The Digital Currency Group is a prominent investment fund established in 2015 that has made successful investments in numerous projects and played a key role in significant market deals in the crypto industry. This article will delve into DCG’s investment style, portfolio, and general scope as a financial institution.

Table of Contents

ToggleWhat is Digital Currency Group (DCG)?

Since its establishment in 2015, Digital Currency Group (DCG) has functioned as an investment fund dedicated to accelerating the development of a new financial system on the blockchain. DCG fulfills this mission by constructing and supporting pioneering startups in the realm of digital currencies and blockchain technology.

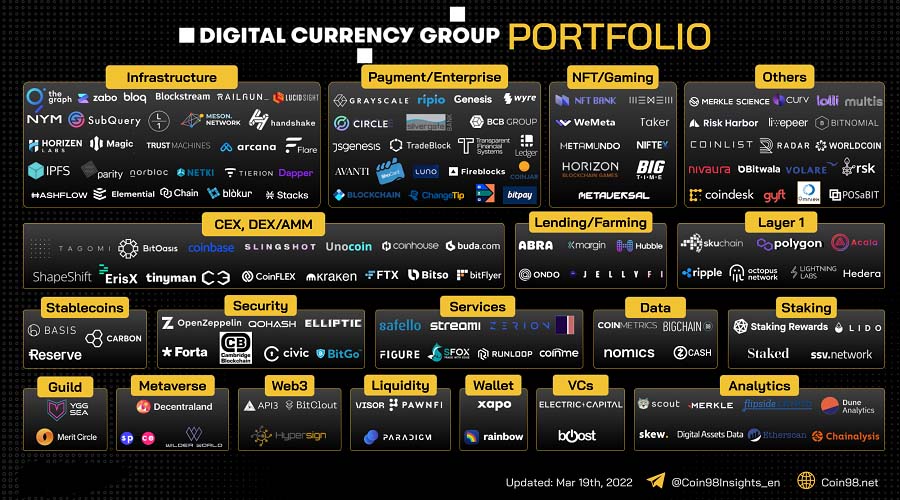

DCG ranks among the top investment funds within the digital asset industry, with a portfolio that spans over 100 companies situated across 30 different countries. The companies invested in encompass a broad range of sectors, with market leaders such as Coinbase, Circle, Ledger, Ripple, and ShapeShift, amongst others, among its investees.

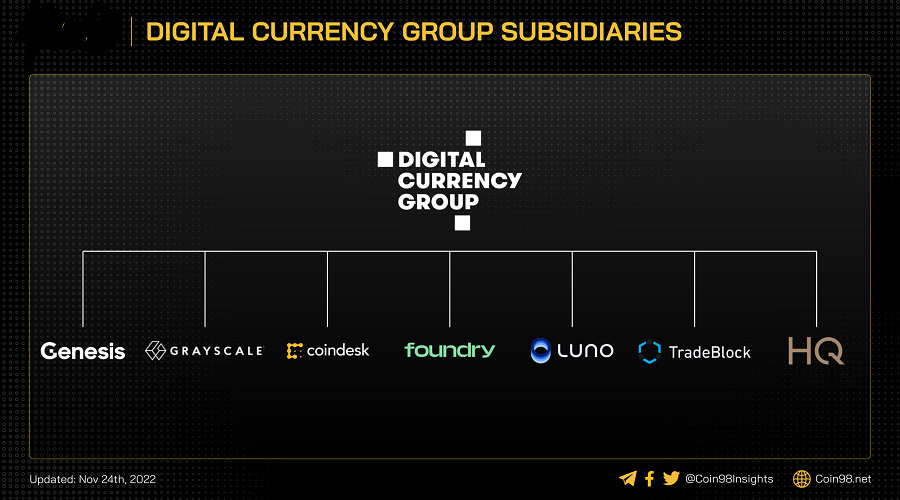

They also possess and operate several businesses, prominently including:

- CoinDesk: Media platform, covering industry news and events.

- Genesis Trading: Leading crypto brokerage company in the market.

- Grayscale Investments: The largest digital asset management company, which manages multiple products including the first publicly traded bitcoin investment vehicle – Bitcoin Investment Trust GBTC, is being referenced.

In January 2021, Grayscale reported managing assets valued at $20.2 billion. By September 2021, this figure had increased to $50 billion.

