In recent years, Crypto has witnessed a significant advancement with the increasing popularity of the “decentralized” market. One of the most prominent players in this market is Uniswap, which currently holds the position of the largest decentralized exchange. To gain in-depth knowledge about this promising project, our esteemed readers are encouraged to join us at 247btc.net.

Table of Contents

ToggleWhat is Uniswap?

Uniswap is a decentralized exchange protocol or an Automated Market Maker (AMM) protocol built on the Ethereum Blockchain, allowing the trading of ERC-20 tokens between each other. On May 5, 2021, Uniswap unveiled its version 3, providing users with enhanced trading features and capabilities.

The Uniswap platform is user-friendly and enables users to directly swap tokens, add tokens to pools for profit, and list tokens without involving any intermediaries. As all interactions are on-chain, a gas fee is imposed to maintain the platform’s smooth operation.

Since then, Uniswap has emerged as the most significant gas supplier on the Ethereum network and has become the most widely used decentralized application to date.

What are the features offered by Uniswap?

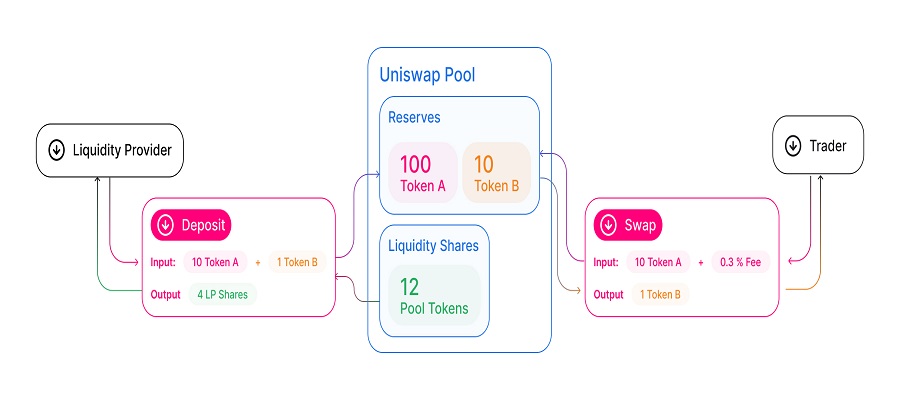

There are 2 main functions when it comes to Uniswap, which are Swap and Pool:

- Swap: The term “swap” refers to a feature that enables the exchange of Ethereum and various ERC-20 tokens.

- Pool: The Uniswap feature referred to as “Pool” enables users to earn money by becoming a liquidity provider. This is accomplished by depositing tokens into a smart contract and receiving pool tokens in return. These tokens represent the user’s share of the total liquidity in that particular pool.

It is conceivable in simplified terms that these two features operate under the Uniswap schematic as follows.

What is the mechanism by which Uniswap provides liquidity?

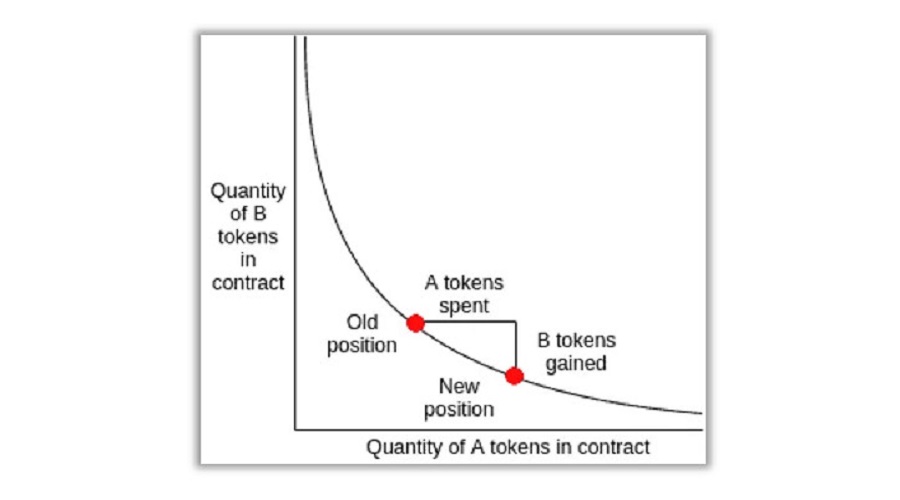

The modus operandi of liquidity provision is illustrated in the equation: x * y = k

In the given equation, x and y represent the number of available ETH and ERC20 tokens respectively, while k signifies a constant that may be set by the creators of the Uniswap exchange contract. It is important to note that the value of k remains constant throughout the equation.

