Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are locked, which results in decreased capital utilization efficiency. The challenge emerges as to how individuals can stake for yield while still comfortably utilizing their staked assets. Lido offers the key resolution to these issues.

Table of Contents

ToggleWhat is Lido DAO?

Lido is a liquid staking solution that enables increased profitability on locked ETH when participating in ETH 2.0 and other crypto assets. This project falls within the Liquid Staking Derivatives (LSDs) domain, alongside other projects such as Rocket Pool and Ankr Protocol. Currently, Lido has expanded onto five different networks, including Ethereum, Solana, Polygon, Polkadot, and Kusama.

The act of staking involves holding a specific amount of coins within a wallet or nodes/masternodes of a blockchain project for a certain period to receive rewards. Such rewards are hinged on the effort expended, comprising staked coin amount and duration of stake.

The Lido project is at the forefront of unlocking liquidity for ETH staked in ETH 2.0 and leads in this arena, with a current tally of 4,832,979 ETH staked on the platform.

The products and revenue of Lido

Lido products

Lido has three main products:

- Staking pools.

- Synthetics token – stETH

- Lido DAO.

Staking Pool

The foremost and crucial product of LIDO is the Staking Pool. To leverage the Staking Pool, users can stake their ETH in Lido and receive stETH back in a 1:1 ratio. These stETH tokens can be widely utilized in various stETH-supported Dapps.

Lido will proceed to employ the ETH delegated by the users towards its partnered Validators, who shall receive rewards over time for staking Lido’s ETH. The reward shall be apportioned into two portions, wherein 90% will be allocated to stETH holders and 10% will be attributed as the fee for minting stETH by Lido, which is as follows:

- 5% fee for Node Operators

- 5% fee to Lido Treasury

Synthetics token – stETH

The token known as stETH acts as a representation of ownership rights of Ethereum (ETH) that are currently being staked within the Ethereum 2.0 network. By holding stETH, users can still participate in various DeFi activities such as trading, lending, farming, and staking, to earn additional profits.

With the stETH tokens currently available, users are capable of participating in various activities such as:

- Liquidity provision: Curve, 1inch, Uniswap V3, Balancer.

- Loan: Anchor, Aave.

- Optimize profits on Aggregator platforms: Yearn Finance, Harvest Finance.

Lido DAO

The Lido DAO is a decentralized autonomous organization that functions as the governing body within the ecosystem, granting members decision-making power over the products and operations of Lido, including fee regulations and the management of node operators and oracles, through the use of LDO tokens.

The Lido DAO will accumulate fees derived from operating the protocol to facilitate research and development initiatives, upgrade versioning, along with liquidity incentives.

Lido V2

On the 7th of February, 2023, Lido presented Lido V2, featuring two primary functionalities: Staking Router and Withdrawals. The aforementioned updates comprise the following key features:

- Staking Router: The Staking Router will function as the cellular nucleus of Lido, providing a robust infrastructure where stakers, developers, and node operators can seamlessly collaborate with each other through modular facilities. Essentially, it is similar to a Node Operator Aggregator that enhances the diversity of Lido’s Node Provider ecosystem, going beyond the current limits of Professional Node Providers.

- Withdrawals: The Shanghai update of Ethereum permits users to initiate withdrawals by unstaking stETH and obtaining an equivalent amount of ETH at a 1:1 ratio.

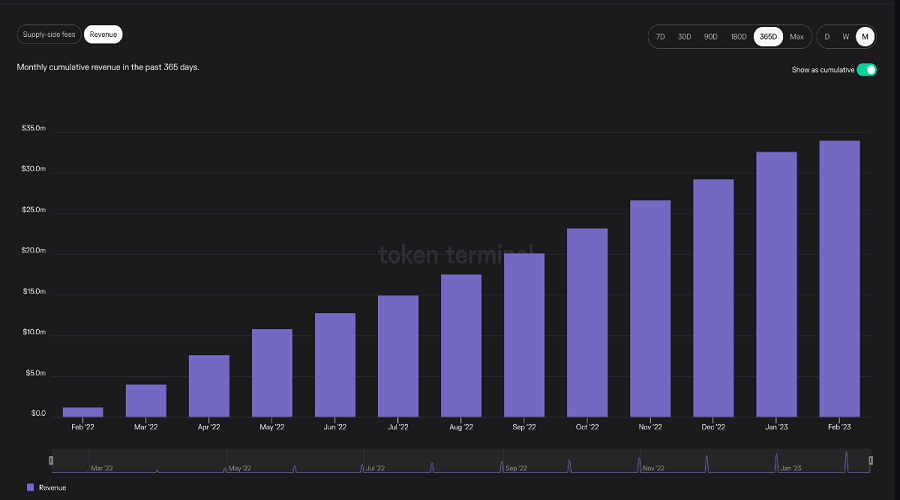

Lido Finance’s revenue

A portion of the revenue source for Lido will be derived from the total rewards of the assets that users stake on the platform.

The salient features of Lido

Lido stands out due to the following distinctive characteristics:

- Flexible: Users can deposit any amount of ETH to stake on Lido and receive stETH at a 1:1 ratio with ETH 2.0. These stETH tokens can then be used for staking, lending, trading, or any other platform that supports stETH.