The prominent members of the Digital Currency Group’s fund

Barry Silbert – Founder & CEO of Digital Currency Group

Barry had seven years of experience as a founder at Second Market, a technology-based platform that provided trading software solutions for private companies and investment funds interested in conducting stock offerings or repurchases, prior to establishing DCG. Following that, he sold the platform to Nasdaq in 2015 for an undisclosed sum.

As of the beginning of the year 2023, Theo Forbes’ aggregate assets are valued at 3.2 billion USD.

Mark Murphy – President of Digital Currency Group

With 9 years of experience in the legal field, followed by 5 years in Communications & Public Affairs, and then stepping into the role of Head of Communications, Mark Murphy went on to lead DCG as COO for the past 3 years.

Overview of the portfolio of the Digital Currency Group fund

Due to the extensive amount of investment projects in the portfolio, only a select number of prominent projects within DCG’s investment process are listed below. Following this, we will highlight several noteworthy projects in each sector. All projects mentioned below have accompanying articles providing information on Coin98 Insights. Should you have an interest in any of these projects, simply search for the project name to obtain further details.

Infrastructure

- Trust Machine: In February 2022, the Trust Machine project, aimed at bringing Bitcoin to Web3, successfully completed a seed funding round with a total of 150 million dollars raised. Notable contributors to the project include esteemed funds such as DCG, Breyer Capital, and Goldentree.

- Magic: In July 2021, Magic achieved a successful Series A fundraising round led by NorthZone, garnering a total of $27 million in funding. Notable investors and key participants in this round included DCG, Tiger Global, and CoinFund.

- NYM Techonologies: In November 2021, a16z led the Series A funding round for NYM, a security infrastructure project utilizing its proprietary technology, the NYM Mixnet and Nym Credentials. The successful funding round brought in $13 million with the participation of DCG, Huobi Ventures, and Hashkey.

- Flare: The project aims to enable new Smart Contracts to be integrated into blockchains. It is the first of its kind to incorporate a Turing-complete FBA network, which simplistically refers to a Turing machine that unlocks the potential of multiple dapps across various blockchains. In June 2021, Flare concluded its fundraising round with $11.3 million in funding, featuring the participation of the DCG Fund and several other similar funds.

RAILGUN: The focus of a Smart Contract project primarily lies in the development of security measures on the Ethereum blockchain. In January 2022, the DCG fund announced its collaboration with RAILGUN and invested $10 million worth of RAIL tokens towards the project.

- The Graph: DCG invested in a data indexing application at the beginning of 2020, which saw participation from Framework, ParaFi Capital, Coinbase Ventures, and Digital Currency Group, in addition to CoinIX, Tally Capital, Multicoin Capital, and DTC Capital.

- SubQuery: In September 2021, Polkadot’s Data Aggregator successfully concluded its Series A funding round with prominent investors including Arrington XRP Capital, Digital Currency Group, and Stratos Technologies leading the way.

- Dapper Labs: A successful funding round up to Series D was secured by a laboratory specializing in the development of blockchain Flow and other notable NFT projects. Nonetheless, it remains unknown at which time DCG participated in the investment and during which funding cycle.

- IPFS: It is not currently known when DCG invested in IPFS and the exact amount of their investment, but it should be noted that Labs has been involved in numerous prominent infrastructure projects, including Filecoin.

- In addition, DCG also invests in a number of other infrastructure projects such as: Dune Analytics, Etherscan, Menson Network, Zabo, Arcana,…

The DCG Fund has demonstrated a clear interest in this field through multiple investments in infrastructure projects since its inception, constituting a significant portion of the fund’s portfolio. However, due to the long timeframe of most deals and inadequate data availability pertaining to areas such as fundraising rounds, time of investment, capital figures, and co-investors, extracting deeper insights about the fund remains challenging.

NFT/Gaming/Metaverse

- Metaversal: An investment organization specializing in the potential NFT and Metaverse projects across the entire market has made numerous funding and resource contributions to projects such as Holaplex, NFT Now, and Far Tech Ventures. In January 2022, CoinFund and Foxhaven led the Series A funding round for Metaversal, resulting in a total of $50 million. The funding round also featured participation from DCG, Collab+Currency, and Dapper Labs.

- Horizon Blockchain Games: A Web3 ecosystem encompasses multiple sectors, such as NFTs, Gamefi, and social networks. A successful project in this field has raised funds twice, amounting to a total of 8.8 million US dollars. The first two rounds of investment were led by Initialized Capital, along with Polychain Capital, ConsenSys, Golden Ventures, Digital Currency Group, CMT Digital, and Regah Ventures.

