The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support for farming purposes. Do you seek to understand the nature of the Hubble Protocol and how it functions? Refine your knowledge by delving into the content of this article.

Table of Contents

ToggleWhat is Hubble protocol (HBB)?

The Hubble Protocol project is a Debt Protocol based Lending system on the Solana blockchain network, where users can deposit their assets to mint HUSD. This mechanism bears a resemblance to the MakerDAO and DAI model, and it operates similarly to Parrot and PAI within the Solana ecosystem.

The salient feature of the Hubble

Hubble has a diverse range of assets available for use as collateral, which includes SOL, BTC, and ETH. The collateral ratio, also known as CR, is at 110%, enabling a LTV of up to 90.9%.

For instance, if SOL is priced at $100, and 10 SOL is deposited, resulting in borrowing of 500 HUSD, the CR will be calculated as (10*100/500)*100 = 200%. Asset liquidation occurs when the CR falls below 110% (i.e. $909 in borrowed HUSD).

The aforementioned assets shall not remain stagnant within MakerDAO, rather they shall be deployed elsewhere for increased profitability. SOL may be staked, while BTC or ETH may be employed for farming operations.

The operational mechanism of Hubble is similar to Fei Protocol, or more precisely, Alchemix, whereby collateralized assets are utilized to generate interest for borrowers. Thus, in some sense, Hubble enables users to “borrow” future profits, rather than simply taking out loans.

Notwithstanding, one drawback of Hubble is that HUSD borrowing requires a minimum of 200 HUSD, equivalent to $200.

Detailed information about HBB token

Key Metrics

- Token Name: Hubble

- Ticker: HBB

- Blockchain: Solana

- Token Standard: SPL

- Contract: HBB111SCo9jkCejsZfz8Ec8nH7T6THF8KEKSnvwT6XK6

- Token Type: Utility, Governance

- Total Supply: 100,000,000 HBB

- Circulating Supply: Updating…

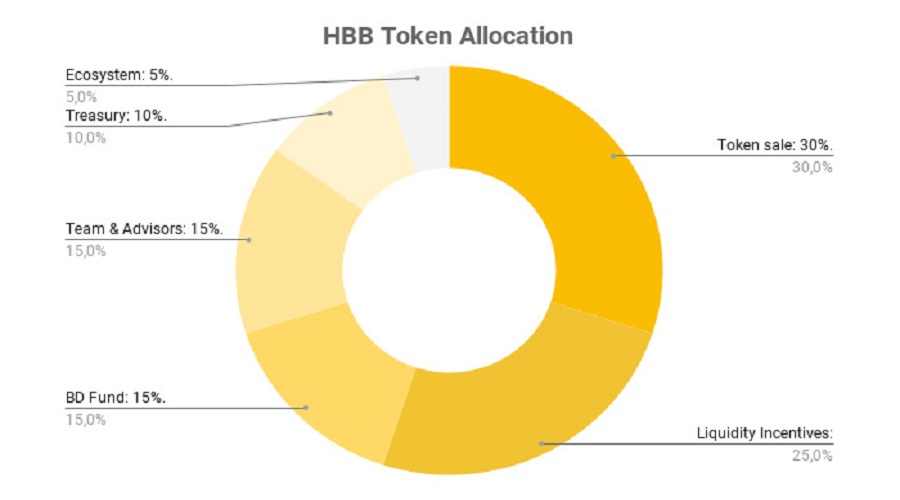

HBB Token Allocation

- Token Sale: 30%

- Preseed Sale: 4.4%

- Seed Sale: 12%

- Private Sale: 9.2%

- Strategic Sale: 0.4%

- Public Sale: 4%

- Liquidity Incentives: 25%

- Team & Advisors: 15%

- BD Fund: 15%

- Treasury: 10%

- Ecosystem: 5%

HBB Token Sale

Below are the HBB sale rounds:

HBB Token Release Schedule

- Token Sale:

- Preseed Sale: 0% TGE, 1 month Cliff, then unlock 15% and pay in installments over 12 months.

- Seed Sale: 0% TGE, 1 month Cliff, then unlock 15% and pay in installments over 12 months.

- Private Sale: 0% TGE, 1.5 months Cliff, then unlock 10% and pay in installments over 18 months.

- Strategic Sale: 12.5% TGE, then installments over 8 months.

- Public Sale: 33% TGE, then paid in installments over 3 months.

- Liquidity Incentives: No information available.

- Team & Advisors: 0% TGE, 6 months Cliff, then unlock 10% and pay in installments over 24 months.

- BD Fund: 0% TGE, 1 month Cliff, then unlock 2.5% and pay in installments over 12 months.

- Treasury: 0% TGE, 12 months Cliff, then amortized over 12 months.