Based on the chart presented, the graphical representation of the constant k is shown as a function. The x-axis denotes the token A (ERC-20) while the y-axis represents token B (ETH).

The initial red dot signifies the present market value for exchanging the ETH-ERC20 pair, based on the current balance of ETH in comparison with ERC20 tokens.

For instance, when swapping an ERC-20 token for ETH, the resulting outcome will manifest as follows:

As a result, the remaining balance of ETH tokens has decreased while the balance of ERC20 tokens has increased. This signifies that the red marker will relocate to a new position when there are more ERC20 tokens and fewer ETH tokens in the liquidity pool. In other words, this is a straightforward pricing algorithm where the exchange rate shifts based on the chart.

Now that you have gained an understanding of the liquidity providers on Uniswap, it is advisable to delve into the two editions of the platform – v1 and v2, the former being the maiden version and the latter integrating numerous new features and upgrading the already existing ones.

Differences between Uniswap V1 and Uniswap V2

Uniswap V2 has introduced numerous functionalities that facilitate the exchange of ERC20 tokens in pools, such as flash swaps and original prices. It is recommended to analyze the differences between the two versions in order to better understand their unique features.

Uniswap V1 swap

Uniswap V1 operates by executing two transactions, the first of which involves the exchanging of ERC20 tokens for ETH and the second involving the conversion of ETH back into the desired ERC20 tokens. In effect, end-users are required to pay transaction fees twice.

This causes some limitations when using Uniswap:

- Fees are higher

- Uniswap is closely tied to the use of ETH

- ERC20 tokens cannot be directly swapped with other ERC20 tokens.

For the above reasons, Uniswap V2 was created.

