Kinza Finance is a Lending protocol built on the BNB Chain, utilizing Solidity’s neoteric ve(3,3) model to entice early users. Recently, this enigmatic project has achieved the distinction of being one of the five victorious projects in the DeFi field, earning a prestigious award as a result of participating in Binance Labs’ MVB VI program. This is undoubtedly an accomplishment that the development team should be immensely proud of. This article aims to provide a comprehensive understanding of what Kinza Finance is and how it operates.

Table of Contents

ToggleWhat is Kinza Finance?

An overview of Kinza Finance

Kinza Finance is a Lending protocol built on BNB Chain which employs the Solidity ve(3,3) model to entice early adopters. Although not novel, it is the first time a Lending project has implemented the ve(3,3) model.

Kinza’s focus on security and the aim of connecting supply and demand for liquidity is intended to create the best possible online currency market. However, due to the risk issues that current Lending platforms still encounter, the project requires collaboration with numerous large security companies to effectively address these concerns.

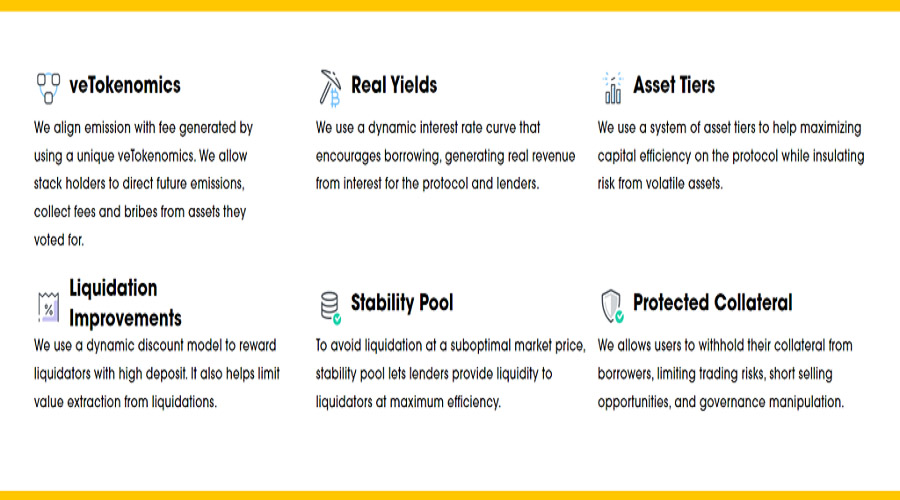

Similar to other prominent lending platforms in the current market, Kinza employs a flexible interest rate curve to incentivize borrowing and generate real revenue from interest payments for the protocol and lenders.

The protocol employs a hierarchical system of assets to optimize capital utilization and mitigate risks associated with easily dissipating assets.

Utilizing the dynamic discounting model as a form of reward for depositors with high liquidation values not only aids in incentivizing their participation but also minimizes the exploitation of liquidation values.

To avoid liquidation at a market price below the optimal level, stabilizing group allows lenders to provide liquidity to liquidators with maximum efficiency. Additionally, the protocol enables users to retain their collateral from borrowers, mitigating transaction risks, short selling opportunities, and administrative manipulation.

The mechanism of operation

The lender deposits assets into the protocol and receives interest from the borrower. The protocol earns a portion of fees from the activities of both the borrower and lender, which are distributed to those holding administrative Tokens of the project. Additionally, individuals holding administrative Tokens of the project can participate in voting to allocate rewards and receive kickback fees.

What is the Real Yield outlook for the Kinza Finance project?

Profitability

As the advent of smart contracts emerged, developers began to experiment with decentralized financial products such as lending and borrowing. Rather than relying on third-party intermediaries to determine who can lend and borrow, decentralized solutions utilize smart contracts and incentivization mechanisms to ensure secure accounts and a sustainable ecosystem.

The concept of Decentralized Finance (DeFi) provides an inclusive environment wherein everyone can access financial opportunities. It empowers individuals and offers them the chance to earn rewards and tokens without having to sell their investment positions.

