remained relatively stable from 2010 through to 2022, with few significant changes observed over time.

It appears that BlackRock consistently maintains a specific allocation objective for each asset class. Following changes in the proportion of assets under management (AUM) due to price fluctuations, the company will proceed with portfolio restructuring to attain the aforementioned objective.

What is the current direction of BlackRock with regards to cryptocurrency?

Accessing through Coinbase

On the 11th of August, BlackRock announced its entry into the crypto market by introducing a Bitcoin fund, particularly designed for institutional investors, called the Private Bitcoin Trust.

BlackRock has chosen Coinbase as its trading platform for conducting cryptocurrency transactions. On August 3rd, Coinbase also announced that it will provide related services to BlackRock’s customers.

Two noteworthy points can be discerned with regards to these news, which are inclusive of:

- The Bitcoin Private Trust fund by BlackRock enables its clientele to access Bitcoin spot, resulting in direct impact on market prices and inflow of funds into the market.

- Coinbase has been chosen as the preferred vendor. As analyzed earlier, BlackRock is a company that tends to offer long-term financial solutions, therefore, if BlackRock continues to trust Coinbase in the long run, Coinbase will benefit significantly.

Despite having expressed negative views towards the crypto industry in the past, BlackRock’s CEO Larry Fink referred to Bitcoin as an “index of money laundering” in 2017, implying that the digital currency’s price and network activities were closely linked to money laundering.

However, by means of the aforementioned actions, it is apparent that we can discern:

- The market demand and customer base of BlackRock are significant enough to prompt them to revise their perspective and offer relevant services.

- It is possible that BlackRock recognizes the long-term growth potential of the crypto market, given the organization’s focus on delivering long-term financial benefits to its clients.

Upon the release of this news, there is a notable increase in optimism towards the future of the market and predictions have been made regarding BlackRock’s allocation of a percentage of their massive current AUM into the cryptocurrency sphere.

Some expected figures, such as 1% or 5%, have been provided (equivalent to about 85 billion or 425 billion USD). The question remains as to whether this is realistically achievable. This issue will be addressed in the following section.

Does BlackRock’s impact have significant effects in a brief period of time?

A method of determining BlackRock’s relative capital allocation into Bitcoin will be discussed in this article, utilizing a comparative approach based on market capitalization with assets such as stocks, technology stocks, and gold.

Currently, BlackRock is entering the cryptocurrency market by offering investment services for Bitcoin. Since Bitcoin has a high correlation coefficient with the stock market, the first step is to compare it to this asset class.

In accordance with the data released by BlackRock (updated until the end of Q2 2022), BlackRock’s AUM reached approximately USD 8,500 billion. Out of this figure, equities accounted for around 51%, which is equivalent to roughly USD 4,328 billion.

When comparing the market capitalization of Bitcoin, which was approximately 409.3 billion US dollars on August 24th, 2022 according to Coinmarketcap, with the global stock market capitalization of 84.387 trillion US dollars as reported by companiesmarketcap, the allocation for cryptocurrencies would represent 0.25% of BlackRock’s assets under management (AUM), equivalent to 21 billion US dollars.

Nonetheless, Bitcoin is frequently likened to technology stocks by financial market investors due to its high correlation.

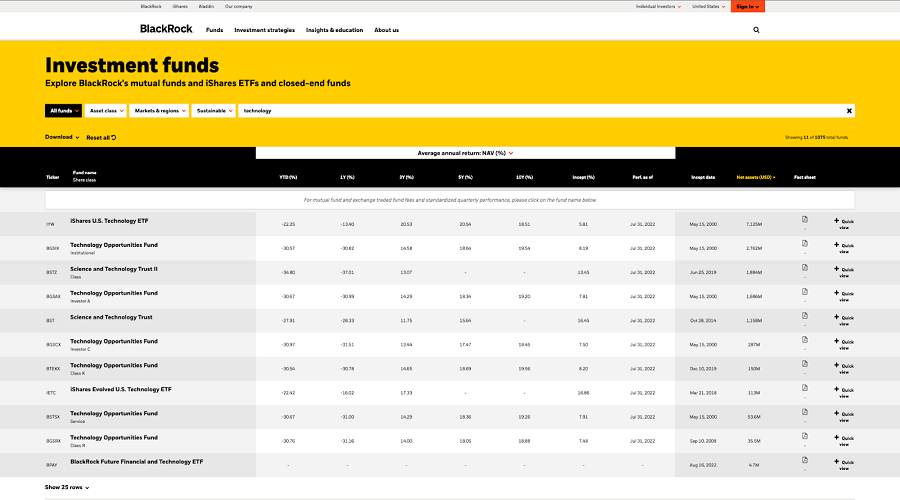

Therefore, we shall proceed with comparing the allocation of capital by BlackRock to technology stocks in order to estimate the potential capital influx into the crypto market. Based on data gathered from the BlackRock website, utilizing the keyword “Technology” within the United States region, we have obtained 11 results concerning technology stock investment funds.

