What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on HAY, a Stablecoin built and developed on the BNB chain. Stablecoins are no longer unfamiliar in the market, but Helio Protocol sets itself apart with its distinct features. Let us delve into this topic further in the article below.

Table of Contents

ToggleWhat is Helio Protocol?

The protocol Helio offers liquidity to its users, allowing them to generate profits through lending, borrowing, yield farming, and staking activities. To be more specific, users can collateralize BNB/BUSD and borrow HAY to maximize their returns.

Within the context, the native stablecoin (also referred to as Destablecoin – Decentralized stablecoin) of the project plays a crucial role, with protocol Helo operating on BNB Chain.

The operational mechanism of the Helio Protocol

Products of Helio Protocol

Helio enables its users to access various features such as: collateralizing BNB or BUSD, borrowing HAY, farming HAY, withdrawing collateral assets, claiming rewards in Helio while borrowing HAY, and participating in governance activities of the protocol. Some prominent products/features offered by Helio include:

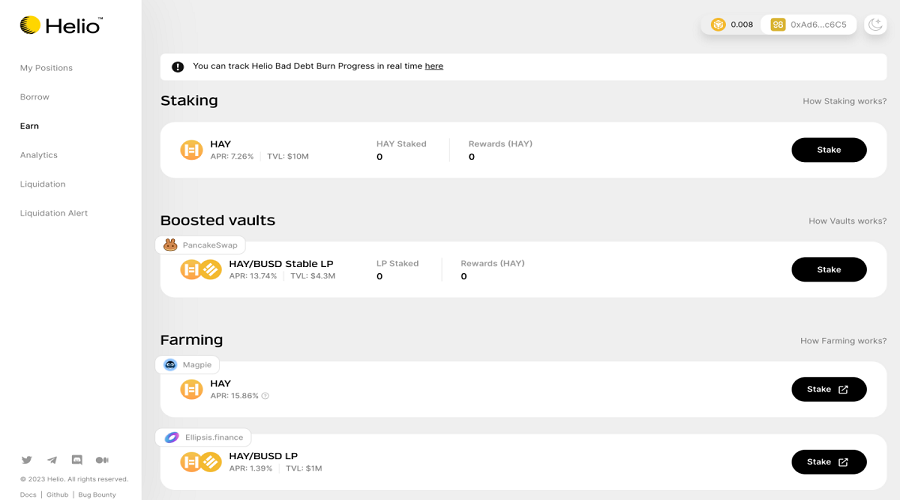

Earn (Reward in Helio Protocol)

Within this section, there will be an array of features designated for the community, such as:

- To participate in staking on the Helio protocol and receive APR, users must hold Destablecoin. Rewards from staking activities can be claimed immediately. Currently, the platform has a total of 7,874 users and over $67 million in Total Value Locked (TVL).

- Boosted vaults: Helio’s bonus cash out feature enables users to leverage it for compound interest by aggregating profits.

- Farming: Helio offers several DEX platforms that support asset farming for users, such as PancakeSwap, Ellipsis, Magpie, and Thena.