Uniswap V2 swap

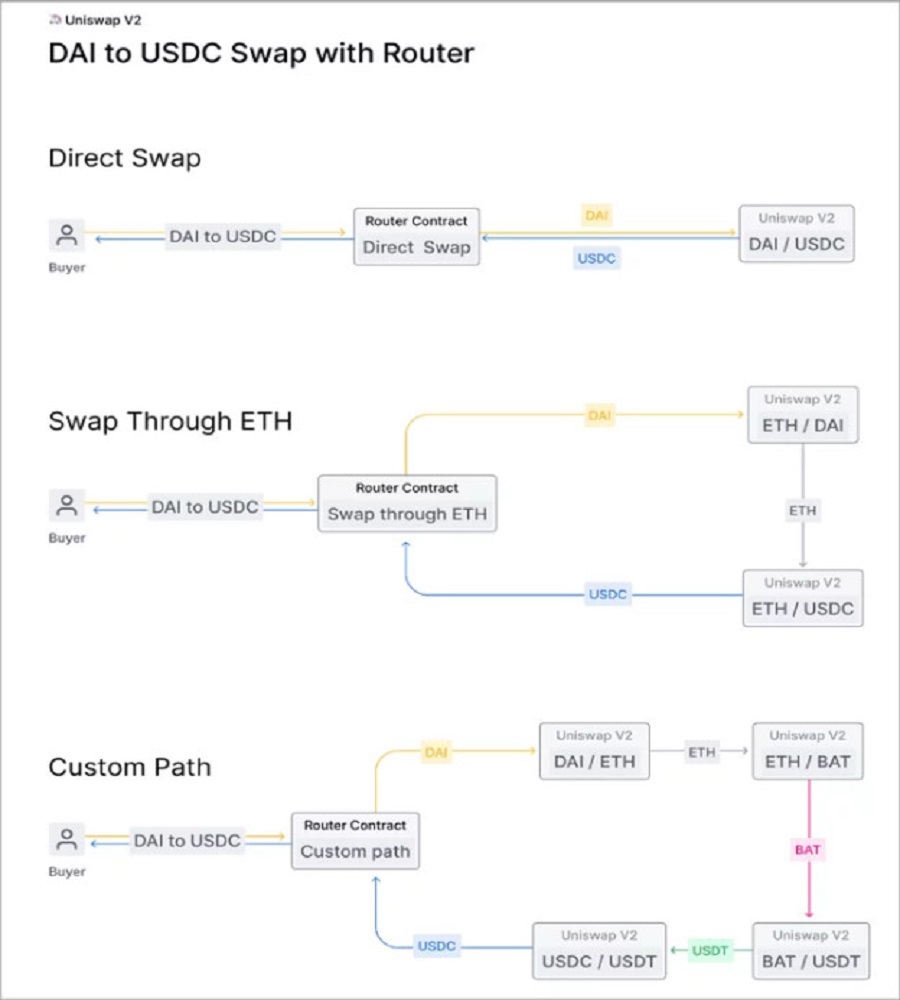

Uniswap V2 offers end-users three distinct options to swap their tokens via the “Router Contract”.

It has been observed by Router Contract that every exchange contract executes the Uniswap V2 protocol.

Here are three swap possibilities:

- One option for facilitating a direct exchange between two ERC20 token pairs is through swapping. For instance, stablecoin pairs such as DAI/USDC can be particularly advantageous for traders.

- Traditional swap through ETH, where you pay the fee twice.

- Swap Custom path is a feature that allows traders to build a more complex trading path, such as DAI/ETH, ETH/BAT, BAT/USDT, and USDT/USDC, to swap their DAI into USDC. This typically provides traders with price arbitrage opportunities.

An evaluation of the benefits of Uniswap

Do you happen to possess comprehension as to the reasons why Uniswap has garnered such popularity? Familiarity with its distinctive features and operational mechanics will aid in the understanding of its widespread adoption.

- Low transaction fees: Uniswap applies a fixed transaction fee of 0.30%, which is significantly cheaper compared to the majority of centralized exchanges. There have been discussions regarding the possibility of reducing the fee to 0.25% in the future.

- No KYC (Identity Verification) Required: They do not require you to undergo the KYC process, which involves disclosing your full name and ID information that will be kept confidential. This enables faster trading on the platform and ensures that your information will not fall into the wrong hands in case of a cyber attack.

- Self-management of assets: As an individual, you have complete control over your finances which can help avoid potential risks associated with decentralized exchanges where you may face the risk of financial loss in case of bankruptcy or cyber-attack.

- Opportunity to access new coins/tokens: One common occurrence on centralized cryptocurrency exchanges is that certain cryptocurrency projects must undergo an approval process from the platform they are listed on. However, on Uniswap, users can acquire newly released tokens first, which may experience significant fluctuations in value particularly during their initial launch.

Is Uniswap safe? Assess disadvantages and risks

Fake smart contract

The issue of fake smart contracts within Uniswap, particularly those involving the creation of counterfeit genuine contracts, is a major concern due to the ease with which anyone can generate ERC20 tokens and add them to the platform.

The issue with this is that immediately after a large liquidity provider decides, they can withdraw their liquidity from the pool, causing other users to incur losses. Consequently, some individuals have taken advantage of this by using it on Uniswap with the intention of deceiving users to deposit their funds with them in exchange for scam coins. Users must exercise caution in this matter.

Transaction failed

The transaction success rate on Uniswap cannot be guaranteed to be 100%, as there exists a possibility of failure due to multiple factors, such as:

- Your payment of insufficient Gas fee has resulted in a prolonged transaction processing time beyond the set deadline.

- Prior to completing the transaction, it is essential to note that the price may increase beyond the maximum amount that you are willing to pay for the token.

- At times, despite being a liquidity provision protocol, Uniswap may not always have sufficient liquidity in its pool. Ultimately, the liquidity levels within Uniswap’s pool can fluctuate and fall below the required threshold for efficient trading.

The aforementioned reasons have an adverse effect on your transactions leading to failure. However, there is no cause for alarm since you will be compensated for the amount lost. Therefore, it is more favorable to consider the second scenario.

Fee Gas

Since the composition of this article, there has been a significant surge in the gas fee of Ethereum, mainly due to the overwhelming usage of its network resulting in a level of congestion that has peaked at 97%.