The combined Assets Under Management (AUM) of the aforementioned funds amount to $13.4 billion, which represents 0.16% of BlackRock’s total AUM. Comparing this figure to the market capitalization of technology companies in the United States, which is $15.118 trillion (source: companiesmarketcap), suggests that BlackRock’s allocation to Bitcoin is approximately $890 million.

When compared to gold, utilizing a similar filter with the keyword “Gold” in the United States, the outcome yielded four investment funds related to gold with a total AUM of 29.4 billion USD, accounting for 0.35% of BlackRock’s total AUM.

Based on the current market capitalization figure of gold, estimated at $11.635 trillion, BlackRock’s allocation of funds towards Bitcoin would equate to $1.03 billion, equivalent to 0.01% of their Assets Under Management (AUM), if compared side by side with gold.

The estimated inflow of 961.7 million USD into Bitcoin can be obtained by computing the average of comparing the equivalents with gold and technology stocks.

It should be noted that at present, BlackRock only offers this product to organizations. As of Q2 2022, organizations comprise 57% of BlackRock’s total AUM. Therefore, the aforementioned figure will be adjusted accordingly.

=> According to reports, it is estimated that out of the total amount of 961.7 million USD, 57% of it, equivalent to 548 million USD, will potentially flow into Bitcoin from BlackRock, when compared to investments in gold and technology stocks.

Furthermore, we have yet to assess other criteria such as risk level, profit expectations, liquidity, market demand, etc. Therefore, the aforementioned figures serve only as a reference and cannot be conclusively relied upon.

In addition, it should be noted that the current level of correlation between Bitcoin, stocks, and gold is significant. According to The Block, the current average 30-day correlation between Bitcoin and gold and stocks is at a relatively high level of 0.6.

The number in question is quite substantial and when combined with the risk level of Bitcoin in comparison to other assets, it will impact BlackRock’s AUM allocation decisions. As a sizable asset management company with numerous quantitative methods and a high percentage of capital allocation toward stocks, BlackRock will face significant consideration in this regard.

In short:

- When compared to the market capitalization of gold or technology stocks (excluding other factors), the capital allocation towards Bitcoin by BlackRock would amount to USD 548 million (based on the figures in the US market, which is the primary market for BlackRock).

- There exist several additional factors that may impact this figure, such as liquidity, customer demand, risk level, and profitability.

What would be the future development of the cryptocurrency market?

At present, it remains uncertain whether BlackRock will pour billions of dollars into the market in the short term.

However, if organizations were to spend 548 million USD to purchase Bitcoin in the near future, what kind of price fluctuations could be expected?

It is highly likely that the aforementioned scenario will occur, as BlackRock has partnered with Coinbase to provide its clientele with Bitcoin trading and storage related services. Should they choose to purchase directly on the Coinbase trading platform, this outcome is probable.

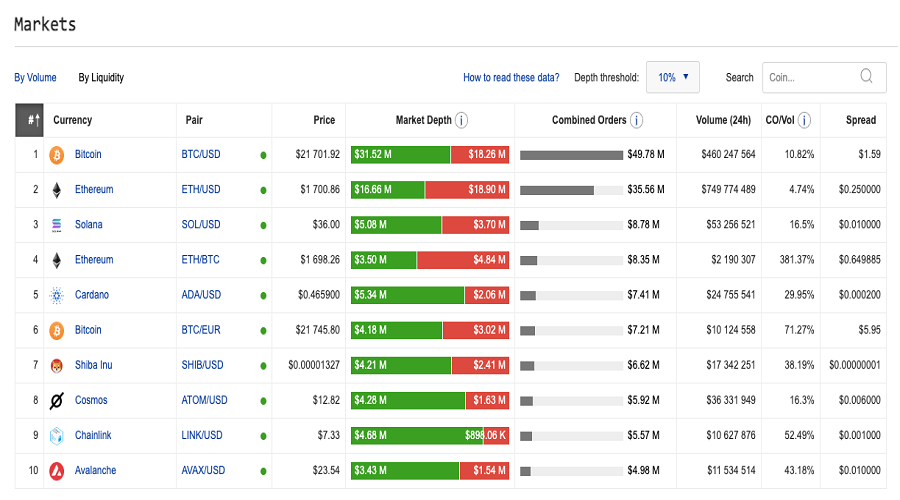

By analyzing the current depth of liquidity on Coinbase, it can be inferred that a market buy order amounting to approximately 10.4 million USD would result in a 2% increase in the trading price on the platform.

