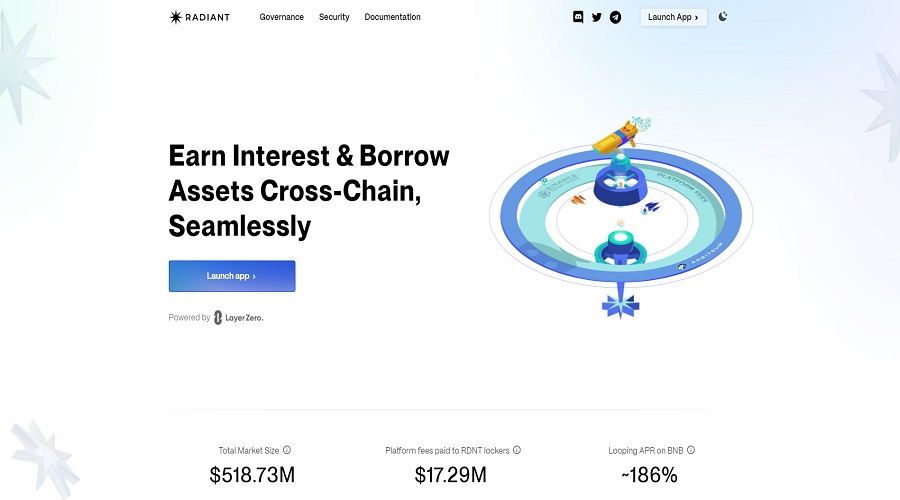

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its primary objective is to facilitate easy and convenient cross-chain lending and borrowing for users, with LayerZero support. Let us delve deeper into the specifics of this innovative project.

Table of Contents

ToggleWhat is Radiant Capital (RDNT)?

Radiant Capital is a Lending Protocol project that operates on the Arbitrum layer 2 chain. The primary objective of Radiant is to establish itself as the first Money Market to incorporate the omnichain model, which enables users to borrow and lend assets on any chain.

The ability to interact with cross-chain protocols will be inherited by Radiant upon its construction on LayerZero through the Stargate interface, providing lenders with the ability to withdraw their funds on any desired chain. This feature enhances the overall functionality of the platform and streamlines the borrowing and lending process.

Products & Revenue of Radiant Capital

Money Market

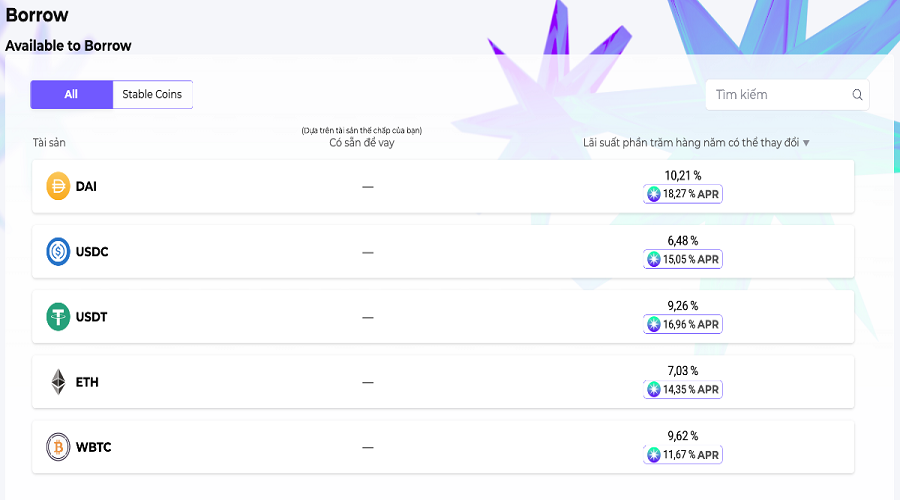

The most essential product in the lending/borrowing project is undoubtedly the Money Market. Radiant is the designated location to cater to the needs of both lenders and borrowers.

The lender pledges their asset as collateral on the platform to receive both interest and RDNT Token rewards from the protocol.

The borrower is required to pledge assets and receive rTokens, representing the pledged assets, before borrowing the desired cryptocurrency. Additionally, the borrower is responsible for paying interest on the loan. Currently, borrowers are still incentivized with RDNT tokens for borrowing.

However, all RDNT Tokens earned through lending, borrowing, or providing liquidity must undergo a 28-day vesting period. If users wish to withdraw their earnings earlier, they will incur a 50% penalty fee, and the amount will be transferred to all other users who are currently locking their RDNT Tokens.

