Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the critical areas for any ecosystem looking to expand into the DeFi space is AMM DEX. If Ethereum has Uniswap and Binance Smart Chain has Pancakeswap, then Cosmos has Osmosis, which acts as its representative.

Table of Contents

ToggleWhat Is Osmosis Crypto ?

Osmosis is an Automated Market Maker (AMM) DEX built on the Cosmos SDK and operates within the Cosmos ecosystem. Despite being a relatively new ecosystem with few standout DeFi projects, current developments suggest that Cosmos will expand its DeFi space in the near future. As such, Osmosis has the potential to become the liquidity hub of the Cosmos network.

The mechanism for Osmosis involves the implementation of AMM. This means that assets will not be traded in the form of an Orderbook, but rather swapped within a Liquidity Pool according to the formula set forth by the Smart Contract.

The salient feature of Osmosis

The distinguishing feature of Osmosis is its exceptional flexibility. The Osmosis team has identified an issue with current AMMs such as Uniswap, whereby users are required to use Curve Finance when in need of a stablecoin asset, and Balancer when seeking to minimize Impermanent Loss risks.

Therefore, Osmosis was developed to address the aforementioned issues, and certain functionalities can be adjusted through the Governance of Osmosis

- Change fee: Transaction fee, Liquidity withdrawal fee.

- Can actually manage the Pool (pool creator or community).

- Add or remove assets that are supported in AMM.

- Create Pool with different Swap curve (similar to Curve Finance) => Suitable for Stable Asset.

- Create a Pool with a different ratio of tokens in the Pool (similar to Balancer) => Reduce the risk of Impermanent Loss.

In this manner, Osmosis has the capability to merge the strengths of Uniswap, Balancer, and Curve by easily customizing the functions within their respective pools. This feature allows Osmosis to scale effortlessly without the need to migrate liquidity from Uniswap V2 to Uniswap V3.

In addition to functioning as an automated market maker (AMM), Osmosis also operates as a Blockchain built on Cosmos. It may surprise many individuals that Osmosis has a dual purpose, serving both as an AMM and a Blockchain. To clarify, Osmosis is an App-Chain, which entails constructing a Blockchain specifically for a particular application, rather than a typical Blockchain ecosystem.

Detailed information about OSMO Token

Key Metrics OSMO

- Token Name: Osmosis.

- Ticker: OSMO.

- Blockchain: Cosmos.

- Token Standard: Updating…

- Contract: Updating…

- Token Type: Utility & Governance.

- Total Supply: 1,000,000,000 OSMO.

- Initial Supply: 100,000,000 OSMO.

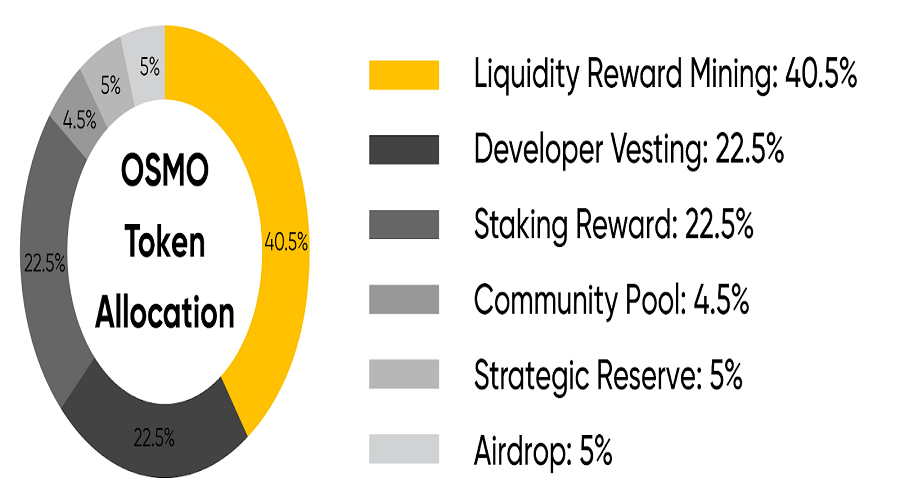

OSMO Token Allocation

The total supply of 1,000,000,000 OSMO will be distributed in the following manner:

- Liquidity Reward Mining: 40.5% – 405,000,000 OSMO.

- Developer Vesting: 22.5% – 225,000,000 OSMO.

- Staking Reward: 22.5% – 225,000,000 OSMO.

- Community Pool: 4.5% – 45,000,000 OSMO.

- Strategic Reserve: 5% – 50,000,000 OSMO.

- Airdrop: 5% – 50,000,000 OSMO.

OSMO Token Sale

Osmosis has decided to refrain from conducting a token sale and instead plans to distribute all of its tokens through various channels including Airdrop, Developer Unlock, Staking, and Liquidity Mining. These distribution mechanisms will be made available exclusively on the Osmosis platform.