Security

Kinza Finance believes that lending protocols form the foundation of the DeFi system and operate as a decentralized risk management component, safeguarding the assets of individual investors, organizations, and groups. These lending protocols leverage liquidity pools to establish and maintain lending markets.

Just like any system related to liquidity provision, security is of utmost importance. In light of recent security breaches, lending protocols have upgraded to incorporate advanced security features. Kinza Finance aims to establish a new standard by implementing cutting-edge security measures to ensure the safety of user assets.

Sustainability

Liquidity is the foremost important factor in the lending market, lack of which renders borrowing and lending unfeasible. Kinza Finance Tokenomics has integrated a ve(3,3) mechanism that has been error-corrected, enabling investors to participate in the selected lending groups every week, promoting growth in both lending and borrowing activities.

Details regarding the Token of Kinza Finance

The Kinza token’s code is designed with a ve(3,3) mechanism that aims to provide real profits. Such profits come from the interest that borrowers are obliged to pay. By encouraging borrowing through the use of the ve(3,3) mechanism, investors benefit from increased interest payments, resulting in higher actual profits for the users.

Kinza Finance employs a primary token with the KZA protocol. Following the placement of a wager, the token KZA becomes xKZA. To participate in the voting process, it is necessary for individuals to possess xKZA tokens.

Token Metric

- Token name: Kinza token.

- Ticker: KZA.

- Blockchain: BSC.

- Contract: Updating…

- Token type: Governance, Utility.

- Total Supply: 100,000,000 KZA.

- Circulating Supply: Updating…

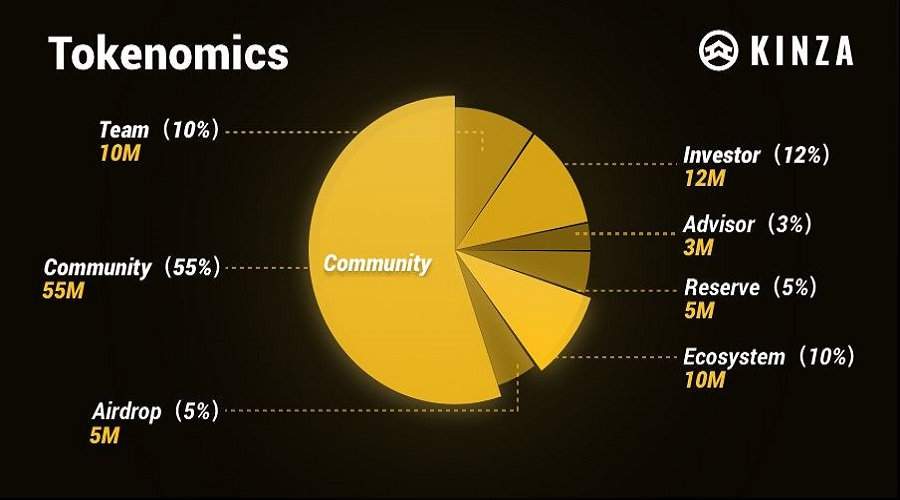

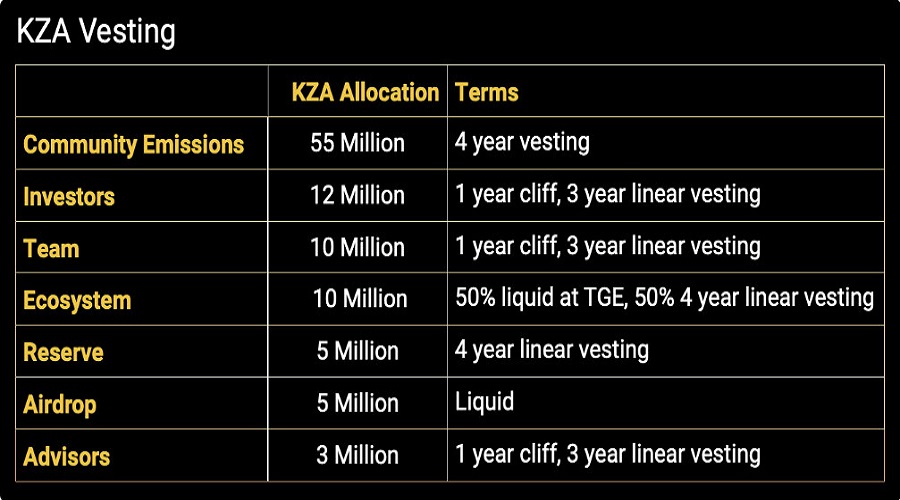

Token Allocation

- Team: 10%.