According to data from coinpaprika, with a volatility rate of 10%, a total expenditure of 31.52 million USD would be adequate.

Hence, placing a market buy order for a quantity exceeding 500 million USD can cause significant price volatility. However, this scenario is unlikely to occur due to the high level of price slippage. In reality, for such a substantial order, it is necessary to split the trade into multiple smaller portions to minimize the potential impact on the market price.

Based on the depth of liquidity data, it can be predicted that a substantial injection of hundreds of millions of USD by BlackRock into Bitcoin in a short period will create a positive impact, resulting in the growth of prices.

In addition to BlackRock’s demand, such a trend is expected to generate a Fear Of Missing Out (FOMO) effect among individual investors. One can assess the preliminary impact by reviewing the events pertaining to Tesla’s purchase and sale of Bitcoin.

- In February 2021, Tesla announced it had purchased $1.5 billion worth of Bitcoin.

- Subsequently, Elon Musk made several announcements concerning the acceptance of Bitcoin and Dogecoin as means of payment for his services.

- Elon Musk’s crypto “shill” maneuvers have contributed to the overall growth of the market, particularly towards meme coins.

- In the second quarter financial report of the year 2022, Tesla has demonstrated its decision to sell 75% of its Bitcoin holdings, resulting in a profit of $936 million.

Presently, according to Bitcointreasuries, Tesla currently holds approximately 10,800 BTC. This implies that in Q2 of 2022, Tesla disposed of 75% of its Bitcoin holdings at an approximate price of 30,000 USD.

The fluctuations in prices, commonly known as “pump dump,” were heavily influenced by Elon Musk’s trading activities and Twitter posts. Additionally, several investors attribute the recent market turmoil from Three Arrows Capital and Celsius to Tesla’s decision to sell Bitcoin.

With BlackRock, it is possible that the short-term impact will not be as great as Tesla based on the following grounds:

- Market sentiment at the time Tesla bought Bitcoin was very positive.

- BlackRock likely won’t be as active on Twitter as Elon Musk.

- Based on the aforementioned estimate, it can be inferred that BlackRock’s purchasing power will be approximately threefold less than that of Tesla.

- There is still one favorable possibility which suggests that BlackRock may purchase Bitcoin via the Coinbase exchange, potentially creating a bullish buying pressure that could directly impact the cryptocurrency’s price. This is a move that Tesla may not have undertaken in the past, as there were speculations at that time that the company had acquired $1.5 billion worth of Bitcoin through an over-the-counter transaction.

BlackRock is a prominent organization with considerable influence in the fields of finance and politics. As such, the positive impacts it generates are different in nature from those of Tesla. An example of this is the promotion of favorable legal frameworks for the long-term growth of cryptocurrencies through political impacts.

The potential impact of BlackRock on the cryptocurrency market

Strengthening is imperative for the sustained growth of the market

In the long run, it is entirely reasonable to anticipate that BlackRock will broaden their investment products beyond Bitcoin to encompass the entire crypto market. This will provide an expanded offering to clients, including individual investors.

Based on the analyzed historical data, it can be observed that BlackRock’s AUM has experienced considerable growth since the introduction of iShare ETF products. Therefore, it is reasonable to anticipate a similar strategy may be implemented for BlackRock’s cryptocurrency-related offerings, such as launching ETF funds related to the crypto market.

As an asset management firm striving to develop lifelong financial plans for our clients, we anticipate that BlackRock’s involvement will likely encourage pension funds to allocate capital towards the cryptocurrency market.

The annual report released by BlackRock highlights the fact that the majority of the assets managed by the organization belong to pension funds. As of the end of 2021, this figure accounts for 65% of the total assets under management (AUM) of the organizations overseen by BlackRock.

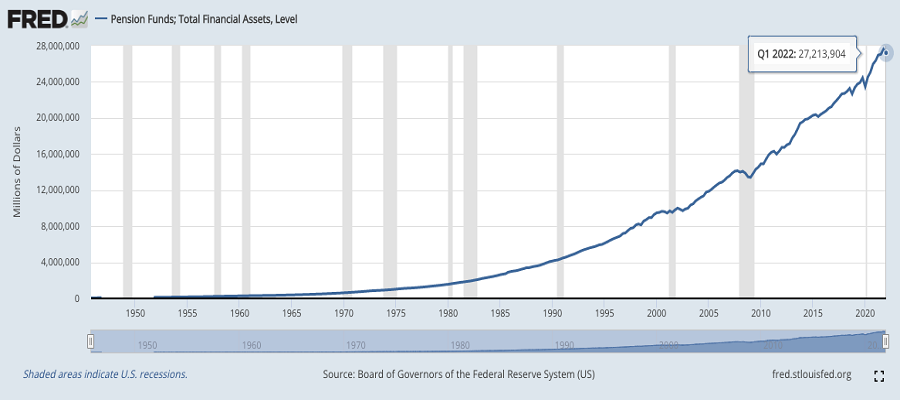

As of Q1 2022, the pension funds have a total asset of 27,213 billion USD, which is more than triple the AUM of BlackRock.