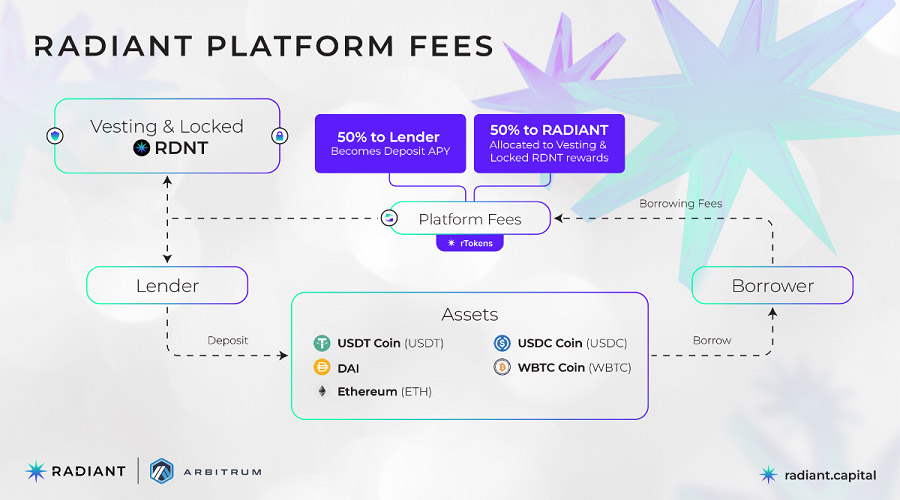

Radiant Capital’s revenue

The total fees comprising of interest charges for borrowing (paid by the borrower) and penalties for premature withdrawal before the 28-day period shall be split into two parts.

- 50% for lenders (lenders)

- 50% protocol return, which will be allocated to RDNT Vester, Locker and Liquidity Provider for Pool2’s RDNT-WETH pair.

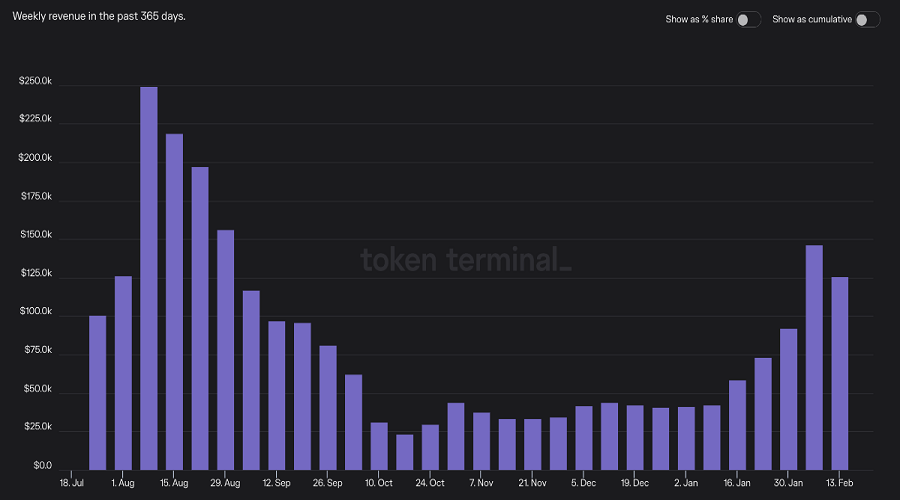

Recently, Radiant has experienced an increase in revenue, surpassing the threshold of $100,000 per week.

The salient feature of Radiant Capital

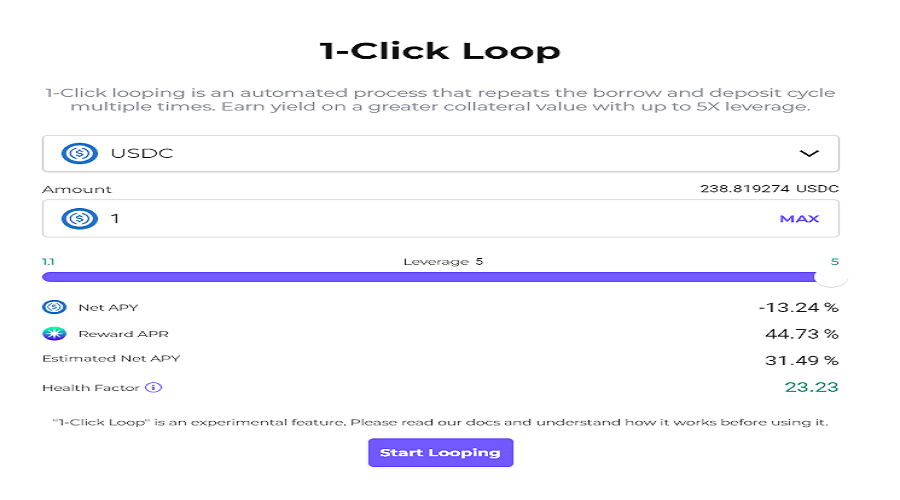

Looping feature

The looping feature enables the automatic repetition of the collateral and borrowing process, with leverages up to 5x available for use.