- Taker Protocol: In September 2021, Taker achieved a successful $3 million seed funding round led by Electric Capital along with other funds, with the participation of DCG, for a project aimed at enabling the liquidity of a non-fungible token (NFT) asset on the Synthetic Metaverse through lending and leasing.

- Metamundo: In November 2021, the NFT exchange platform successfully raised $2.7 million in seed funding, with major investments from Animoca Brands, DCG, OP Crypto, Metacartel Ventures, and several other prominent funds. This demonstrates the growing interest and excitement around the potential of NFTs among investors and indicates optimism for the platform’s future prospects.

- NFTBank: In April 2021, a data analytics hub that focuses specifically on the NFT market successfully completed a seed funding round, raising $1.4 million. This round was participated in by notable investors including Hashed, DCG, and 1xk.

WeMeta: In November 2021, WeMeta, a virtual real estate trading platform in the form of NFT, announced a fundraising round of $1.1 million which was participated by DCG and other investment funds.

- NIFTEX: In November 2020, a project was launched to enable NFTs to be traded through Fractional Trading. The project was led by 1xk, which successfully raised $500,000 in seed funding. The funding round also saw participation from renowned firms such as CoinFund, MetaCartel Ventures, Sparq, and Digital Currency Group.

- SPACE: In December 2021, a metaverse focused primarily on commerce and media successfully raised $7 million in seed funding. Dapper Labs, DCG, and CoinFund were among the participants in the fundraising campaign led by SPACE.

- WilderWorld: WilderWorld has collaborated with Epic Games engine, a major player in the gaming industry, to create an immersive virtual world that includes exciting details such as the ability for users to purchase cars, shoes, and even real estate. In May 2021, WilderWorld completed a fundraising round led by Spartan Group, with participation from Dapper Labs, Animoca Brands, and DCG.

- Decentraland: Recently, the pixelated virtual world has been a major player in the market, with numerous famous celebrities spending hundreds of thousands to millions of dollars to purchase virtual land. DCG invested in Decentraland in January 2020, although the exact amount of the investment has not been disclosed by either DCG or Decentraland.

- Livepeer: The leading project in the field of decentralized streaming is Livepeer, which focuses on non-centralized streaming services. DCG has indicated a clear interest in this project by participating in all three rounds of Livepeer’s funding calls that spanned from 2019 to 2022. The total funding raised from all three rounds amounts to $48 million for Livepeer.

DCG displays a keen interest in NFT and Gaming, with a predominant focus on investing in infrastructure-related applications for NFT. Noteworthy examples include projects that address NFT liquidity (such as NIFTEX and Taker Protocol), analyze and invest in potential purposeful NFTs (such as Metaversal and NFTBank).

The DCG fund is known for its early recognition and foresight in the metaverse field. In January 2020, when the concept of metaverse was still vague to many, DCG invested in Decentraland. It is noteworthy that Dapper Labs often participates in metaverse projects that the DCG fund invests in.

Lending/Farming

- Hubble Protocol: A debt protocol application has been developed on the Solana blockchain to generate stablecoins through an escalation collateral mechanism. This project has successfully secured 8.8 million dollars in seed round funding since January 2022 from diverse funds, including DCG.

- Ondo Finance: The project calls for $4 million in seed round capital from many funds including DCG from August 2021.

- Other projects on lending and liquidity in DeFi but deal information is unknown: Jelly Finance, Xmargin, Abra.

This field is relatively new in the market, with an age of only about two years compared to other fields such as CEX, infrastructure, and blockchain platforms. Hence, DCG has only invested in a few seed round deals regarding these projects, with minimal investments. Notably, the Ondo Finance and Hubble Protocol projects, operating on Ethereum and Solana, respectively, have gained significant market attention at present.

CEX, DEX, AMM & Derivatives

- BitOasis: BitOasis, a centralized cryptocurrency exchange specializing in the MENA market, recently concluded its Series B funding round with a total of $30 million raised in October 2021. The funding round was led by Jump Capital from the United States and Wamda Capital from the MENA region, and was accompanied by Alameda Research, DCG, Pantera Capital, and other notable funds.

- ErisX: In July 2019, the CFTC (Commodity Futures Trading Commission) officially recognized the CEX exchange. In August 2018, DCG collaboratively ventured with Nasdaq Ventures and ConsenSys in a series B fundraising campaign for the trading platform, resulting in a substantial amount of $27 million for Eris X.