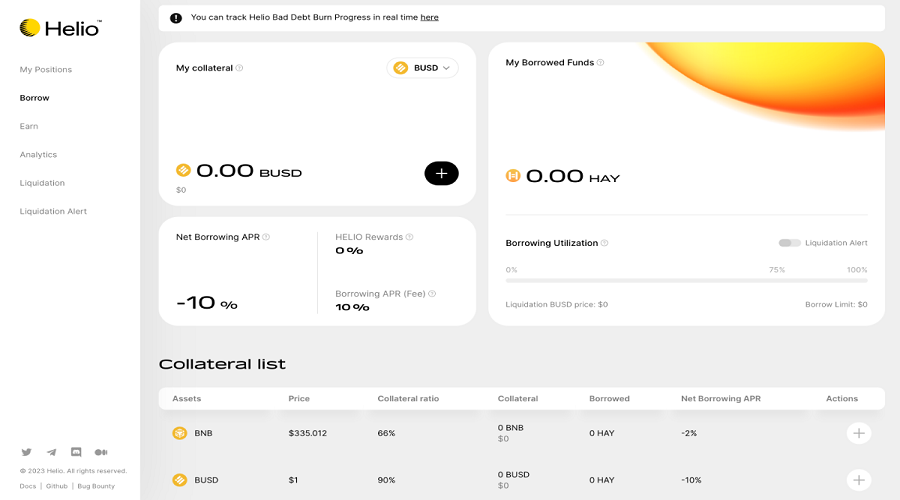

Borrow HAY

In the Helio protocol, users are presented with the option to borrow HAY using either their BNB or BUSD holdings, with a low interest rate set at 2% and 10% of the total loan value, respectively. Following this, users may then choose to utilize their HAY for staking or farming activities, thereby profiting from the platform (such as by earning HELIO token rewards). It is important to note that the Collateral Ratio for the lending protocol sits at 66% for BNB assets and at 90% for BUSD holdings.

As of present time, a total of 1,551 users have participated in the lending program, resulting in over 67 million USD being pledged against Helio and 21.5 million HAY tokens being borrowed (figures are based on a monthly calculation).

The revenue of Helio Protocol

The revenue projection for the Helio protocol is as follows:

- The difference between savings interest and loan interest HAY.

- Liquidation fee.

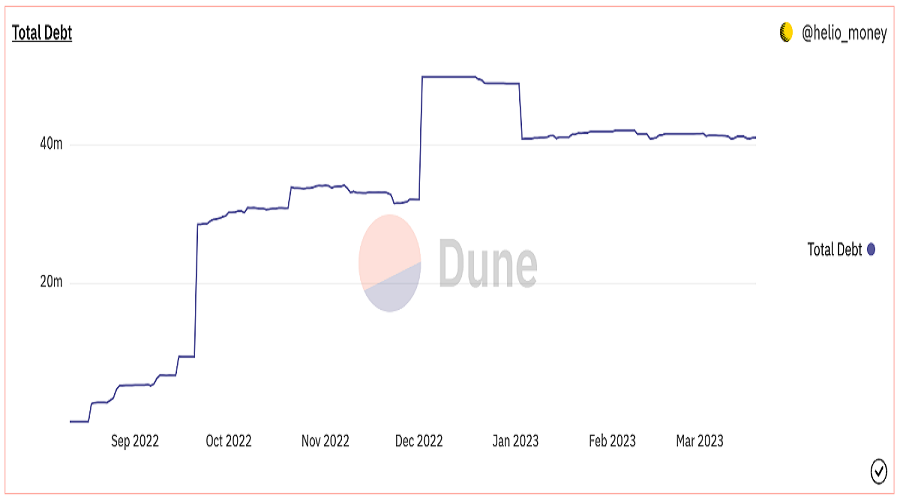

Currently, Helio Protocol has not disclosed specific revenue information. Nevertheless, according to statistical data provided by the @helio_money account on Dune Analytics, there are currently 7,874 users. Additionally, the total debt on the platform is over 40 million HAY.

OR What is Destablecoin?

HAY is a stablecoin within the Helio ecosystem that can be converted into an equivalent value of 1 USD. Unlike other stablecoins in the market which must always be pegged to 1 USD, Helio’s peg is accurate but not sustainable due to its vulnerability to market demands.

In the event of a change in the value of HAY, there exist measures to ensure Helio’s preservation, such as:

- Case 1: In the event that the value of HAY increases beyond one US dollar, Helio will encourage borrowers to take out additional loans in order to sell off other assets, leveraging the profits derived from the differential.

- Case 2: If the price of HAY is less than 1 USD, as HAY is currently discounted, borrowers will be encouraged to purchase HAY from the market to repay their debts on the platform.

The salient feature of the Helio Protocol

In certain stablecoin models, such as the MakerDAO’s DAI stablecoin, HAY operates in a similar manner. However, the primary difference with Helio is its advanced version that enhances capital efficiency through BNB Liquid Staking and enables collateral assets to generate rewards from the protocol. This operation provides sustainable profits for all parties involved.

In contrast to other protocols, Helio possesses numerous mechanisms aimed at mitigating risks for borrowers, including:

- Oracles

- Debt Ceiling

- Loan-to-Value

- Liquidation model

- Liquidation Alert System

What is Helio Protocol Token?