- Investor: 12%.

- Advisor: 3%.

- Reserve: 5%.

- Ecosystem: 10%.

- Airdrop: 5%.

- Community: 55%.

The Vesting schedule exemplifies Kinza Finance’s steadfast dedication to sustainable growth and commitment to the community. The entirety of the Vesting period spans four years, with the team, investors, and advisors commencing their Vesting after one year from the TGE.

Token widget

Updating…

Roadmap

Updating…

Project development team

Updating…

Investors and partners

Binance Labs has recently announced its undisclosed investment in Kinza Finance.

What is Stader Labs (SD)? A comprehensive guide to SD cryptocurrency

What is Stader Labs? Stader Labs is a multichain Liquid Staking platform that enables users to participate in staking while...

Read moreWhat is DeFi Land (DFL)? A comprehensive overview of the digital currency DFL

DeFi Land is a simulated farming game developed to gamify the DeFi ecosystem on Solana, however, the current state of...

Read moreWhat is Lido DAO? A comprehensive overview of the LDO Token cryptocurrency

Numerous projects utilize Staking as a solution for reducing supply and voting proposal. However, as a consequence, staked assets are...

Read moreWhat is Acala Network (ACA)? Overview of the cryptocurrency ACA coin

Acala Network has recently gained significant attention from the community. The project's success in winning the first Parachain on Polkadot...

Read moreWhat is Yield Farming? Gain a comprehensive understanding of the terminology associated with Yield Farming

The concept of Yield Farming, prominent Yield Farming platforms, and the associated risks and opportunities are explored in this article,...

Read moreWhat is Slingshot Finance? A comprehensive overview of the digital currency Slingshot Finance

Slingshot Finance is an innovative DeFi application that offers a wide range of services related to cryptocurrency asset exchange and...

Read moreWhat is Ondo Finance (ONDO) ? Overview of the Ondo Finance token

The Ondo Finance DeFi platform recently announced the successful raising of $20 million in capital from major funds such as...

Read moreWhat is Hubble protocol (HBB)? A comprehensive guide to the cryptocurrency HBB

The Hubble Protocol represents a pioneering project within the Debt Protocol arena, as it provides users with collateral asset support...

Read moreWhat is Railgun crypto (RAIL)? Consider comprehensive information about the RAIL token

The importance of privacy and security has increased significantly in the field of cryptocurrency as it continues to develop. Several...

Read moreWhat is Fei Protocol TRIBE cryptocurrency? A comprehensive overview of TRIBE digital currency

Fei Protocol (TRIBE) is a platform developed to address the current issues of stablecoins, which have contributed significantly to the...

Read moreWhat is Symbiosis Finance? Things to know about SIS tokens

Symbiosis Finance, being a decentralized multi-chain liquidity protocol, is tasked with aggregating liquidity from all EVM-compatible chains such as Ethereum,...

Read moreWhat is Gnosis Crypto (GNO)? Complete set of GNO Cryptocurrency

What is Gnosis Crypto (GNO)? This article provides comprehensive and valuable information regarding the digital currency Gnosis (GNO) for individuals...

Read moreWhat Is Osmosis Crypto ? OSMO Token Details

Learn more about Osmosis, including its standout features and details about the OSMO Tokenomics by clicking here. One of the...

Read moreWhat is Radiant Capital (RDNT)? Complete set of RDNT cryptocurrency

Radiant Capital is a lending protocol project that has been developed as a native platform within the Arbitrum ecosystem. Its...

Read moreWhat is Helio Protocol (HELIO)? Helio Protocol Cryptocurrency Overview

What is Helio Protocol? It is a liquidity protocol that enables users to borrow and collateralize assets for profit on...

Read more