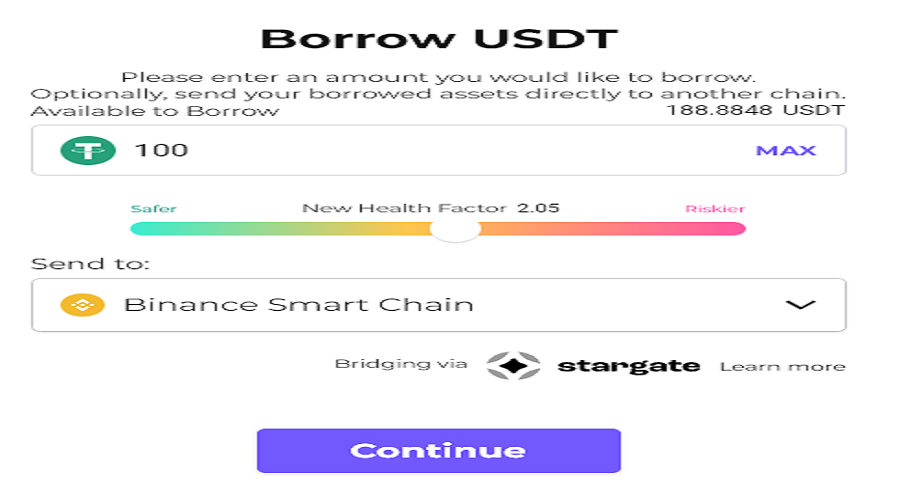

Bridge

Once assets are collateralized, users can obtain loans from multiple chains directly using the Stargate interface on Radiant. This feature is currently available for the USDC and USDT pairs.

Radiant stands out from many other DApps due to its added support for Vietnamese users, thus facilitating accessibility and building positive rapport with Vietnamese users. Despite launching after AAVE on Arbitrum, the protocol has developed rapidly and attracted a considerable TVL, currently leading the lending sector on this layer.

Let us compare Radiant Capital and AAVE V3, two leading Lending platforms on Arbitrum, through the following illustration.

What is RDNT token?

RDNT is the native Token of Radiant Capital

RDNT Token Key Metric

- Token Name: Radiant Token

- Ticker: RDNT

- Blockchain: Arbitrum

- Token Contract: 0x0C4681e6C0235179ec3D4F4fc4DF3d14FDD96017

- Token Type: Utility

- Total Supply: 1,000,000,000 RDNT

- Circulating Supply: 208,636,984 RDNT

RDNT Token Use Cases

The RDNT Token is associated with various instances of application utilization, as follows:

- Used to reward lenders/borrower/staker

- Administer Radiant DAO through locked RDNT

- During the RDNT lock-up period, the user is entitled to a portion of the fee from the protocol

RDNT Token Allocation

The allocation of RDNT is distributed in the following proportions:

- Incentives – Supply and Borrowers: 50%

- Incentives – Pool 2: 20%

- Team: 20%

- Core Contributors and Ecosystem: 7%

- Treasury: 3%

RDNT Token Release Schedule

RDNT Tokens are allocated according to the following schedule:

RDNT Token Sale

Radiant Capital does not open Token Sale

Where to buy RDNT Token?

The available methods for purchasing RDNT are as follows, with options for users to choose from.

- Centralized Exchange (CEX): Gate, MEXC, BKEX, Bitget

- Decentralized Exchanges (DEX): UniSwap (Arbitrum), Trader Joe v2 (Arbitrum), SolidLizard…

RDNT Token storage wallet

Users are able to hold RDNT tokens in any wallet that supports the Arbitrum network, some reputable wallets which may be mentioned include Coin98 Super App, Metamask, and Trust Wallet.

Roadmaps & updates

- 7/2022: Radiant Capital officially launched on Arbitrum

- Q1/2023: Radiant V2 has been introduced with various upgraded features to cater to the largest Omnichain and Money Market on Arbitrum. The latest update of version 2 includes the following enhancements:

- Enable cross-chain lending/borrowing for BTC, ETH and USDC

- Change with penalty for early withdrawal

- Introducing Dynamic Liquidity Pool and changing RDNT Token reward mechanism

- Change reward vesting time

- Launched Island Game, allowing bots to liquidate other users’ positions

Project team

Although the project has yet to publicly share images of its members, we hereby present a list of the core members’ names:

- Core Team: George, Tom, Aaron, Liam, Roger

- Developers: Khanh, Steve, Daniel, Roy

Investors & Partners

Investors and funding rounds

The development team of Radiant operates the project entirely through personal funds, thus making Radiant Capital devoid of any private sale, IDO, or involvement of venture capital.

Partner

Radiant’s largest partner is LayerZero. The team is currently collaborating with LayerZero Labs to conduct smart contract audits, and Radiant has integrated Stargate into its interface to realize the Omnichain mission that both parties are pursuing together.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more