HAY Token Key Metric

- Token Name: Destablecoin HAY

- Ticker: HAY

- Blockchain: BNB Chain

- Token Contract: 0x0782b6d8c4551b9760e74c0545a9bcd90bdc41e5

- Token Type: Stablecoin, Utility

- Total Supply: 40,943,769 HAY

- Circulating Supply: 40,811,221 HAY

HELIO Token Key Metric

- Token Name: Helio Protocol

- Ticker: HELIO

- Blockchain: BNB Chain

- Token Contract: Updating…

- Token Type: Governance

- Total Supply: 1,000,000,000 HELIO

- Circulating Supply: Updating…

HELIO, HAY Token Use Cases

In terms of liquidity protocol, Helio possesses two types of tokens, namely:

- HAY: serves as a stablecoin and provides transaction methods such as lending, borrowing, and minting on the platform

- HELIO: serves as an administrative and management tool for the Helio Revenue Pool. Its purpose is to incentivize users participating in the protocol and engaging in liquidity mining activities.

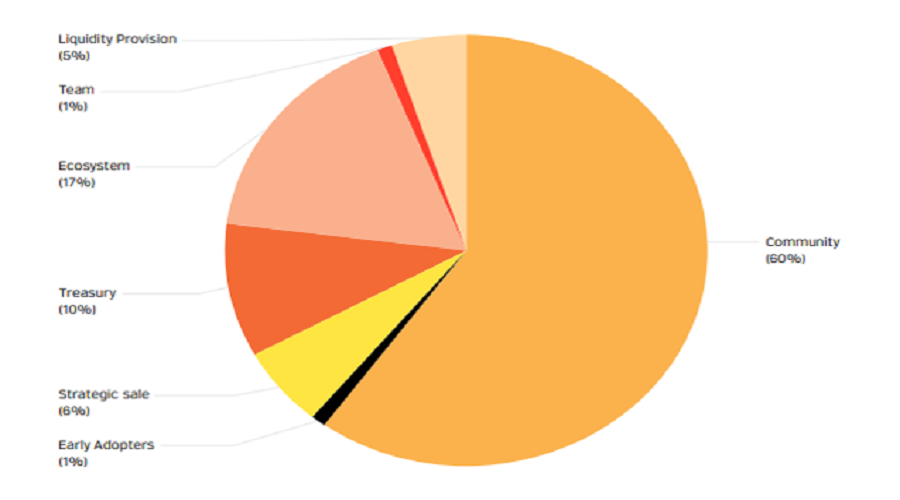

HELIO Token Allocation

The allocation of HELIO follows the proportion indicated below:

- Community: 60%

- Ecosystem: 17%

- Treasury: 10%

- Liquidity Provision: 5%

- Strategic Sale: 6%

- Team: 1%

- Early Adopters: 1%

Token Release Schedule

Helio Protocol does not mention a detailed release time.

HELIO, HAY Token Sale

Helio Protocol does not have a token sale event.

Where to buy HELIO, OR Token

- The HAY cryptocurrency will be generated through the means of minting or can be purchased on the decentralized exchange (DEX) platforms such as PancakeSwap (BNB Chain) and Thena.

- Currently, HELIO lacks a marketplace for buying and selling. As indicated in the company’s documentation, it is intended to be used as a mode of reward for borrowing in the future, however, as of now, there is no such system in place.

Individuals are able to store tokens in any wallet that supports the BNB Chain network, with notable reputable options including the Coin98 Super App, Metamask, and Trust Wallet.

Roadmaps & updates

The summary of the developmental trajectory of Helio Protocol is as follows:

- State 1: Helio is set to introduce their new destablecoin, HAY, and expand its market share within the BNB Chain ecosystem, marking a significant advancement within the traditional stablecoin market.

- State 2: Helio extends cross-chain and governance

- State 3: The emergence of Helio as a stablecoin alternative is gaining momentum in the community and is poised to become a new trend.

Project team

The Helix Protocol refrains from disclosing information regarding its project team, instead indicating that the leadership members possess several years of experience in both the financial and technological sectors.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more