Furthermore, certain studies have indicated that retirement funds possess up to 20% of the equity market share in the United States.

Thus, the pension funds have contributed significantly to the growth of the U.S. stock market due to various characteristics such as:

- There are tax incentives

- Money flows in steadily

- Long-term investment period

As a consequence, the inclusion of Bitcoin or other cryptocurrencies within the portfolio of retirement funds would serve as a potential catalyst for long-term growth.

The matter concerning legal ramifications shall be resolved in a seamless manner

Apart from its impact in the financial sector, BlackRock possesses resources to exert influence on the political arena and lawmakers, particularly in the US market.

The individuals hitherto recruited by BlackRock include but are not limited to:

- Brian Deese: Formerly a senior advisor to former president Barack Obama and deputy director of the National Economic Council.

- Wally Adeyemo: Having previously served on the economic advisory team of President Obama, he was nominated for the position of Deputy Secretary of the United States Department of Treasury during the tenure of President Biden.

- Thomas Donilon: Previously held the position of national security advisor under President Obama.

- Dalia Blass: An ex-official with extensive experience at the U.S. Securities and Exchange Commission (SEC) has been appointed to head the investment management division.

- Coryann Stefansson: The individual previously worked on bank supervision matters at the Federal Reserve Board and held senior positions at the Federal Reserve Bank of New York.

Furthermore, BlackRock plays a key supporting role to the Federal Reserve in various policy decisions. It is evident that BlackRock’s political influence is significant. Therefore, if the company intends to expand investment products related to cryptocurrencies, such as adding them to the portfolios of retirement funds or developing ETF spot products to reach a wider customer base, it would be considered a positive development.

According to this perspective, under its influence, the prospect of facilitating the resolution of aforementioned issues is highly plausible, paving the way for sustained growth in the cryptocurrency market.

Cryptocurrency will have a greater correlation with equities

Prospects for positive scenarios such as sustained inflows of capital into Crypto, introduction of appropriate legal frameworks to support growth, and the like, can be seen, but it is also important to consider possible ramifications. With BlackRock’s participation, it is highly likely that Crypto will experience price fluctuations similar to those in the stock market, as BlackRock is a traditional financial company that applies prior investment models and theories to investing in Crypto.

Ultimately, owing to the massive capital resources of BlackRock, it follows that the cryptocurrency market may exhibit trends similar to those of stocks, and may fluctuate in response to the monetary policies of various central banks. Despite exerting significant political influence, BlackRock is unable to exert complete control over governments. If crypto investment products become more widespread, issues such as KYC compliance, stablecoins, and money laundering prevention will continue to be the subject of legislative adjustments in the future.

Conclude

BlackRock is a global leading asset management company with vast experience and high reputation in the asset management industry. The company’s foray into crypto exemplifies its recognition of the long-term growth potential of this market.

However, based on a relative estimate, it is not realistic to expect a influx of billions of USD into the market in a short period of time. Nonetheless, considering the aforementioned analyses, the long-term benefits that BlackRock brings are likely to be significant.

The above information was researched by the team at 247btc.net. We hope that this information will be helpful to our readers. However, please note that this is not investment advice, but rather an informational channel. Therefore, investment decisions should be carefully considered.

What is Animoca Brands? Investment trends of Animoca Brands fund

The investment fund, Animoca Brands, specializes in the areas of NFT, gaming, and metaverse. An analysis has been conducted on...

Read moreWhat is BlackRock, and what are the implications of the financial giant’s foray into the world of cryptocurrencies?

On August 11th, BlackRock issued a statement announcing its intention to offer Bitcoin spot investment services to its clients through...

Read moreWhat is Digital Currency Group (DCG) and what are the investment trends of the DCG fund?

The Digital Currency Group is a prominent investment fund established in 2015 that has made successful investments in numerous projects...

Read moreWhat is Andreessen Horowitz’s (a16z)? Investment trends of a16z

This article endeavors to provide a comprehensive overview of the investment portfolio of Andreessen Horowitz's (a16z), a well-known investment fund...

Read moreWhat is Binance Labs investment fund? Comprehensive details regarding Binance Labs.

Binance is a renowned and reputable global cryptocurrency exchange platform, widely known to most of us. Today, we proudly introduce...

Read more