The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as Pantera and Founders Fund. Simultaneously, the platform launched its new ONDO token for public sale on Coinlist. In this article, we will delve into the details of the Ondo Finance project and provide an overview of the ONDO token, inviting readers to discover more about this exciting venture with us at 247btc.net.

Table of Contents

ToggleWhat is Ondo Finance (ONDO) ?

Ondo Finance is a decentralized finance protocol that facilitates profitable and risk-sharing exchanges among cryptocurrency investors in a secure manner through Vaults. Ondo also broadens its product offerings to support investors in establishing a fixed yield position while ensuring risk reduction.

In particular, investment returns are subject to varying factors and fluctuations. Ondo Finance facilitates investors by providing and supporting financial instruments for effectively managing capital utilization. Notably, investment products are segmented into two categories based on investment preferences.

- Fixed Yield positions for those who like stable profits.

- Variable Yield positions for those who like risk and high returns.

The salient feature of Ondo Finance

Ondo Finance has established the Ondo Vault, which allows members to contribute liquidity and share profits or risks within the same Vault.

A Vault at Ondo Finance will include 4 main features as follows:

- Vault term: Initially, the Vaults will have a fixed time period, following which they will be converted to a permanent duration.

- Asset Pool: Asset types are available in the Vault for users to provide liquidity.

- Number of positions and position size: The initial Vaults will present the users with two positions, namely fixed and variable, each of which will represent 50% value of the assets whenever the Vault is instantiated.

- The fundamental basis for profit allocation (aimed at distributing profits among different positions) is as follows: The initial Vault batches will segregate reward payouts based on the user’s equity using specified calculation methods.

Each Vault that is created must adhere to the following four steps in a defined process:

- Structuring: Users subscribe to an on-chain Vault structure, stating the properties.

- Subscription Requests: LPs will supply assets to the pool and start the process running.

- Deployment: Prior to the conclusion of the Subscription phase, the assets owned by limited partners shall be allocated to pre-designed Asset Pools established by the pool originator.

- Redemption: Once the Vault has expired, LPs holding fixed-profit positions shall receive a portion of the profits from the pool, followed by full asset restitution to LPs holding variable positions.

Detailed information about ONDO Token

At present, Ondo Finance has not disclosed any detailed information regarding its token. As soon as updates become available, our team will promptly provide them for peer review and reference.

Key Metrics ONDO

- Token Name: Ondo Finance Token.

- Ticker: ONDO

- Blockchain: Ethereum

- Contract: Updating…

- Token type: Governance

- Token Standard: ERC-20

- Total Supply: 10,000,000,000 ONDO

- Circulating Supply: Updating…

ONDO Token Allocation

Updating…

ONDO Token Release Schedule

- Coinlist Tranche 1: ~ 1% (locked for 1 year and gradually distributed over 18 months)

- Coinlist Tranche 2: ~ 4% (locked for 1 year and gradually distributed over 6 months)

- Seed round investors: < 7% (1 year locked and gradually distributed over 24 months) 4 million USD

- Series A investors: < 7% (1 year locked and gradually distributed over 24 months) 20 million USD

ONDO Token Sale

Currently, you can start participating in the token sale on Coinlist.

- Sales opening time: Starting from May 12, 2021 22:00 (Vietnam time).

- For each option, you are allowed to buy:

- Min: $100

- Max: $2,000

- Lockup: Lock up for 12 months from June 2022, payable in installments over the next 6 months.

Registration deadline: Registration ends on May 9, 2022 19:00 (Vietnam time).

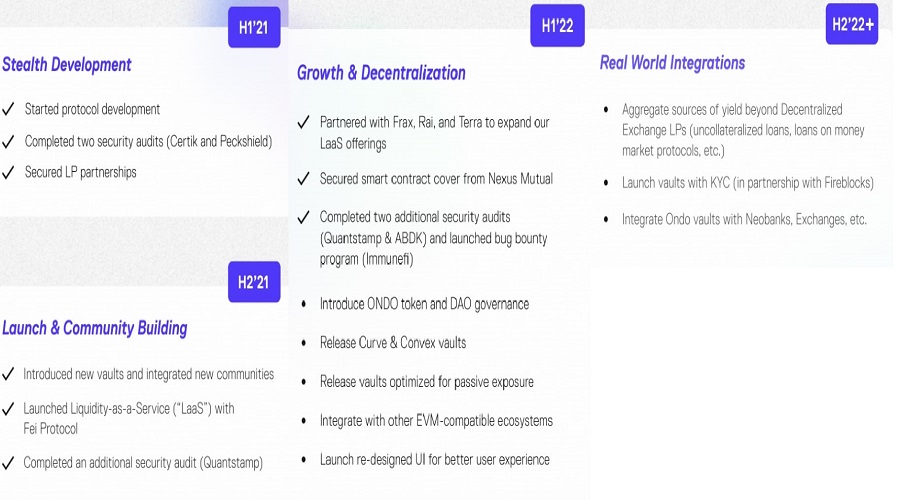

Roadmaps & Updates Ondo Finance

First half of 2021:

- Start developing the platform

- Complete security audits by Certik and PeckShield

- Connect to liquidity pools

Second half of 2021:

- Open more vaults and connect with more new communities

- Open Laas service partner with Fei Protocol

- Complete a security audit by Quantstamp

First half of 2022:

- Cooperate with Frax, Rai, Terra to increase partners for Laas service

- Completed smart contract insurance signing from Nexus Mutual

- Completed 2 additional security audits conducted by Quantstamp and ABDK

- Organize a bug hunting program on Immunefi

- Announcement of ONDO token and governance model

- Open vault for Curve and Convex platforms

- Open vault optimized for passive investors

- Integrate with other EVM ecosystems

- Updated UI to enhance user experience

Second half 2022 onwards:

- Synthesize additional yield sources other than liquidity pools on Defi AMM platforms

- Open Vaults with integrated KYC

- Integrate Vaults into new generation exchanges and banks…

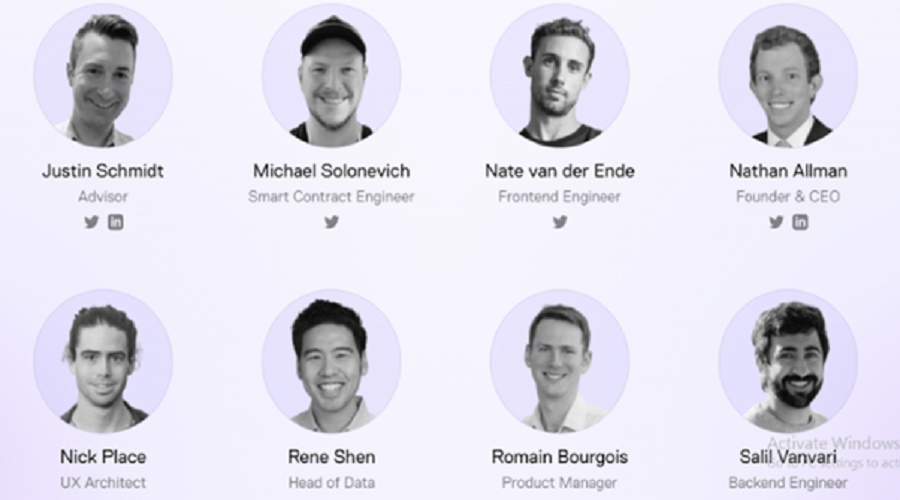

Project team, investors & partners

Ondo Finance Core Team

Nathan Allman: Founder & CEO

- Nathan acquired his Bachelor’s degree in Art and Economics from Brown University, followed by a Master’s degree in Business Administration (MBA) from Stanford University.

- After graduating, Nathan had become a valued partner for several well-established investment firms, such as Prospect Capital Management and ChainStreet Capital, over a period of three years.

- Subsequently, Nathan officially ventured into Wall Street when he assumed the position of Digital Asset Management Manager at Goldman Sachs.

- After more than two years of affiliation with Goldman Sachs, Nathan made the decision to leave the corporation and commence the establishment of Ondo Finance, effective as of February 2021.

Gabriel Bianconi: Chief Product Officer

- Gabriel has spent a tenure of approximately five years with Stanford University, achieving the dual degrees of Bachelor’s and Master’s in Computer Science and Engineering with a laudable success record.

- Upon graduating, Gabriel immediately embarked on his entrepreneurial journey with Scalar Research, a consultancy specializing in data science and artificial intelligence.

- After nearly three years of dedication to Scalar Research, Gabriel has transitioned to Ondo Finance as of November 2021, approximately nine months since Natha initiated the project.

Romain Bourgois: Senior Product ManSenior

- Roman has received instruction on Management and Business from various institutions including the Shanghai University of Finance and Economics as well as Audencia.

- During his tenure at various organizations such as Altran CIS, The Manitowoc Company, Delasource, and Quatsuo, Romain amassed significant experience as a web developer proficient in the utilization of Web2 technology.

- Subsequently, Romain has been associated with Criteo, a global advertising company, for a period of 8 years and has ascended to the position of Senior Product Manager, after holding various high-level positions within the organization.

- Upon leaving his employment at Criteo, Romain will assume a position with Ondo Finance for the first time, as well as venture into the crypto market in a role similar to that held at Criteo. This will commence in March 2022.

Investors

- August 17, 2021: Seed round successfully raised $4M led by Pantera Capital and a number of other funds such as: Genesis, Digital Currency Group, CMS, CoinFund, Chapter One, Bixin, Divergence, Protoscale Capital, The LAO , Stani Kulechov, Josh Hannah, Richard Ma, Diogo Monica, and Christy Choi.

- April 27, 2022: Series A successfully raised $20M led by Founders Fund, Pantera Capital and with the participation of Coinbase Ventures, GoldenTree, Wintermute, Steel Perlot, Tiger Global, Flow Traders.

Summary

Ondo Finance is a decentralized financial product that effectively addresses some of the liquidity limitations in the DeFi space. By breaking down the barriers between traditional finance and DeFi, it facilitates the widespread implementation of DeFi in the global economy. Through this article, we have established a clear understanding of what Ondo Finance is and provided an overview of the digital currency. We hope that this write-up has imparted valuable knowledge to our readers.

The above information was researched by the team at 247btc.net. We hope that this information will be helpful to our readers. However, please note that this is not investment advice, but rather an informational channel. Therefore, investment decisions should be carefully considered.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more