This makes using Uniswap very expensive, as a single token transaction can be up to $20 (depending). With Uniswap, you also have to approve every new token you want to swap, and this also incurs a fee that can go up to $2.

Phishing attacks

There exist fraudulent websites claiming to be Uniswap. The two domains provided in this guide are the only legitimate domains that should be utilized, as all other domains are not the original Uniswap and may be part of a deceitful scheme.

In order to ensure optimal usage of Uniswap

As previously mentioned, Uniswap is not a typical exchange platform. This means there are no “buy” orders or a specific list of assets available for trading, as liquidity can be added to any specific token pair by anyone. However, this also means that anyone can quickly remove that liquidity, making it difficult for users to swap their tokens. Therefore, it is essential to ensure that the liquidity for the currency pair you wish to trade has been locked.

There are two main domains that you need to pay attention to:

- uniswap.info

- app.uniswap.org

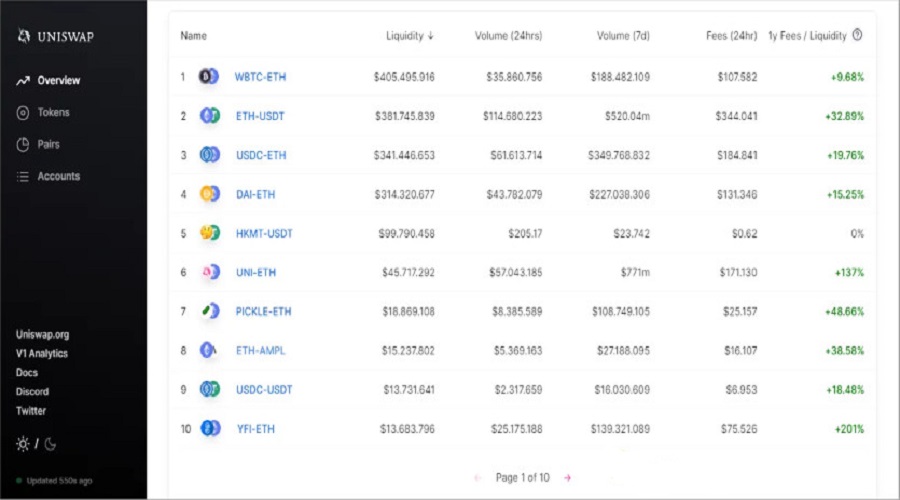

Uniswap.info: The location where you can monitor trading data, check the volume of individual currency pairs, search for currency pairs, evaluate current liquidity, and access token price information is available for your reference.

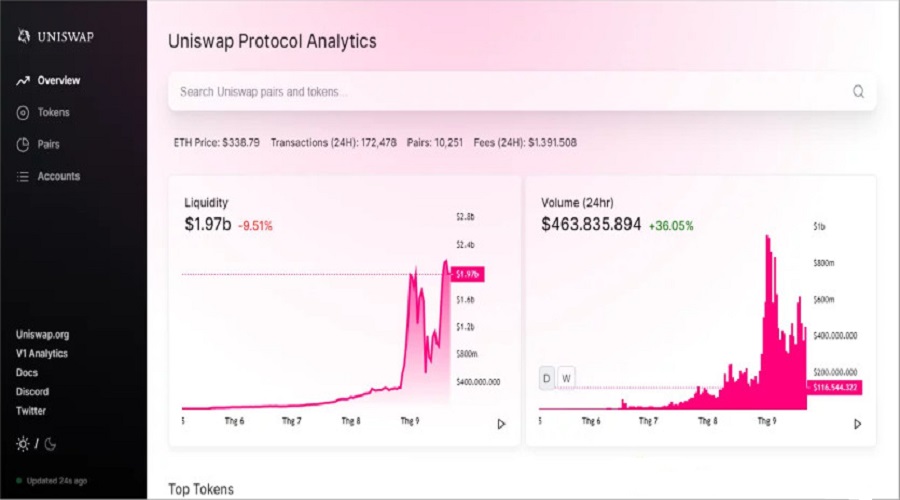

At this interface, users are able to verify general information such as the price of ETH, total liquidity on the trading platform, as well as overall volume and quantity of transactions.