- Dual Yield: Upon staking ETH on Lido, users shall be rewarded with stETH tokens and yields. Proceeding to use stETH or lending it out will result in further yield dividends, a highly effective measure to generate passive income.

Currently, Rocket Pool holds the second position in the market of Liquid Staking, with Lido Finance being the only one ahead of it.

We kindly suggest reviewing some fundamental information presented in the table below to assess Lido Finance and its second-largest competitor in the market.

What is LDO Token?

LDO Token Key Metrics

- Token Name: Lido DAO

- Ticker: LDO

- Blockchain: Ethereum

- Token Contract: 0x5a98fcbea516cf06857215779fd812ca3bef1b32

- Token Type: Governance

- Total Supply: 1,000,000,000 LDO

- Circulating Supply: 842,729,086 LDO

LDO Token Use Cases

The LDO token is designated for Governance purposes, whereby token holders possess the right to participate in the administration and exert influence over the decision-making process concerning the protocol’s development.

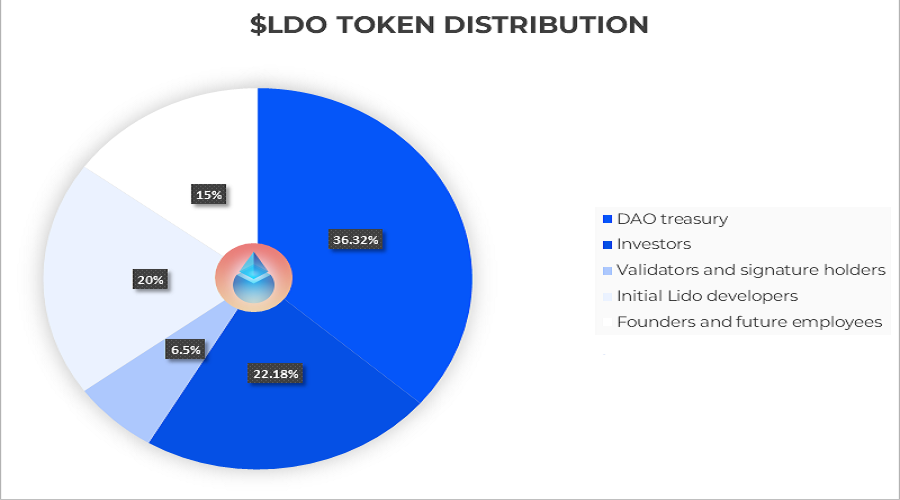

LDO Token Allocation

LDO is allocated proportionally as follows:

- DAO Treasury: 36.32%

- Investors: 22.18%

- Initial Lido Developers: 20%

- Founders & Future Employees: 15%

- Validators & Signature Holders: 6.5%

LDO Token Release Schedule

The LDO tokens allocated to the team and investors shall be subject to a one-year lock-up period (fully released on December 17th, 2021) and subsequently vest over a period of one year.

The proposed allocation plan of 36% remaining LDO tokens necessitates an approval process via governance proposal within Lido DAO. Furthermore, the DAO holds the discretion to issue further tokens for the purpose of capital calls, marketing, or to establish user incentives.

LDO Token Sale

Updating…

Roadmap & updates

- December 2020: Lido officially launches on Ethereum

- March 2021: Lido expands to Terra with bLUNA

- September 2021: Lido expands to Solana with stSOL

- March 2022: Updated introduction to Distributed Validator Technology (DVT), Node Operators Score (NOS) and balance creation mechanism in governance.

- February 2023: Introducing Lido V2 with two main updates: Staking Router and Withdrawals. This is Lido’s biggest upgrade ever. The promise is to move the protocol closer to decentralization.

Lido-Project team

Lido is managed through a decentralized autonomous organization (DAO) structure. The initial members of Lido DAO consist of prominent figures such as Founders and Co-founders of renowned projects in the market, including:

- CryptoCobain: KOL with more than 220k followers.

- Anton Bukov: Co-founder of 1Inch.

- Will Harborne: Co-founder of Deversifi

- Julien Bouteloup: Founder & CEO of Stake Capital

- Kain Warwick: Founder of Synthetix.

Additionally, numerous professional organizations and investment funds such as Semantic VC, ParaFi Capital, Libertus Capital, Bitscale Capital, StakeFish, StakingFacilities, Chorus, P2P Capital, and KR1 are also involved in the industry.

Investors & Partners

Investors and capital raising rounds

Over a span of three years, Lido Finance had a total of four funding rounds with notable participants such as A16z, Paradigm, Dragonfly, KR1, and more than 30 other investors including Semantic Ventures, Staking Facilities, ParaFi Capital, and Stake.fish.

Partner

Lido Finance’s partners include two main groups:

The product is supported by partners who offer a range of DApps that enable users to utilize the stTokens for diverse purposes across multiple platforms.

The Validator Partners are the designated group that will receive ETH from Lido to perform network protection and verification tasks, thereby accruing rewards from such authentication efforts.

Summary

247btc.net has provided answers to the question of what Lido is and furnished information on the project as well as its LDO token. We encourage everyone to conduct further research and evaluation to make informed investment decisions. Good luck to everyone! This statement adopts a formal tone and informative style to convey the message clearly and coherently.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more