OSMO Token Release Schedule

Osmosis will have a total of 1 billion OSMO tokens, which will be released in multiple phases with a one-year cycle. The initial token supply will be 100 million OSMO, and starting from the second year, the token release quantity will decrease by one-third compared to the first year until the remaining 900 million OSMO tokens are distributed.

According to Osmosis’ estimation, the entirety of their tokens are projected to be unlocked by approximately the ninth or tenth year following the initial release. For further illustration, refer to the provided example.

- Initial total supply: 100,000,000 OSMO.

- Year 1: 300,000,000 OSMO.

- Year 2: 200,000,000 OSMO.

- Year 3: 133,333,333 OSMO.

OSMO Token Use Case

OSMO token will be applied in the following cases:

- Provide liquidity in Osmosis Pool to get Reward.

- Staking on Osmosis to get Reward.

- Propose and vote on system changes.

How to earn and own OSMO Token

At present, there are two methods through which one may acquire OSMO tokens:

- Buy OSMO directly at Osmosis.

- Claim Fairdrop OSMO tokens.

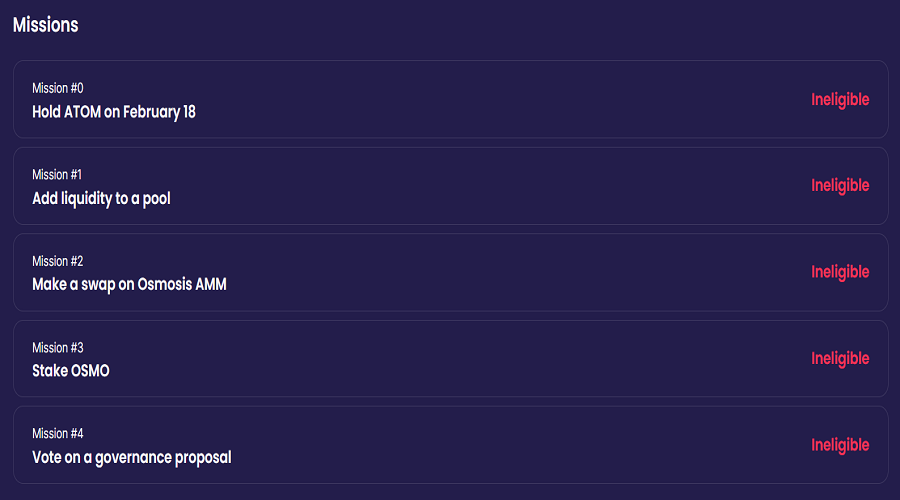

This is an airdrop designed for individuals who held ATOM in their wallets before February 18th, 2021. A total of 50,000,000 OSMO tokens will be distributed based on the proportion of ATOM held in wallets. However, only 20% will be airdropped at the initial stage. In order to claim the remaining 80% of OSMO tokens, users are required to complete four additional steps to demonstrate active participation on the platform. These steps include: (list the steps). Please note that this information is presented in a formal tone and is intended to provide informative language about the airdrop.

- Execute a swap command.

- Provide liquidity to the exchange.

- Stake OSMO.

- Vote in the Governance Proposal of Osmosis.

This measure is implemented to ensure that the airdropped tokens are received by those individuals who genuinely utilize the platform. Users will be given a two-month window to claim the tokens, up until the sixth month. In the event that an excess of OSMO tokens remain unclaimed, they will be transferred to the community pool.

OSMO Token Storage Wallet

According to the information provided by Osmosis, in order to achieve optimal interaction with the platform, users are advised to utilize the Keplr wallet. This wallet is directly linked to Osmosis, enabling users to store and transfer OSMO tokens with ease.

Keplr is a concentrated wallet that assists the construction of chains built on Cosmos such as FetchAI, Kava, Certik Chain, among others. It is crucial to remember to carefully safeguard your private key when utilizing this platform to prevent the potential loss of assets.

Roadmap & Updates

On February 28th, 2022, Osmosis introduced a new feature called Superfluid Staking, which enables users to earn Staking interest while providing liquidity.

Project team, investors, partners

Project team

Although Osmosis does not disclose the specific project team, some members were found on the Twitter channel

- Sunny Aggarwal (@sunnya97).

- Josh Lee (@dogemos).

- George Wosmongton (@wosmongton).

- John Patten (@jpatten_).

- Dev (@valardragon).

Investors

Updating…

Partner

Updating…

Summary

The entity known as 247BTC has furnished pertinent data to the recipients regarding the core elements of Osmosis and the associated token OSMO. It is advisable for the individuals to engage in thorough research and examination of the project’s prospects before making any investment decisions. Best wishes to all.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more