- Tagomi: In 2020, Coinbase acquired a centralized exchange, which had previously undergone a seed funding round in May 2020 with a participation by DCG, SV Angel, Tectonic Capital, and several other Funds.

C3 Protocol: In November 2021, the non-centralized derivatives, spot, and cross-chain trading platform successfully accomplished its seed funding round, generating a total of $3.6 million. DCG, ParaFi Capital, Mechanism Capital, and Borderless Capital were among the notable participants in the fundraising event.

- Slingshot: The Concourse Open Community established the DEX platform. In October 2020, Slingshot effectively raised $3.1 million in a seed round, spearheaded by Framework Ventures, along with Electric Capital, IDEO CoLab, Coinbase Ventures, DCG, and numerous other sizeable funds.

- Tinyman: The AMM DEX platform on the Algorand blockchain was leveraged by Tinyman to successfully raise $2.5 million in seed funding from 20 distinguished funds in October 2021, including prominent entities such as DCG, Borderless Capital, Arrington Capital, and The LAO.

- DCG has invested in major DEX platforms in the market, such as Coinbase, FTX, Kraken, and Coinhouse.

Observation: DCG predominantly invests in centralized exchange platforms within the market while allocating relatively lesser investments in decentralized and non-centralized financial products such as DEX and derivatives. Their investment portfolio is heavily concentrated on large CEX platforms including but not limited to Coinbase, FTX, Kraken, and Coinhouse, with only a few investments in DEX such as Tinyman in the DCG ecosystem.

Blockchain

- Polygon: Polygon, a blockchain with an Ethereum scaling solution, experienced explosive growth in 2021 with its native token MATIC and attracted over 7,000 dapps utilizing its solution. Recently in February 2022, Polygon successfully raised over $450 million through the sale of MATIC tokens, with the funding round led by Sequoia Capital alongside SoftBank, DCG, Republic Capital, and various other significant funds.

- Ripple: Ripple was created with the intention of introducing a new form of payment to the world and made its mark as one of the earliest blockchains in the market, alongside Ethereum and Bitcoin. However, due to its entanglement in a lawsuit with the SEC, Ripple has relatively lost its market prominence in recent times. Nevertheless, in December 2019, Ripple successfully completed its Series C funding round with over 60 significant investment firms, including DCG Fund. The funding round resulted in a $200 million investment in Ripple.

- Acala Network: A parachain on Polkadot was invested in by DCG, however it is unclear which funding round DCG participated in.

- Octopus Network: A blockchain network on Near is invested by DCG, and DCG participates in investing from the seed round.

- Other blockchains invested in by DCG but information about the investment deal is unknown: Hedera Hashgraph, Lightning Labs, Skuchain.

DCG has made investments in various prominent layer 1 blockchain projects in the market such as Polygon, Ripple, Acala, and Hedera. It is observed that they have not invested much in layer 1 blockchain deals, but most of their investments have received positive responses from the market.

Payment & Wallet

- Circle: A company providing payment solutions to both individuals and businesses, Circle, has successfully unlocked the potential of USDC with the objective of offering its users a comprehensive range of payment capabilities. DCG, a digital assets investment firm, had invested in Circle twice, once in July 2020 with a call for $25 million, and again in May 2021, with a successful call of $440 million. In total, Circle has raised $465 million from the two fundraising rounds.

- BCB Group: The European company provides financial services catering to the affluent class. In January 2022, BCB conducted a Series A funding round amounting to $60 million, the largest in the history of blockchain fundraising in the United Kingdom. The funding round was led by Foundation Capital and BACKED VC, with participation from DCG, Nexo, Wintermute, Menai Financial Group, Circle, and several other funds.

- Ripio: In September 2021, the financial and crypto brokerage company based in Argentina, Ripio, successfully raised $50 million in its Series B funding round led by DCG. The round also saw the participation of Amplo VC and Boost VC.

- Other major investment applications invested in by DCG include: Ledger, Wyre, Tradeblock, Fireblock,…

- Wallet applications invested in by DCG include Rainbow, Xapo.

- In addition, DCG also invested in two more payment companies: Transparent Financial Systems (February 2020), Avanti (June 2020).