Thanh Search provides a platform for individuals to identify a specific token. Upon scrolling down the main page, one can observe pools with the highest levels of volume and liquidity.

Guidance for conducting transactions on Uniswap

Uniswap facilitates direct connection between the Exchange platform and authorized wallets such as MetaMask, Coinbase wallet, and WalletConnect, thereby playing a crucial role in linking traders and investors.

How to connect Metamask to Uniswap

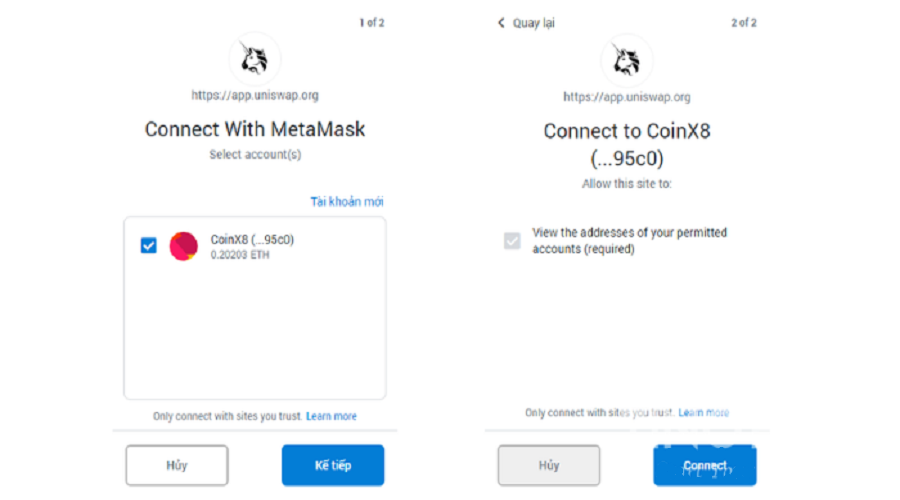

Step 1: Visit https://app.uniswap.org/#/swap.

Step 2: Then Click “Connect to a wallet” in the upper right corner and select a wallet you want to connect.

Step 3: Select the account on the wallet you use (if there is more than 1 account), click “Next” and “Connect”.

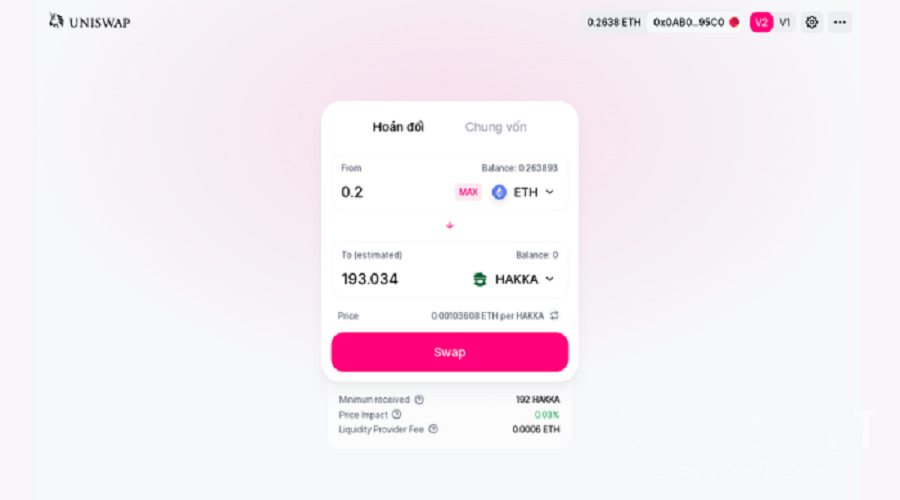

Step 4: Enter the amount you want to swap. Remember to always deduct a little ETH as a transaction fee.

Step 5: After clicking “Swap”, you need to confirm on the wallet and you’re done. The tokens after being swapped will be transferred directly to your wallet. Swap time is fast or slow depending on the number of GAS you set.

