DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of DeFi remains relatively austere and usability is challenging due to the rapid surge of dApps. Supposing we could simplify access to DeFi as playing a game, then let us delve into DeFi Land, a project that integrates gamification into DeFi.

Table of Contents

ToggleWhat is DeFi Land (DFL)?

DeFi Land is a blockchain-based decentralized farming simulation game designed to gamify Decentralized Finance (DeFi). In other words, the project facilitates users to perform DeFi activities in a fun and interactive way, similar to playing the once-popular “Farmville” game.

In case there is still some ambiguity about the gamification process in DeFi Land, allow me to elaborate that it refers to the integration of gaming mechanisms into non-gaming entities, with the aim of enhancing user engagement and promoting adoption. The term gamification pertains to this approach and is designed to create an immersive experience for the target audience.

An example of the current zapper method, which demonstrates user login, liquidity provision, asset swapping, and experience point accumulation to ultimately exchange for bát mắt NFTs, is indicative of a small example. As a result of this campaign, zapper has successfully attracted a substantial number of users to try its product.

The salient feature pertaining to DeFi Land (DFL)

The DeFi land is anticipated to offer an assortment of values to its end-users, as listed below

- Bringing together DeFi features on one platform: Similar to projects like Zapper and Debank, DeFi Land will aggregate multiple platforms (AMMs, lending, yield,…), providing users with a single user interface for their operations.

- Gamify everything: The highlighted characteristic of DeFi Land resides precisely in gamifying every user experience, thereby facilitating a more accessible interaction with DeFi for all stakeholders.

What is the reason that propelled DeFi Land to opt for Solana as its preferred development platform?

The project aims to become a multi-chain game, however, in the initial phase, in order to optimize user speed and cost, the project has chosen to develop on the Solana blockchain. Speed, cost-effectiveness, and security are critical factors, especially for gamification projects like DeFi Land, and Solana is among the most suitable blockchains for this purpose.

Detailed information about DFL Token

Key Metrics DFL

- Token Name: DeFi Land.

- Ticker: DFL.

- Blockchain: Solana.

- Token Standard: SPL.

- Contract: Updating…

- Token Type: Utility.

- Total Supply: 10,000,000,000 DFL

- Circulating Supply: 586,355,000 DFL

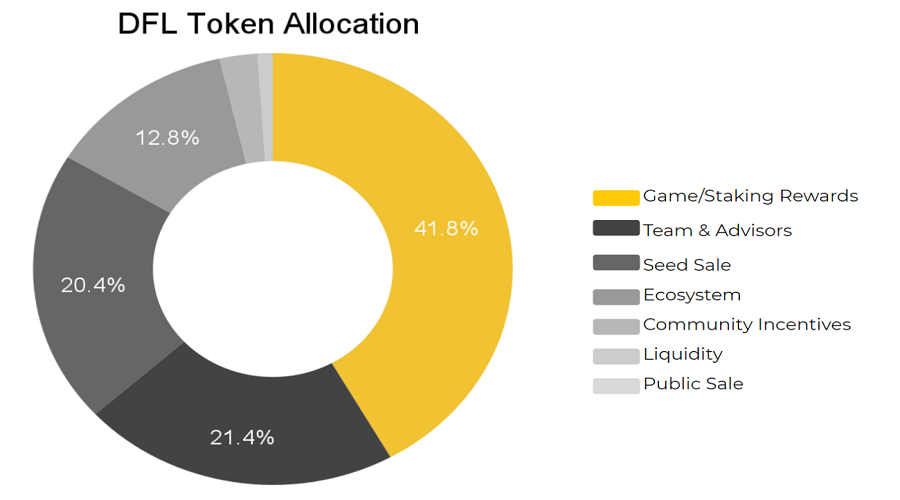

DFL Token Allocation

- Game/Staking Rewards: 41%

- Team & Advisors: 21%

- Seed Sale: 20%

- Ecosystem: 12.5%

- Community Incentives: 2.5%

- Liquidity: 2%

- Public Sale: 1%

DFL Token Sale

DFL Token participates in token sale on 2 platforms:

– AcceleRaytor: Open Pool: 19:00 (Vietnam Time) November 24, 2021 – Close Pool after 12 hours.

– IDO on Raydium: 19:00 (Vietnam Time) November 25, 2021.

DFL Token Release Schedule

DFL Token Use Case

DFL token will be applied in the following cases:

- Propose and vote on project changes.

- As an incentive in the game, creating a “play to earn” model.

- Use to purchase land, and in-game items as well as for future special features.

Roadmaps & Updates

The development team of DeFi Land will release two versions of their platform. V1 is expected to be launched during the summer of this year, while V2 is slated for release in the beginning of 2022.

DeFi Land V1

DeFi Land V1 includes:

- Swap.

- Provide liquidity.

- Staking & yield farming.

- Administration.

- Create your own land.

- Educational land (practice mode): Experimental game mode allows testing all features with virtual tokens.

- Achievements.

DeFi Land V2

DeFi Land V2 includes:

- Lending & borrowing.

- Indices (indices).

- NFT marketplace.

- Interactive chat (interact with other players).

- Betting.

- Create clans and compete.

- Mini games.

- Tournaments.

- Supports Ethereum, Terra, BSC.

Q3 2021

- Connect with Serum, Raydium.

- Testnet / Devnet Launch.

- Mainnet Beta Launch.

- Public Sale.

Q4 2021

- Governance.

- Special Land Sale.

- V2 Closed beta testing.

- Connect with other platforms on Solana.

Q1 2022

- Connect to Ethereum and BSC.

- Apply Bridges.

- Closed mobile version testing.

- Partnerships with other blockchain games.

- V2 launches.

- NFT Marketplace.

Q2 2022

- Ecosystem grant Program.

- Connect with other ecosystems.

- Scholarships/ educational programs.

Team & Investor

Team

The team behind the anonymous project consists of numerous experienced members who specialize in developing DeFi platforms along with expertise in AR, VR gaming, and related fields.

Investor

On September 9th, DeFi Land made an announcement stating that they have obtained approximately $4.1 million in support from over 40 significant investors such as Animoca Brands, Alameda Research, Jump Capital, and NGC Ventures.

247btc.net has provided detailed information regarding the DeFi Land project. We encourage you to conduct further research and evaluate this investment opportunity to make informed decisions. We wish you the best of luck in your endeavors.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more