The Payment sector is of great interest and investment to DCG due to its ability to facilitate the flow of money in and out of the crypto market and create strong use cases for various cryptocurrencies. This is why DCG focuses heavily on investing in this sector, evidenced by their portfolio of successful companies such as Circle, Ledger, wyre, and Tradeblock.

Others

DCG has diversified its investment portfolio across various segments in the market, with prominent projects such as the following:

- Lido: Lido, a leading project in Liquid staking, currently supports staking on 4 blockchains: Ethereum, Solana, Terra, and Kusama. As of now, Lido has locked in over 9 billion dollars and has nearly 75 thousand stakers. In May 2021, Lido successfully completed a funding round of $73 million, with the participation of major funds such as DCG, Coinbase Ventures, Three Arrows Capital, Jump Trading, and Alameda Research.

- YGG Sea and Merit Circle: During recent times, Gaming Guilds have been experiencing a surge in popularity within the market. DCG (Digital Currency Group) has also successfully invested in two major guilds: Merit Circle in October 2021, and YGG SEA, a branch of Yield Guild Game, in December 2021.

- Electric Capital and Boost VC: DCG not only invests in its own projects, but also invests in other venture capitalists to leverage their strengths. Specifically, they have invested in two such venture capitalists, both of which have participated in multiple deals alongside DCG.

An assessment and critique of the Digital Currency Group

Upon examining DCG’s portfolio, it is discernible through the investment portfolio of the company, that the following distinct attributes are evident

- DCG invests in all market segments and it appears that they do not have a specific area of expertise. They have a presence in both new and established market segments, participating in multiple applications and business deals.

- DCG has heavily invested in the foundational infrastructure sector, utilizing numerous infrastructure-based applications such as labs, applications, and companies executing infrastructure solutions.

- DCG is not merely a standalone investment fund, but also possesses a robust ecosystem of products which includes Grayscale, CoinDesk, and Genesis Trading. This ecosystem enables support for the projects in which they invest, as well as additional sources of profit for said projects.

- DCG’s investment strategy does not focus on any specific blockchain, but rather involves investing in multiple blockchain platforms across a variety of sectors and transactions.

The Genesis Trading liquidity incident has resulted in a loss of liquidity

The year 2022 has proven to be a challenging time for the crypto industry as it has witnessed not only a significant decline in BTC prices but also numerous collapses of prominent figures, which were thought to be impervious to failure, namely 3AC, Terra, and FTX.

The occurrence of these events led to a Genesis Trading incident – one of the major subsidiaries of DCG suddenly halting the withdrawal of funds for its users. The reason behind this was attributed to Genesis Trading lending an excessively large sum of money to 3AC. Specifically, they are the largest creditor of 3AC with an amount reaching up to 2.3 billion USD.

Afterward, the scandal involving Genesis Trading and the Gemini exchange surfaced when the 900 million USD of the Gemini Earn program was found to be within Genesis Trading. As DCG is the parent company of Genesis Trading, it suffered severe consequences from this incident.

Summary

DCG not only influences the cryptocurrency market through its investment deals, but also has significant subsidiary companies. Therefore, DCG is among a few reputable funds with considerable impact on the market. If they were to collapse due to the Genesis incident, it would be a severe blow to the cryptocurrency market.

The above information was researched by the team at 247btc.net. We hope that this information will be helpful to our readers. However, please note that this is not investment advice, but rather an informational channel. Therefore, investment decisions should be carefully considered.

What is Animoca Brands? Investment trends of Animoca Brands fund

The investment fund, Animoca Brands, specializes in the areas of NFT, gaming, and metaverse. An analysis has been conducted on...

Read moreWhat is BlackRock, and what are the implications of the financial giant’s foray into the world of cryptocurrencies?

On August 11th, BlackRock issued a statement announcing its intention to offer Bitcoin spot investment services to its clients through...

Read moreWhat is Digital Currency Group (DCG) and what are the investment trends of the DCG fund?

The Digital Currency Group is a prominent investment fund established in 2015 that has made successful investments in numerous projects...

Read moreWhat is Andreessen Horowitz’s (a16z)? Investment trends of a16z

This article endeavors to provide a comprehensive overview of the investment portfolio of Andreessen Horowitz's (a16z), a well-known investment fund...

Read moreWhat is Binance Labs investment fund? Comprehensive details regarding Binance Labs.

Binance is a renowned and reputable global cryptocurrency exchange platform, widely known to most of us. Today, we proudly introduce...

Read more