The aforementioned constitutes the most fundamental aspects of Uniswap, which is currently the largest decentralized exchange platform, regarded as a leading representative in the ecosystem of cryptocurrency trading. It is hopeful that in the future, Uniswap will continue to enhance its features to maintain its prominent position.

What is Uniswap exchange coin?

The token named UNI is primarily used to manage the Uniswap ecosystem, enabling the community members to share their ownership rights by implementing a governance system on the blockchain.

Uniswap currently occupies a highly favorable position for growth, development, and sustainability thanks to its community-led approach. The creation of its own native token is a direct response to this goal. The governance system will facilitate favorable conditions for protocol development and adoption, as well as enabling the expansion of a larger Uniswap ecosystem in the future.

Basic information about the UNI token is as follows:

| Ticker | UNI |

|---|---|

| Blockchain | Etherum |

| Token Standard | ERC-20 |

| Token Type | Governance |

| Contract | 0x1f9840a85d5aF5bf1D1762F925BDADdC4201F984 |

| Max Supply | 1.000.000.000 UNI |

| Circulating Supply | 110.000.000 UNI |

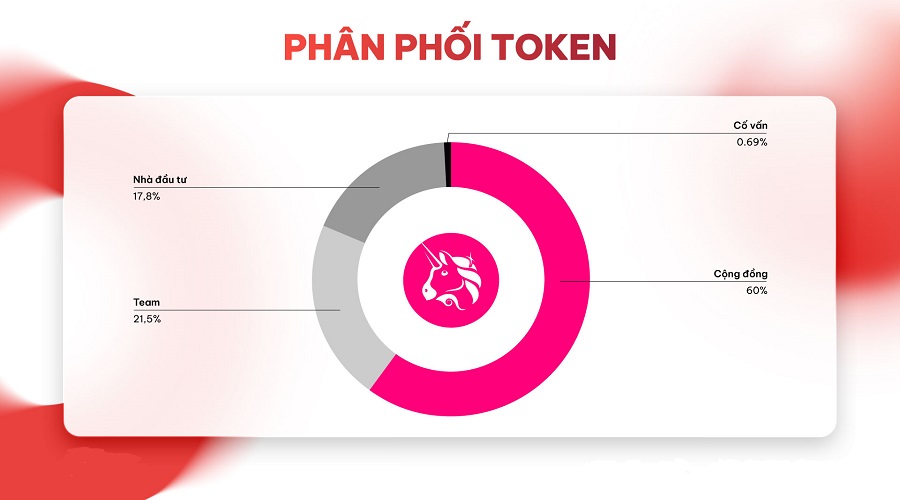

UNI Token Allocation

UNI tokens are allocated as follows:

Community: 60%

Team: 21.51%

Investors: 17.8%

Advisor: 0.69%

Token Release Schedule

Project development team

Conclude

There are a significant number of Liquidity Providers currently in operation, such as Uniswap, however, Uniswap is perhaps one of the foremost representatives in the cryptocurrency exchange ecosystem. To keep abreast of the latest developments pertaining to this platform, kindly follow 247btc.net on various social media channels. It is hoped that in the future, there will be further enhancements to improve the overall user experience.

What is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is 1inch Network and what are the key considerations for investment in 1INCH?

The 1Inch Network is among the first Aggregators in the market and has operated with remarkable efficiency over time. Additionally,...

Read moreWhat is Uniswap? Basic information about UNI Token

In recent years, Crypto has witnessed a significant advancement with the increasing popularity of the "decentralized" market. One of the...

Read moreWhat is Chainflip? AMM Cross-chain project open for sale on Coinlist

Chainflip is a unique project that provides a Cross-chain AMM allowing users to perform cross-chain transactions without the need for...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is KiloEx? Derivative DEX exchange invested by Binance Labs

KiloEX, which originated from BNB Chain's MVB VI program designed to promote the development of Binance Smart Chain, is a...

Read moreWhat is Curve Finance (CRV)? Curve Finance Cryptocurrency Overview

What is Curve? In today's article, we will explore the cryptocurrency CRV together. As the stablecoin market expands, the role...

Read moreWhat is Balancer V2? Ambition to swallow DeFi cash flow

To acquire a comprehensive grasp on the efficiency and drawbacks of the Balancer V2, along with understanding the potential of...

Read more