- Ecosystem: 0% TGE, vesting time unknown.

HBB Token Use Case

- Staking: HBB can be staked on Hubble to earn fees from the protocol and users are eligible to earn 85% of the revenue generated by Hubble Protocol’s services. The aforementioned revenue sources initially stem from a 0.5% USDH minting fee and a 0.5% USDH redemption fee for collateral assets.

- Governance: In the future, HBB will serve as a governance token for Hubble DAO, allowing it to be utilized in voting processes for proposed improvements.

- As the protocol expands, HBB stakers will be exposed to additional revenue streams.

Roadmap of the Hubble Protocol project

The goal of the Hubble Protocol project is to provide users with a centralized hub of essential DeFi services, supported by the speed and efficiency of the Solana platform. The Hubble Protocol is a product developed by a team of experienced professionals in the FinTech industry, who are passionate about bringing DeFi to the world.

The project is determined to develop in 3 phases, specifically:

- Phase 1 – Ongoing: Main focus on USDH loan and mint transactions

- Phase 2 – Estimated for the second quarter of 2022: Participate in providing a DeFi structured product system, complete and fill a vacant space in DeFi.

- Phase 3 – No specific time yet: The plan is to provide decentralized finance (DeFi) loans, which is considered a revolutionary step in DeFi lending. This service has the potential to further popularize the DeFi market in the future.

The development team and investors of the Hubble Protocol project

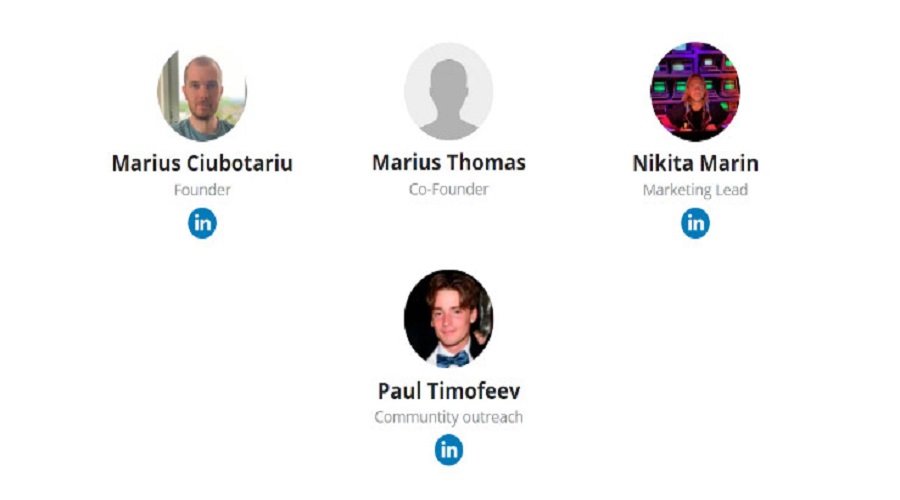

Development team

- Marius George Ciubotariu (Founder): The founder of Hubble Protocol, who holds British citizenship, has graduated from the University of Exeter and has six years of experience working as a software engineer and sales analyst at Bloomberg LP.

- Marius Thomas (Co-Founder): He is a private person and does not like appearing in front of the media.

- Nikita Marin (CMO): The individual in question has been employed by Hubble Protocol for a duration of five months. Prior to this role, Nikita had accrued over two years of experience working for UniDAO, serving part-time as a community manager for Kava Labs and one year of experience as a business development director for the ICOS platform.

- Paul Timofeev (Communtity outreach): The developer of the Hubble Protocol was born in the United States and holds a degree from Baruch College. With over a year of experience as a community manager for BlockchainDriven.com, he has taken on the role of community developer for the Hubble Protocol.

Investors

As of January 18th, 2022, the project has successfully completed its seed round of funding, raising approximately $10 million from renowned funds such as Decentral Park Capital, Jump Capital, Three Arrows Capital, DeFlance Capital, LongHash Ventures, DeFi Alliance, Solana Ventures, Spartan Group, Delphi Digital, CMS Holdings, and Mechanism Capital, as reported by Coindesk.

Partners

Updating…

Summary

The Hubble Protocol intends to further delve into and enhance the features of DeFi on the Solana platform. This indicates that the project will consistently work towards developing new functionalities and exploring novel ways to support their community’s involvement in DeFi. With a focus on leveraging advancements in the Solana blockchain platform, the future plans of the Hubble Protocol include designing new, innovative lending products to be provided to users.

The above information was researched by the team at 247btc.net. We hope that this information will be helpful to our readers. However, please note that this is not investment advice, but rather an informational channel. Therefore, investment decisions should be carefully considered.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more